- United Kingdom

- /

- Capital Markets

- /

- LSE:BBGI

Alpha Group International And 2 Other Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

The market in the United Kingdom has climbed 1.5% over the last week and is up 6.2% over the past 12 months, with earnings forecasted to grow by 13% annually. In this promising environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding; Alpha Group International and two other undiscovered gems stand out as intriguing opportunities in this context.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the United Kingdom, Europe, Canada, and internationally, with a market cap of £1.08 billion.

Operations: Alpha Group International plc generates revenue primarily from its Alpha Pay (£64.30 million), Institutional (£61.29 million), and Corporate London (£45.42 million) segments, with smaller contributions from Corporate Amsterdam (£8.70 million), Corporate Toronto (£4.23 million), and Cobase (£0.19 million).

Alpha Group International, trading at a P/E ratio of 12.2x compared to the UK market's 16.5x, shows strong value potential. Its earnings surged by 130% last year, outpacing the industry growth of 0.5%. The company is debt-free and has consistently high-quality non-cash earnings. Recent developments include being added to multiple FTSE indices and commencing a share repurchase program authorized to buy back up to 4.31 million shares, enhancing shareholder value further.

BBGI Global Infrastructure (LSE:BBGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: BBGI Global Infrastructure S.A. is an investment firm specializing in infrastructure investments in operational or near-operational assets, with a market cap of £1.00 billion.

Operations: BBGI Global Infrastructure generates revenue primarily from its Financial Services - Closed End Funds segment, amounting to £48.10 million.

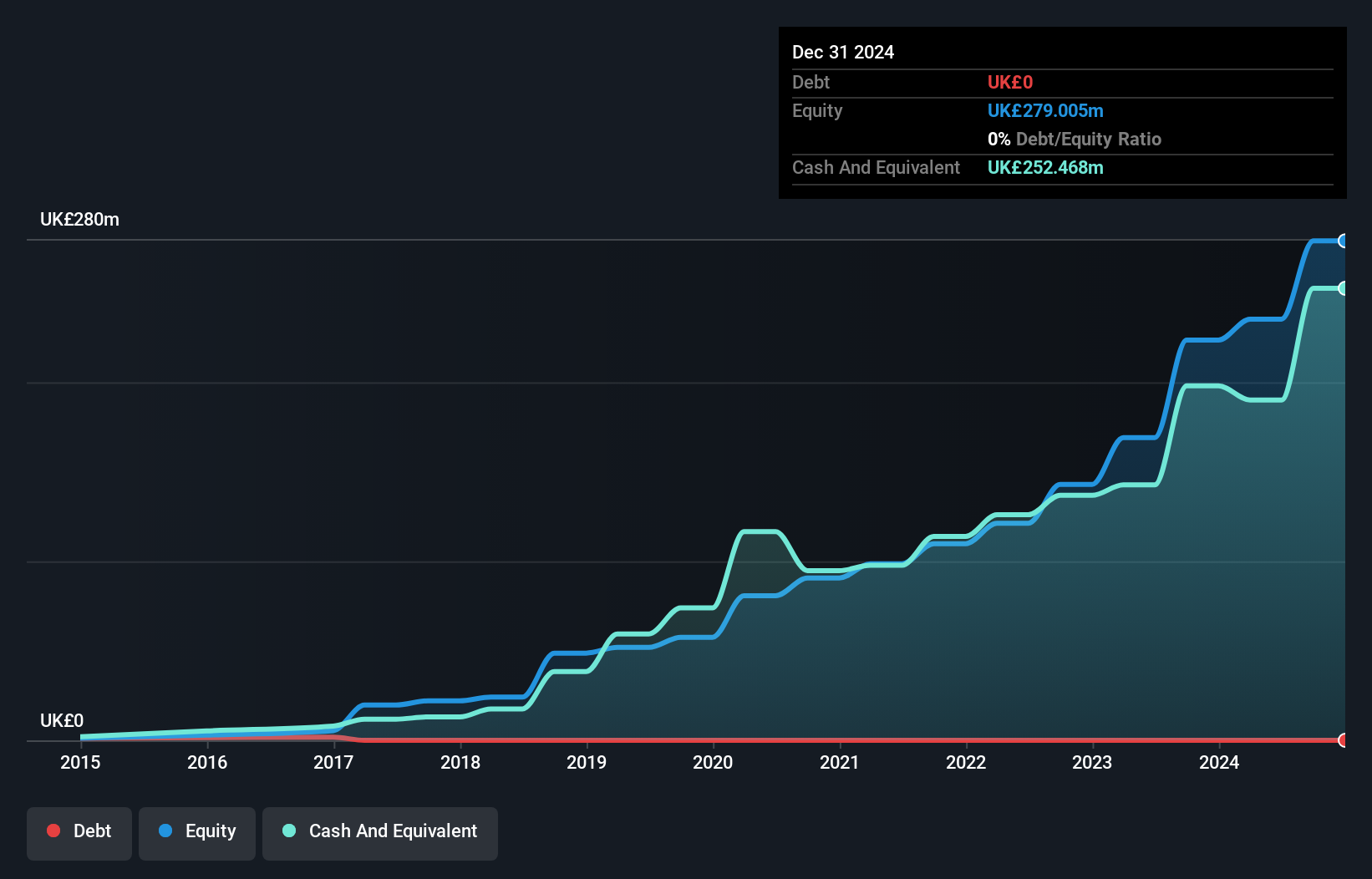

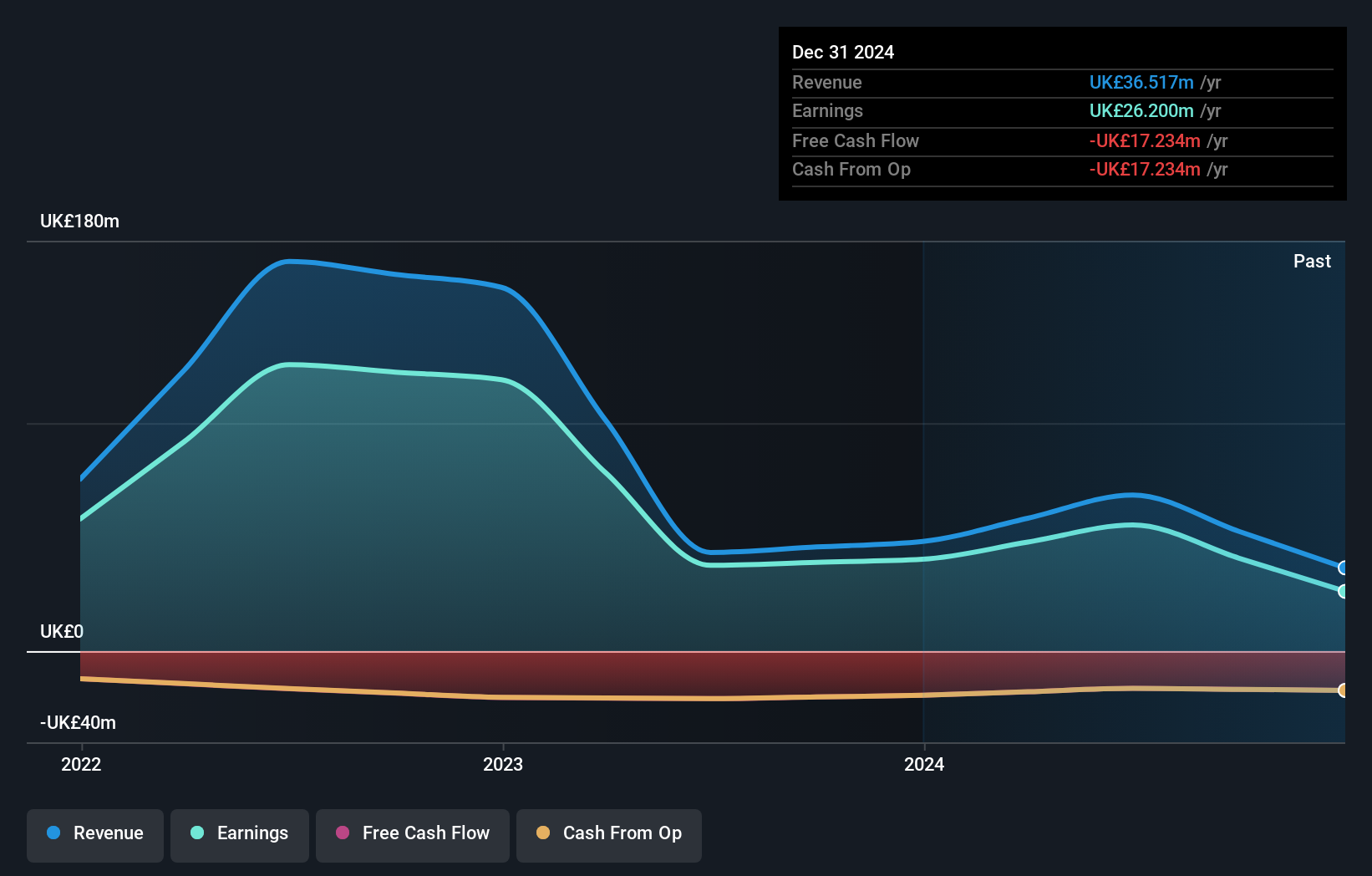

BBGI Global Infrastructure has seen its debt to equity ratio drop from 1.8% to 0.02% over the past five years, demonstrating effective debt management. Interest payments are well covered by EBIT at 14.8 times, indicating strong financial health. However, earnings growth was negative at -66.2% last year compared to the industry average of 0.5%. The company initiated a share repurchase program in May 2024, authorized to buy back up to approximately 107 million shares or about 15% of its issued share capital.

- Click here and access our complete health analysis report to understand the dynamics of BBGI Global Infrastructure.

Gain insights into BBGI Global Infrastructure's past trends and performance with our Past report.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Law Debenture Corporation p.l.c., with a market cap of £1.19 billion, operates as an investment trust offering independent professional services to companies, agencies, organizations, and individuals globally.

Operations: Law Debenture generates revenue primarily from its Investment Portfolio (£35.62 million) and Independent Professional Services (£61.55 million).

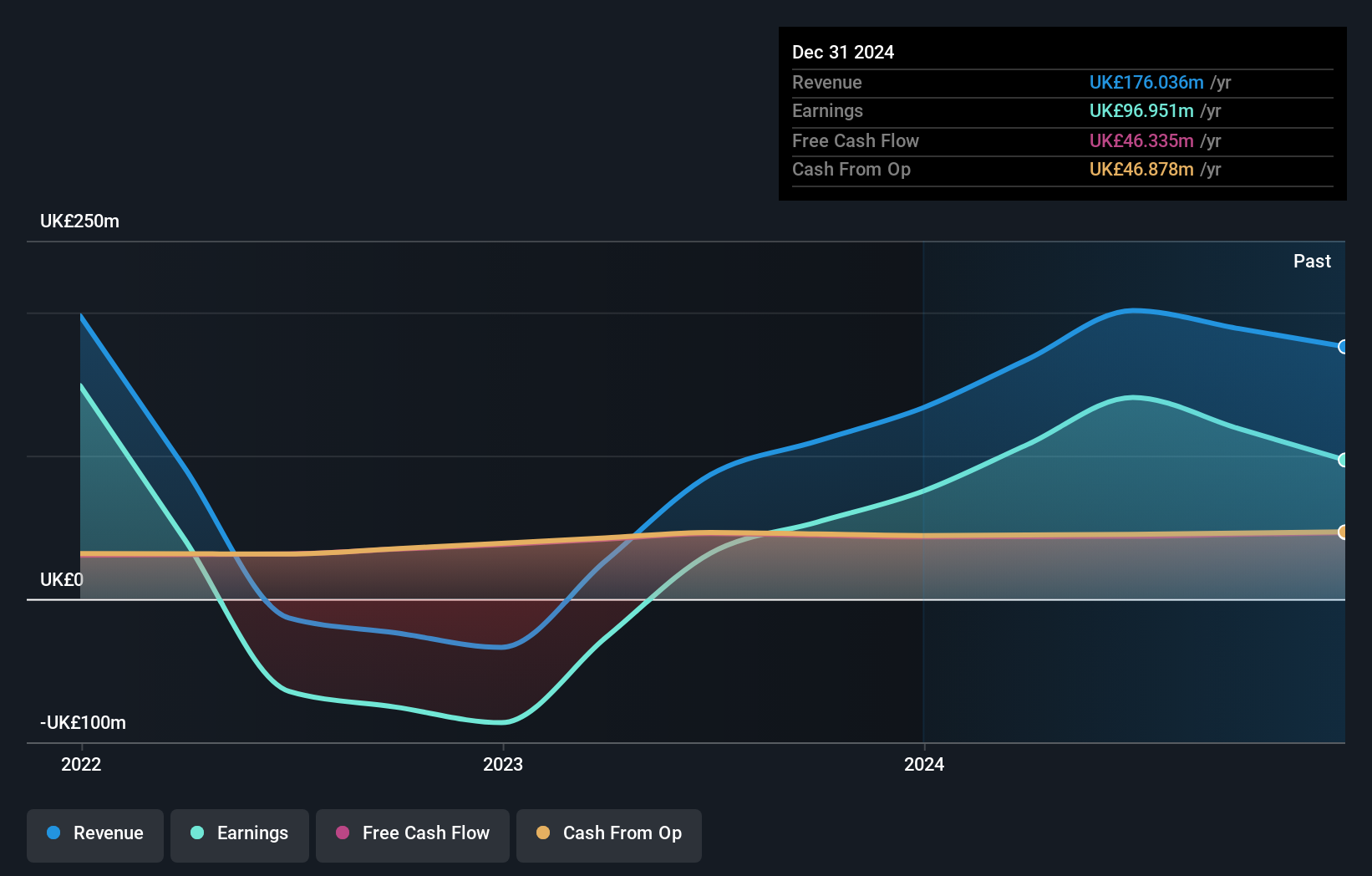

Law Debenture has shown remarkable growth, with earnings surging by 340.1% over the past year, outpacing the Capital Markets industry. The company's net debt to equity ratio stands at a satisfactory 15%, and its interest payments are well covered by EBIT at 21.9x. Recent half-year results revealed revenue of £111.97 million and net income of £82 million, significantly up from last year's figures of £44.02 million and £16.54 million respectively.

- Take a closer look at Law Debenture's potential here in our health report.

Understand Law Debenture's track record by examining our Past report.

Where To Now?

- Unlock our comprehensive list of 76 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BBGI Global Infrastructure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BBGI

BBGI Global Infrastructure

An investment firm specializing in infrastructure investments in operational or near operational assets.

Excellent balance sheet average dividend payer.