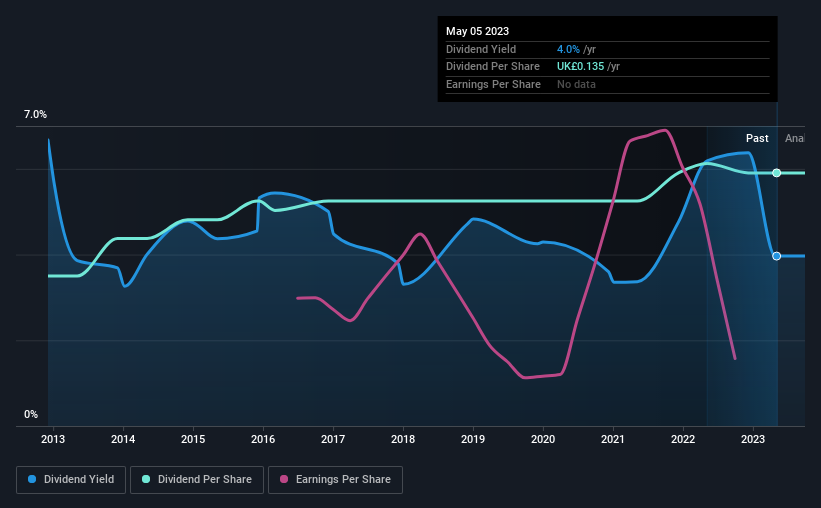

Numis Corporation Plc (LON:NUM) has announced that it will pay a dividend of £0.06 per share on the 23rd of June. This payment means that the dividend yield will be 4.0%, which is around the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Numis' stock price has increased by 56% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Numis

Numis Is Paying Out More Than It Is Earning

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Looking forward, EPS could fall by 14.2% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 127%, which could put the dividend in jeopardy if the company's earnings don't improve.

Numis Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of £0.08 in 2013 to the most recent total annual payment of £0.135. This implies that the company grew its distributions at a yearly rate of about 5.4% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though Numis' EPS has declined at around 14% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Numis (of which 2 are a bit concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Numis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NUM

Numis

Numis Corporation Plc, through its subsidiaries, provides various investment banking services in the United Kingdom, the United States, and Ireland.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives