- United Kingdom

- /

- Professional Services

- /

- LSE:WIL

Insider Actions Highlight Undervalued European Small Caps For March 2025

Reviewed by Simply Wall St

In recent weeks, the European market has shown resilience, with the pan-European STOXX Europe 600 Index experiencing its longest streak of weekly gains since August 2012, buoyed by encouraging company results and gains in defense stocks despite uncertainties surrounding U.S. trade policy. As investors navigate this dynamic landscape, identifying small-cap stocks with strong fundamentals and potential for growth can be crucial, especially when insider actions suggest confidence in these companies' prospects amidst mixed economic signals.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.3x | 4.9x | 24.14% | ★★★★★★ |

| Macfarlane Group | 10.3x | 0.6x | 41.70% | ★★★★★★ |

| Speedy Hire | NA | 0.2x | 27.18% | ★★★★★☆ |

| NCC Group | NA | 1.3x | 22.47% | ★★★★★☆ |

| 4imprint Group | 16.5x | 1.4x | 33.97% | ★★★★☆☆ |

| Gamma Communications | 22.2x | 2.3x | 36.44% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 11.7x | 1.9x | 23.13% | ★★★★☆☆ |

| Franchise Brands | 38.0x | 2.0x | 27.08% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.05% | ★★★★☆☆ |

| FastPartner | 17.7x | 5.0x | -97.25% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

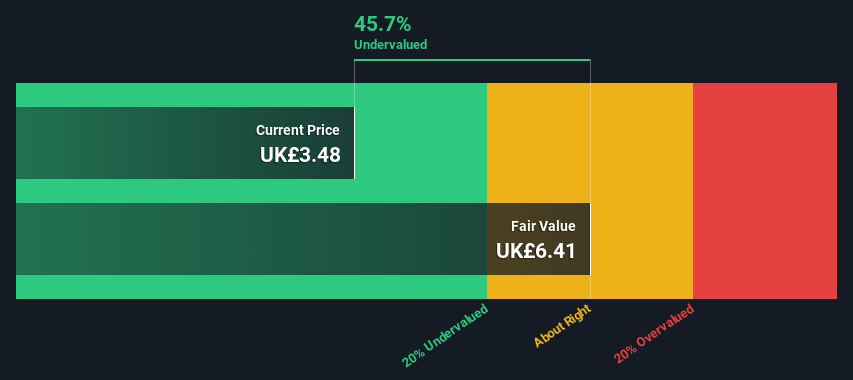

Jupiter Fund Management (LSE:JUP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jupiter Fund Management is a UK-based asset management company specializing in investment management services, with a market capitalization of approximately £1.26 billion.

Operations: Jupiter Fund Management generates its revenue primarily through its Investment Management Business, with recent quarterly revenues reaching £364.1 million. The company has experienced fluctuations in net income margin, which was as high as 47.98% and recently recorded a low of -3.50%. Operating expenses and non-operating expenses have had a significant impact on the company's profitability over time, contributing to variations in net income margins.

PE: 6.2x

Jupiter Fund Management, a European investment firm, is navigating a challenging landscape with earnings projected to decline by 15.4% annually over the next three years. Despite this, insider confidence is evident as they initiate a £13.9 million share repurchase program valid until July 2025. The company reported net income of £65.2 million for 2024, reversing last year's loss of £12.9 million and announced a reduced dividend aligned with its policy of returning half of underlying EPS before performance fees. Recent board changes include Siobhan Boylan stepping down due to new commitments and Dale Murray temporarily assuming her role as Chair of the Audit and Risk Committee starting April 1, 2025.

- Click to explore a detailed breakdown of our findings in Jupiter Fund Management's valuation report.

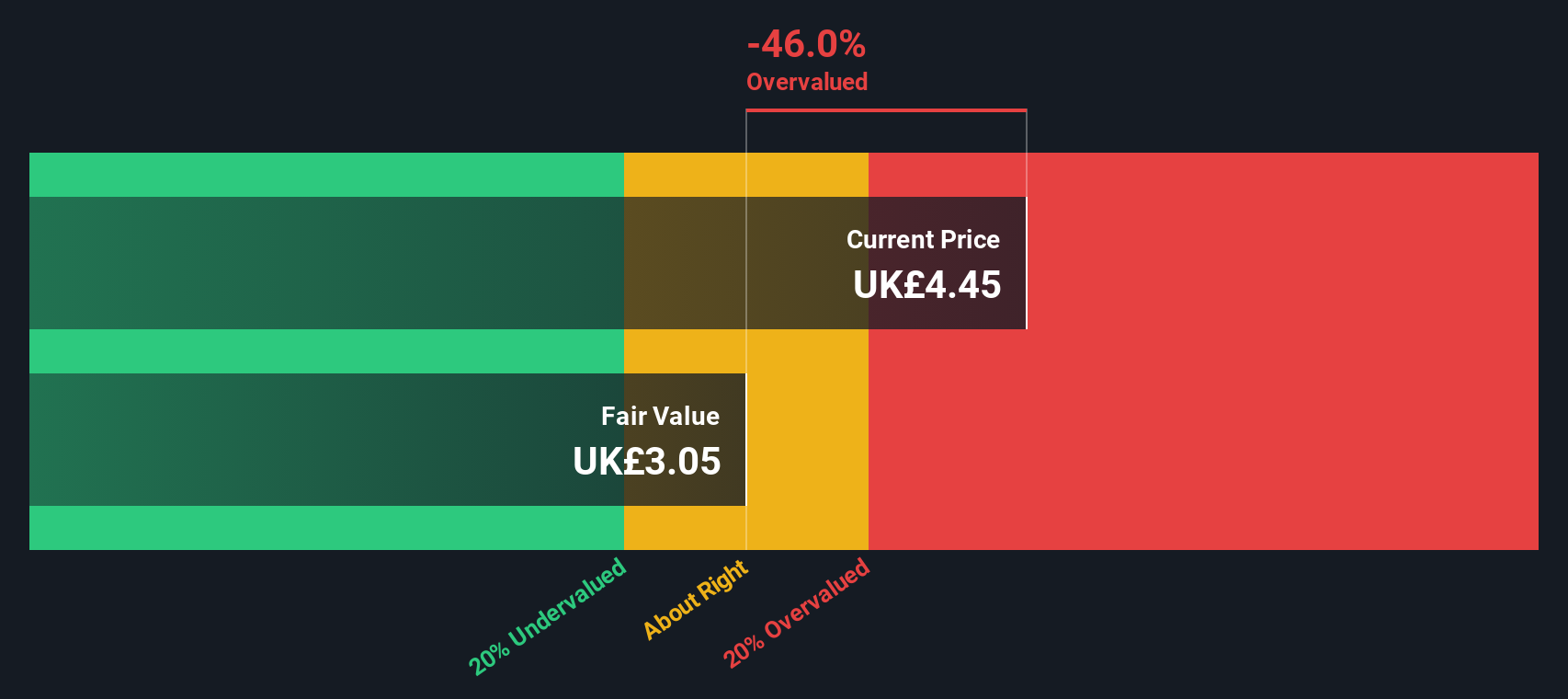

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pinewood Technologies Group is a company that specializes in providing software solutions, with a focus on the automotive industry, and has a market capitalization of £1.75 billion.

Operations: Pinewood Technologies Group generates revenue primarily from its software segment, with recent figures showing £22.62 million in this area. Over time, the company's net income margin has experienced fluctuations, reaching as high as 33.88% in the latest period. Operating expenses have varied but were reported at £10.89 million recently, impacting overall profitability alongside non-operating expenses of £1.57 million.

PE: 38.6x

Pinewood Technologies Group, a smaller European player, has recently secured a five-year contract with Global Auto Holdings Plc to deploy its Automotive Intelligence platform across multiple regions, promising substantial future earnings. Insider confidence is evident from recent share purchases. However, the company relies solely on external borrowing for funding. Despite this riskier financing approach, Pinewood's earnings are projected to grow by 25% annually. Recent equity offerings totaling £42 million may support strategic initiatives and expansion efforts.

- Click here and access our complete valuation analysis report to understand the dynamics of Pinewood Technologies Group.

Gain insights into Pinewood Technologies Group's past trends and performance with our Past report.

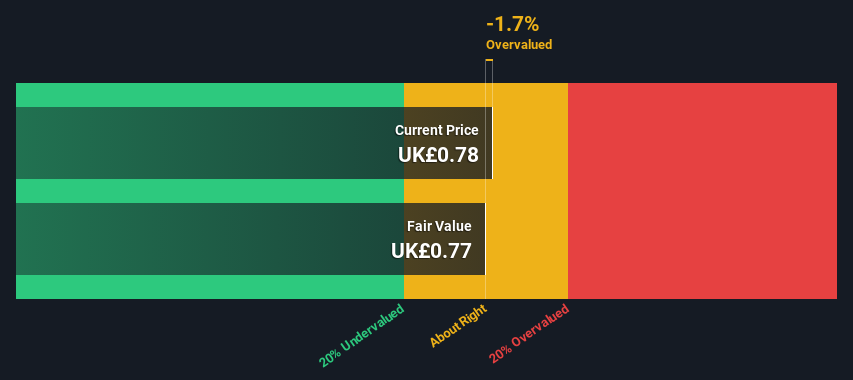

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wilmington is a company that provides information, education, and networking services across various sectors including legal, finance, and health safety and environment (HSE), with a market capitalization of £0.26 billion.

Operations: The company generates revenue primarily from the Finance segment (£69.85 million), followed by Legal (£15.64 million) and Health, Safety and Environment (HSE) (£10.39 million). Over recent periods, the gross profit margin has shown an upward trend, reaching 22.55% in December 2024 from 20.83% in December 2023.

PE: 22.5x

Wilmington, a European small-cap company, is drawing attention with its strategic share repurchase initiative commencing February 27, 2025. This move reflects potential insider confidence in the company's future prospects. Despite a dip in net income to £2.59 million for H1 FY25 from £7.12 million the previous year, sales rose to £46.57 million from £43.91 million, indicating growth momentum. Earnings are projected to grow at 17% annually, suggesting promising long-term potential despite current challenges in profitability and reliance on external borrowing for funding needs.

- Get an in-depth perspective on Wilmington's performance by reading our valuation report here.

Understand Wilmington's track record by examining our Past report.

Taking Advantage

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 47 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wilmington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIL

Wilmington

Provides data, information, training, and education solutions to professional markets in the United Kingdom, the United States, rest of Europe, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives