- United Kingdom

- /

- Capital Markets

- /

- AIM:BPM

B.P. Marsh & Partners And 2 Other Undiscovered Gems In The UK Market

Reviewed by Simply Wall St

In the current landscape, the United Kingdom's market has faced headwinds as evidenced by the FTSE 100's recent decline, influenced by weak trade data from China and its impact on global commodity demand. Despite these challenges, there remain opportunities within the UK market to identify promising small-cap stocks that may not be on every investor’s radar. In this context, finding a good stock often involves looking for companies with strong fundamentals and unique growth potential that can weather broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Anglo-Eastern Plantations | NA | 8.55% | 11.10% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

Overview: B.P. Marsh & Partners PLC is a company that focuses on investing in early-stage financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £255.45 million.

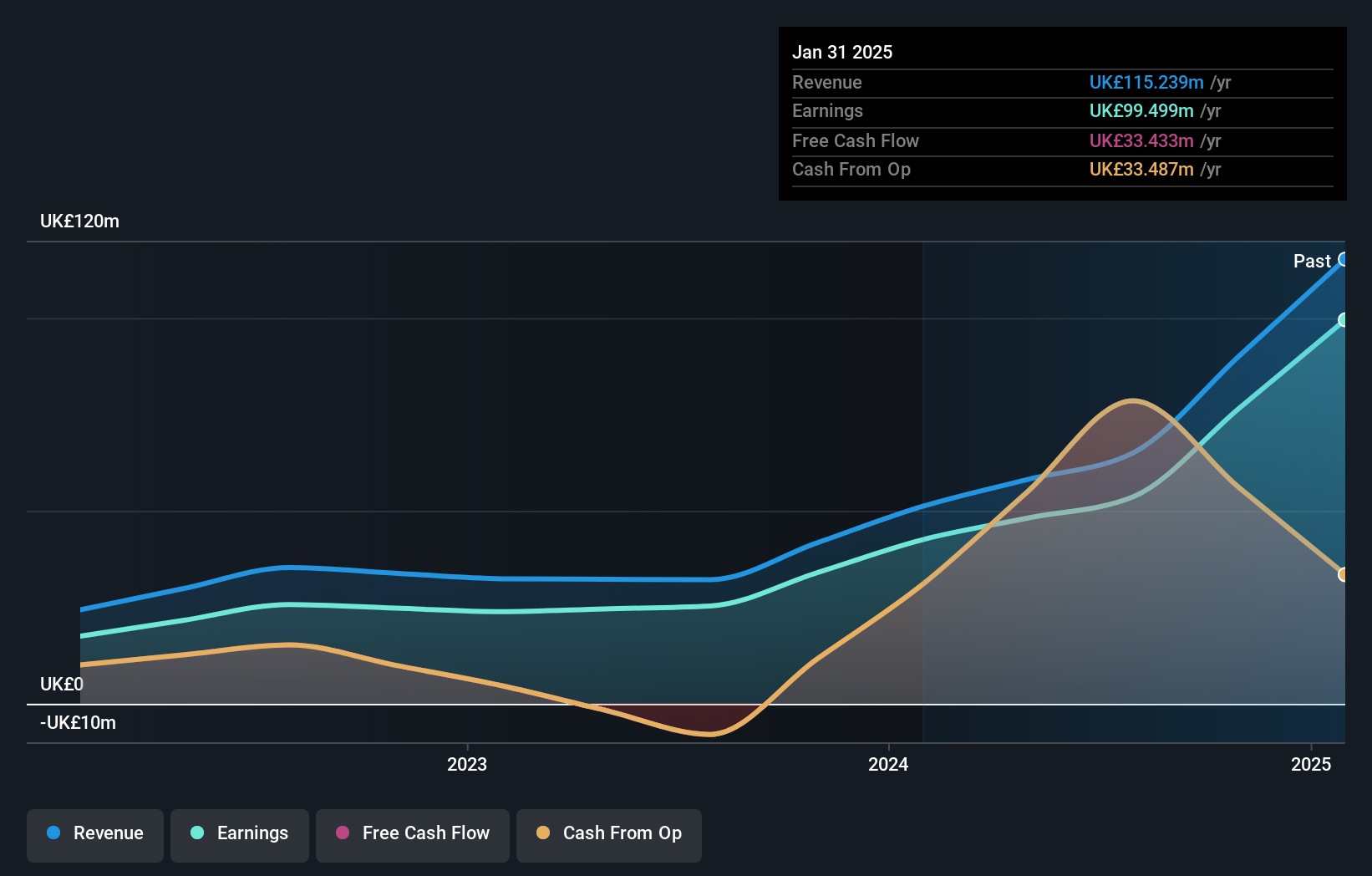

Operations: Revenue for B.P. Marsh & Partners primarily stems from the provision of consultancy services and trading investments in financial services, totaling £115.24 million.

B.P. Marsh & Partners, a nimble player in the financial sector, has shown remarkable growth with earnings surging 134% over the past year, outpacing its industry peers. The firm operates debt-free and trades at a discount of 36.6% below its estimated fair value, signaling potential undervaluation. Recently, it reported net income of £99.5 million for the fiscal year ending January 2025, up from £42.53 million previously. Additionally, they have been active in share repurchases and proposed a dividend increase to 6.78 pence per share pending shareholder approval in July 2025.

- Delve into the full analysis health report here for a deeper understanding of B.P. Marsh & Partners.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across various international markets, with a market cap of approximately £664.77 million.

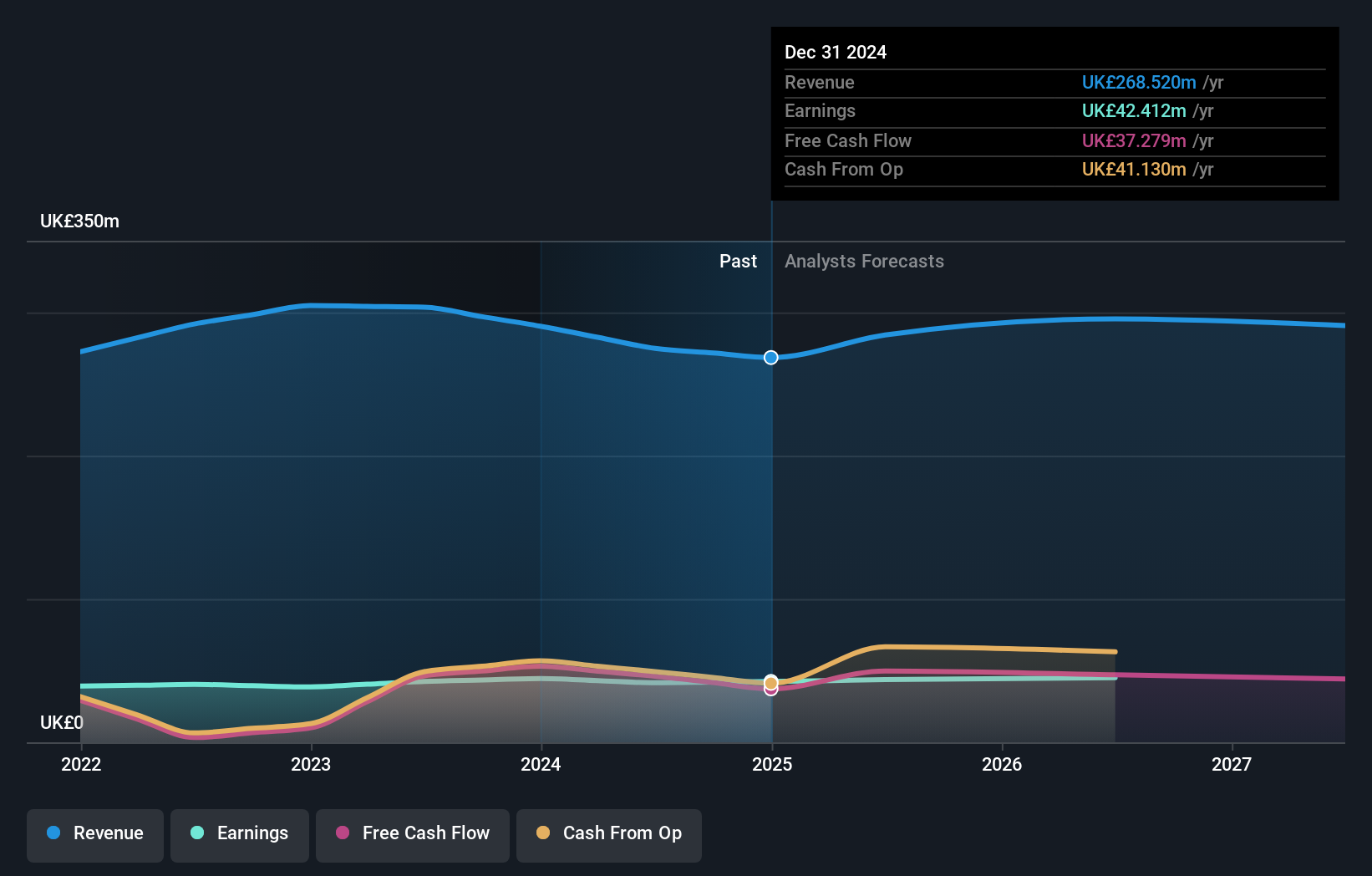

Operations: James Halstead generates revenue primarily from the manufacture and distribution of flooring products, amounting to £268.52 million. The company's operations span multiple international markets, contributing to its financial performance.

James Halstead, a standout in the UK market with a price-to-earnings ratio of 15.7x, offers value below the broader market average of 16.1x. Despite facing a negative earnings growth of 4.6% last year, which is slightly better than the building industry's average of 5.5%, it remains profitable with robust free cash flow standing at £49.54 million as of March 2024. The company has reduced its debt-to-equity ratio from 0.2% to just 0.1% over five years, indicating prudent financial management and more cash than total debt on hand, ensuring stability and potential for future growth initiatives like dividend increases recently announced by the firm.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c. is an investment trust that offers independent professional services globally to a diverse range of clients, with a market capitalization of £1.31 billion.

Operations: Law Debenture generates revenue primarily from its investment portfolio (£35.91 million) and independent professional services (£61.66 million). The net profit margin is a key indicator of financial performance, reflecting the company's ability to convert revenue into profit after covering all expenses.

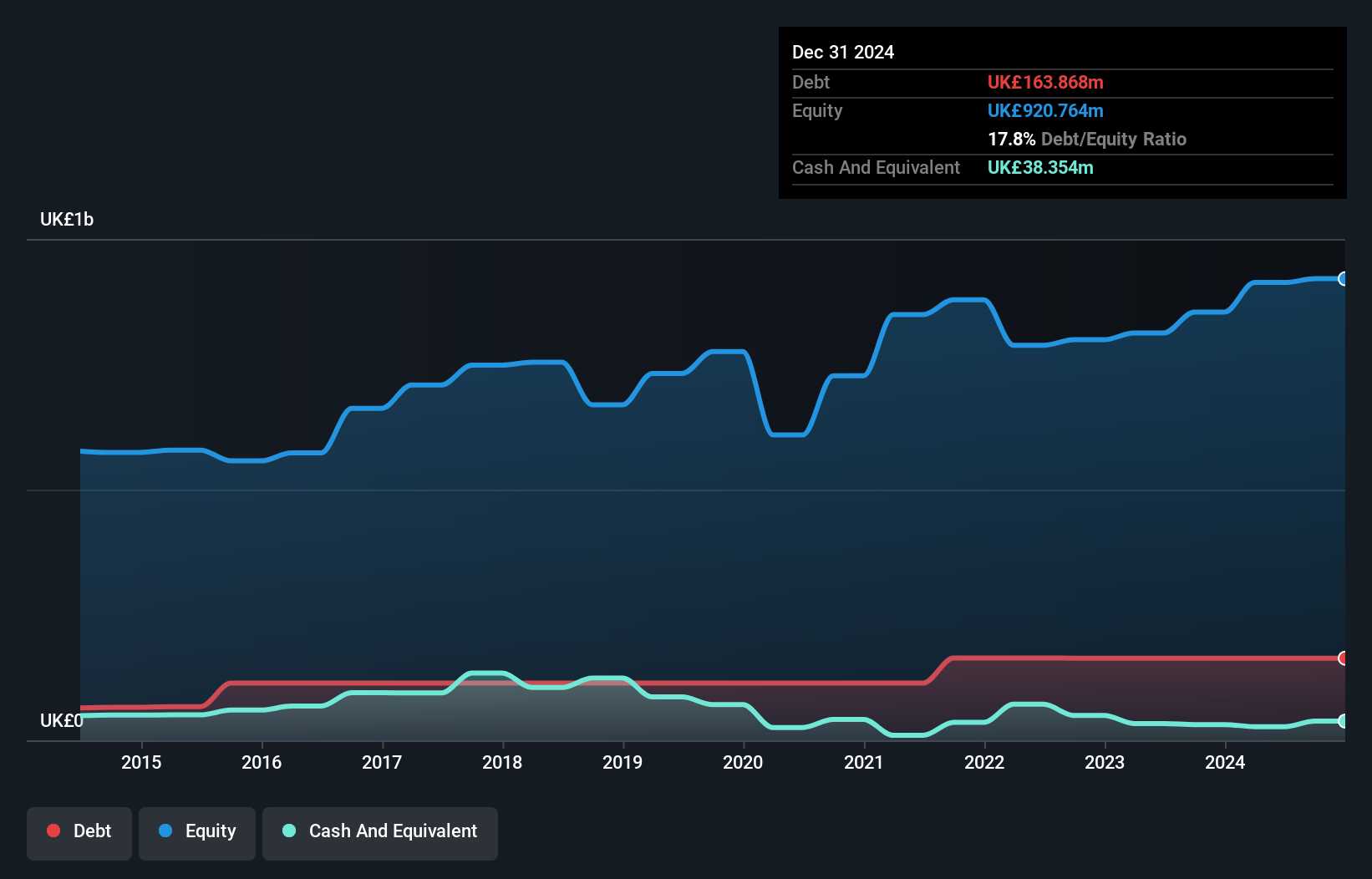

Law Debenture, a promising player in the UK market, has seen its earnings soar by 29% over the past year, outpacing the Capital Markets industry's 11.1% growth. The company's price-to-earnings ratio of 13.5x is attractive compared to the broader UK market's 16.1x, suggesting good value for investors. With a net debt to equity ratio standing at a satisfactory 13.6%, Law Debenture's financial health appears robust, further supported by an impressive interest coverage of 18.2x EBIT over interest payments. Recent dividend announcements reflect confidence in its ongoing performance and shareholder returns strategy.

- Navigate through the intricacies of Law Debenture with our comprehensive health report here.

Evaluate Law Debenture's historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 55 UK Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B.P. Marsh & Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BPM

B.P. Marsh & Partners

Invests in early-stage financial services intermediary businesses in the United Kingdom and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives