- United Kingdom

- /

- Capital Markets

- /

- AIM:MANO

Manolete Partners (LON:MANO) Is Reducing Its Dividend To UK£0.01

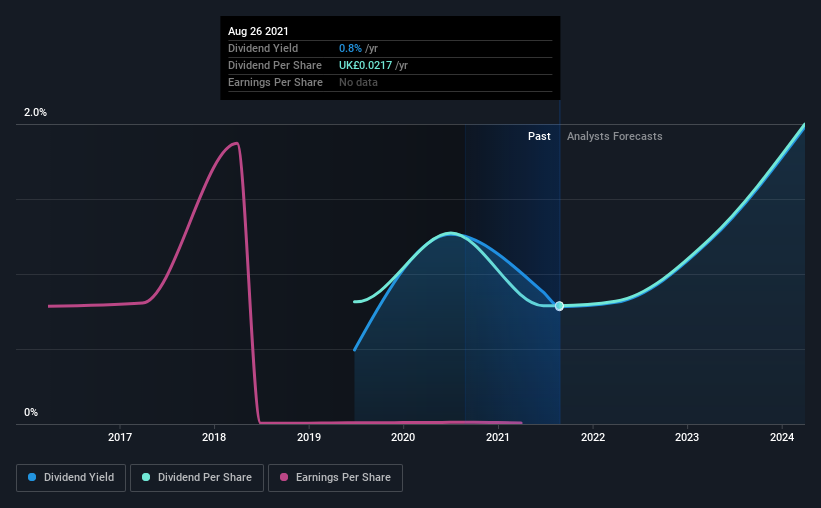

Manolete Partners Plc (LON:MANO) is reducing its dividend to UK£0.01 on the 7th of October. This payment takes the dividend yield to 0.8%, which only provides a modest boost to overall returns.

View our latest analysis for Manolete Partners

Manolete Partners' Dividend Is Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Manolete Partners is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

EPS is set to fall by 54.1% over the next 12 months. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be , which is comfortable for the company to continue in the future.

Manolete Partners' Dividend Has Lacked Consistency

Looking back, the dividend has been unstable but with a relatively short history, we think it may be a bit early to draw conclusions about long term dividend sustainability. The dividend has gone from UK£0.022 in 2019 to the most recent annual payment of UK£0.022. This works out to be a decline of approximately 1.6% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings per share has been sinking by 61% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

The Dividend Could Prove To Be Unreliable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While Manolete Partners is earning enough to cover the payments, the cash flows are lacking. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. To that end, Manolete Partners has 2 warning signs (and 1 which can't be ignored) we think you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Manolete Partners, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:MANO

Manolete Partners

Operates as an insolvency litigation financing company in the United Kingdom.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives