Stock Analysis

- United Kingdom

- /

- Capital Markets

- /

- LSE:LSEG

Investing in London Stock Exchange Group (LON:LSEG) five years ago would have delivered you a 99% gain

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. For example, the London Stock Exchange Group plc (LON:LSEG) share price is up 88% in the last 5 years, clearly besting the market decline of around 5.3% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 8.6% , including dividends .

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

View our latest analysis for London Stock Exchange Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

London Stock Exchange Group's earnings per share are down 1.3% per year, despite strong share price performance over five years.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 1.3% dividend yield is unlikely to be propping up the share price. In contrast revenue growth of 34% per year is probably viewed as evidence that London Stock Exchange Group is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

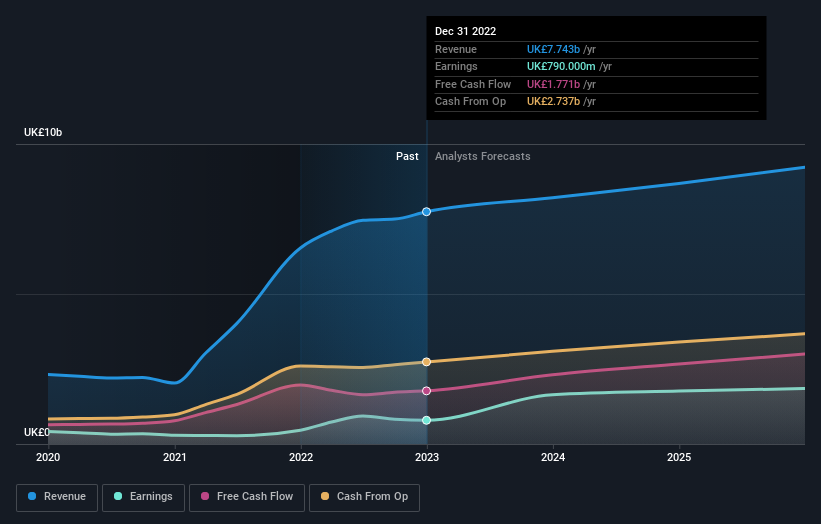

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

London Stock Exchange Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, London Stock Exchange Group's TSR for the last 5 years was 99%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that London Stock Exchange Group has rewarded shareholders with a total shareholder return of 8.6% in the last twelve months. That's including the dividend. However, the TSR over five years, coming in at 15% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether London Stock Exchange Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:LSEG

London Stock Exchange Group

Operates as a financial markets infrastructure and data provider primarily in the United Kingdom and internationally.

Flawless balance sheet with moderate growth potential.