- United Kingdom

- /

- Capital Markets

- /

- LSE:ALPH

Discovering Hidden Treasures in the UK Market August 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China and declining commodity prices. Despite the broader market challenges, there remain hidden opportunities within the UK market that could offer potential growth for discerning investors. Identifying these gems involves looking beyond immediate market sentiment to find companies with strong fundamentals and unique value propositions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the United Kingdom, Europe, Canada, and internationally, with a market cap of £1.07 billion.

Operations: Alpha Group International plc generates revenue primarily from Alpha Pay (£64.30 million), Institutional services (£61.29 million), and Corporate London excluding Amsterdam (£45.42 million).

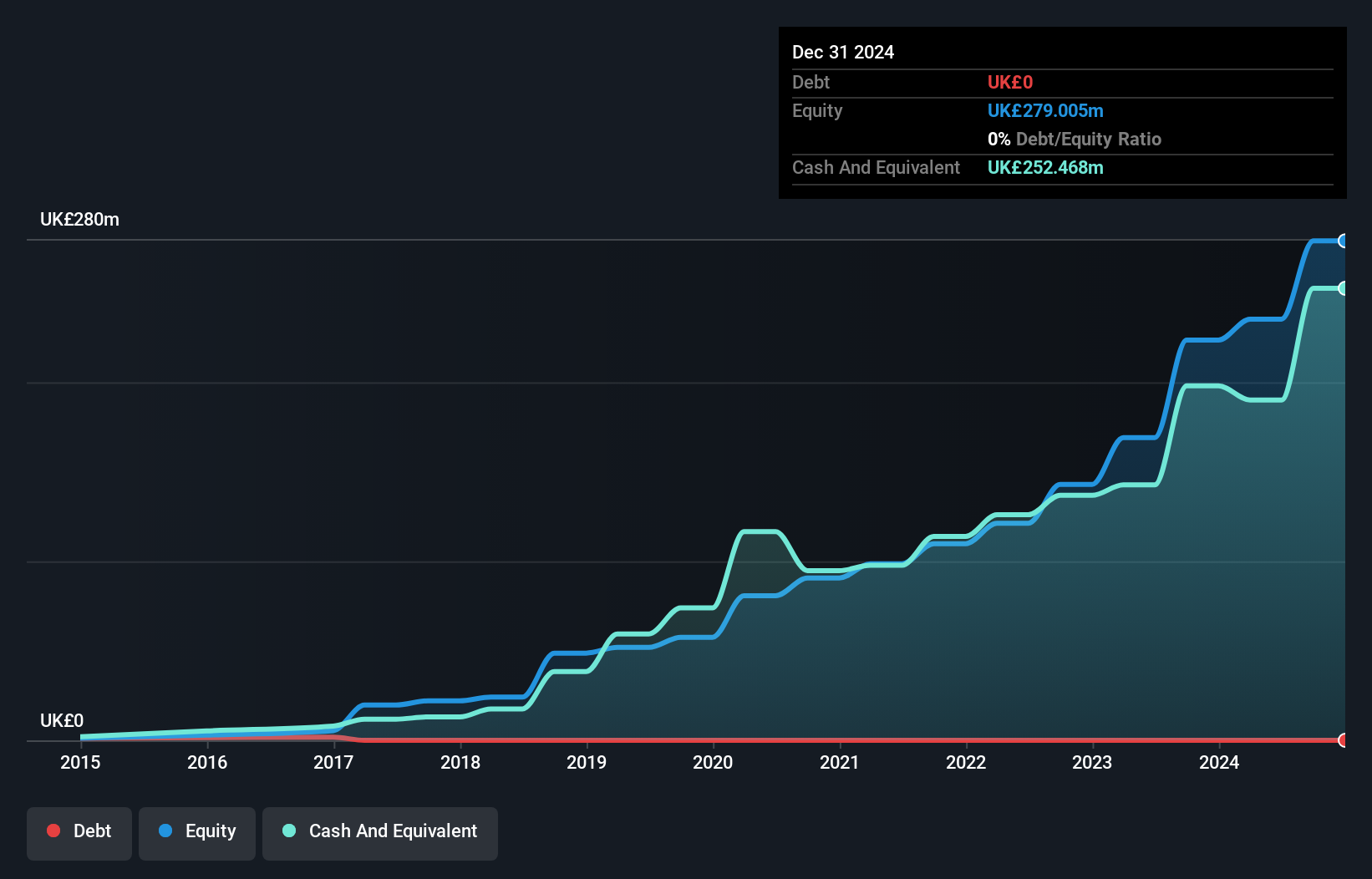

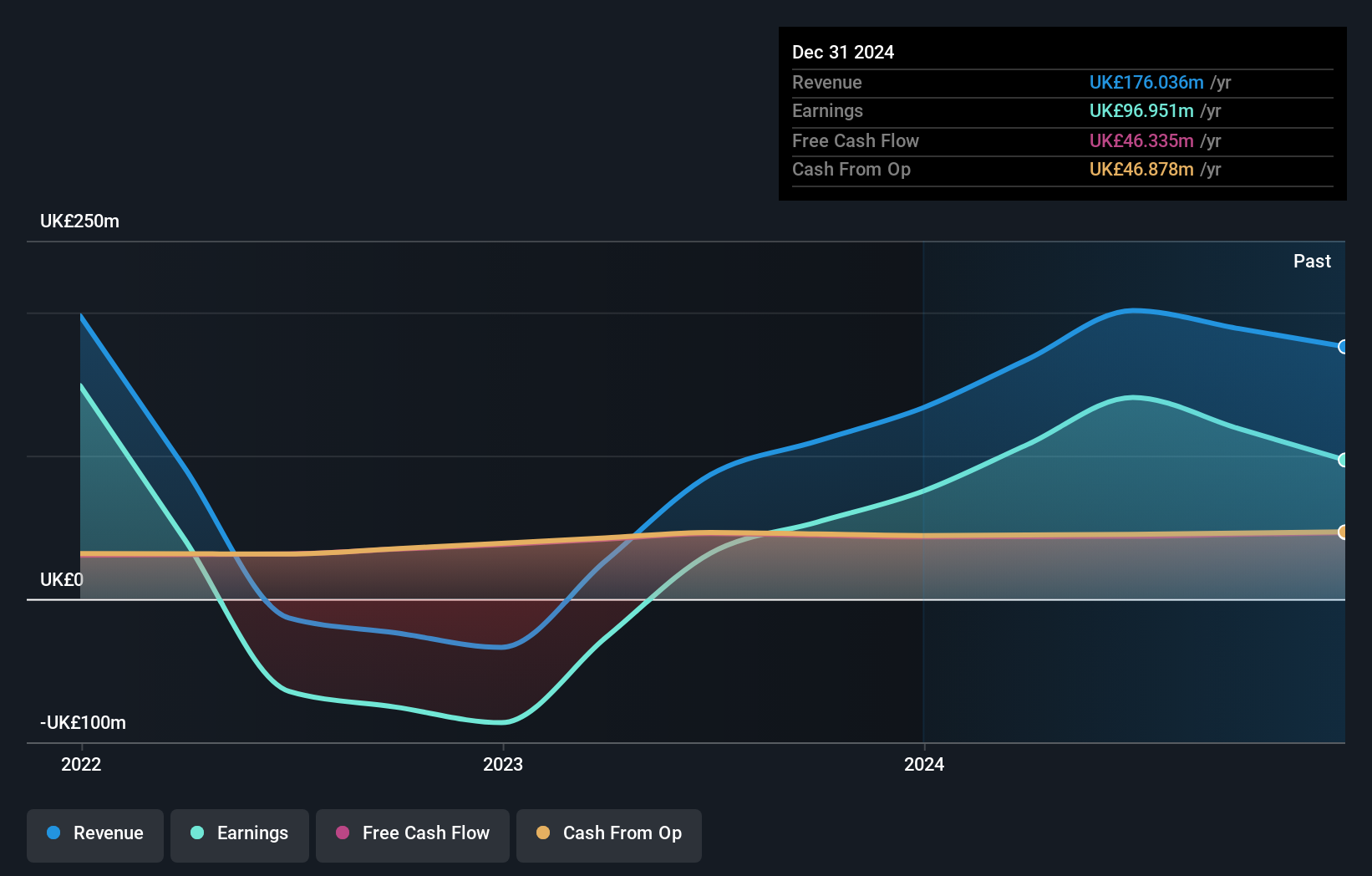

Alpha Group International, recently added to multiple FTSE indices, showcases impressive earnings growth of 130% over the past year, far outpacing the Capital Markets industry. Trading at a P/E ratio of 12x, it offers good value compared to the UK market average of 16.6x. The company is debt-free and has initiated a share repurchase program authorized to buy back up to 4.32 million shares by mid-2025, reflecting strong financial health and shareholder confidence.

- Click to explore a detailed breakdown of our findings in Alpha Group International's health report.

Gain insights into Alpha Group International's past trends and performance with our Past report.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c., an investment trust, offers independent professional services to various entities globally and has a market cap of £1.19 billion.

Operations: Law Debenture generates revenue from its Investment Portfolio (£35.62 million) and Independent Professional Services (£61.55 million).

Law Debenture, a notable entity in the UK market, reported impressive earnings growth of 340.1% over the past year, far outpacing the Capital Markets industry’s 0.3%. The company’s recent half-year revenue was GBP 111.97 million compared to GBP 44.02 million previously, with net income soaring to GBP 82 million from GBP 16.54 million a year ago. Its price-to-earnings ratio stands at an attractive 8.5x against the UK market's average of 16.6x, and its net debt to equity ratio is satisfactory at 15%.

- Get an in-depth perspective on Law Debenture's performance by reading our health report here.

Assess Law Debenture's past performance with our detailed historical performance reports.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets globally, with a market cap of £691.70 million.

Operations: Senior plc generates revenue primarily from its Aerospace segment (£651.10 million) and Flexonics segment (£333 million), with a minor offset from central costs (-£1.50 million).

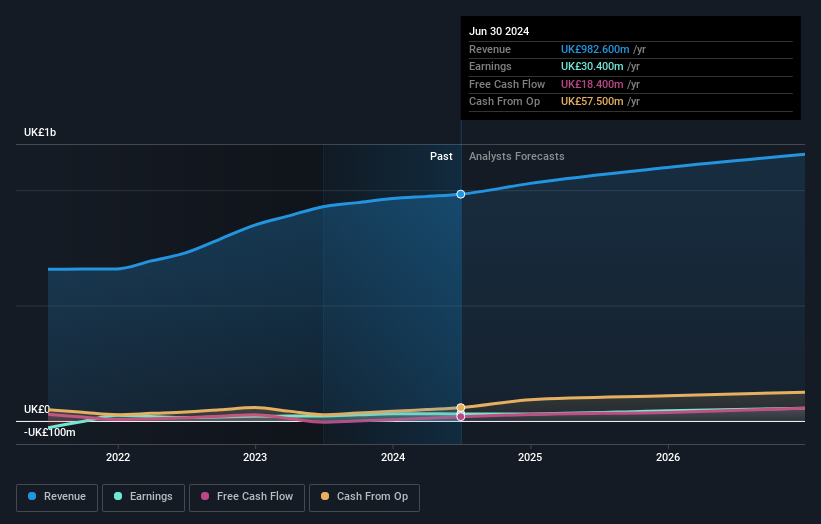

Senior has demonstrated notable performance, with earnings growth of 40.1% over the past year, surpassing the Aerospace & Defense industry average of 14.8%. The company’s net debt to equity ratio stands at a satisfactory 34.4%, while its interest payments are covered 2.8x by EBIT, indicating room for improvement. Recently awarded contracts with Rolls-Royce and Deutsche Aircraft highlight its strong market position and potential for future growth in the aerospace sector.

Key Takeaways

- Explore the 79 names from our UK Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALPH

Alpha Group International

Provides foreign exchange risk management and alternative banking solutions in the United Kingdom, Europe, Canada, and internationally.

Flawless balance sheet with solid track record.