Stock Analysis

- United Kingdom

- /

- Capital Markets

- /

- LSE:IHP

As IntegraFin Holdings (LON:IHP) ascends 5.8% this past week, investors may now be noticing the company's three-year earnings growth

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term IntegraFin Holdings plc (LON:IHP) shareholders, since the share price is down 48% in the last three years, falling well short of the market decline of around 14%. Contrary to the longer term story, the last month has been good for stockholders, with a share price gain of 8.0%.

On a more encouraging note the company has added UK£53m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for IntegraFin Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, IntegraFin Holdings actually managed to grow EPS by 3.1% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It looks to us like the market was probably too optimistic around growth three years ago. However, taking a look at other business metrics might shed a bit more light on the share price action.

We note that, in three years, revenue has actually grown at a 7.6% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating IntegraFin Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

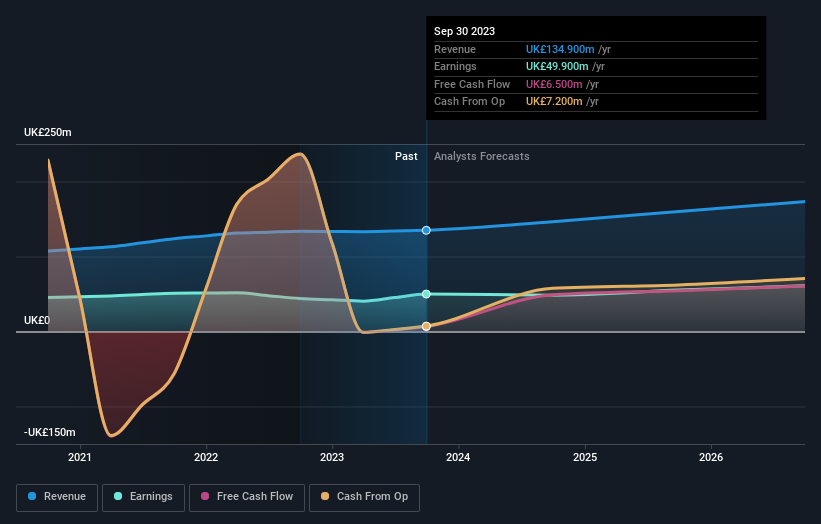

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

IntegraFin Holdings is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling IntegraFin Holdings stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, IntegraFin Holdings' TSR for the last 3 years was -43%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that IntegraFin Holdings shareholders have received a total shareholder return of 10% over the last year. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 3% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand IntegraFin Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with IntegraFin Holdings , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether IntegraFin Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IHP

IntegraFin Holdings

IntegraFin Holdings plc, together with its subsidiaries, provides an investment platform for UK financial advisers and their clients.

Outstanding track record with flawless balance sheet.