Stock Analysis

- United Kingdom

- /

- Renewable Energy

- /

- LSE:DRX

3 UK Dividend Stocks Offering Up To 4.4% Yield

Reviewed by Simply Wall St

The UK stock market is showing signs of resilience, with the FTSE 100 poised for its third consecutive day of gains amidst a broader context of positive momentum in global financial markets. As investors navigate through these dynamic conditions, dividend stocks continue to be an attractive option for those seeking steady income streams in a fluctuating economic environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.12% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.50% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.45% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.08% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.90% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.04% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.63% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.62% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.09% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.43% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

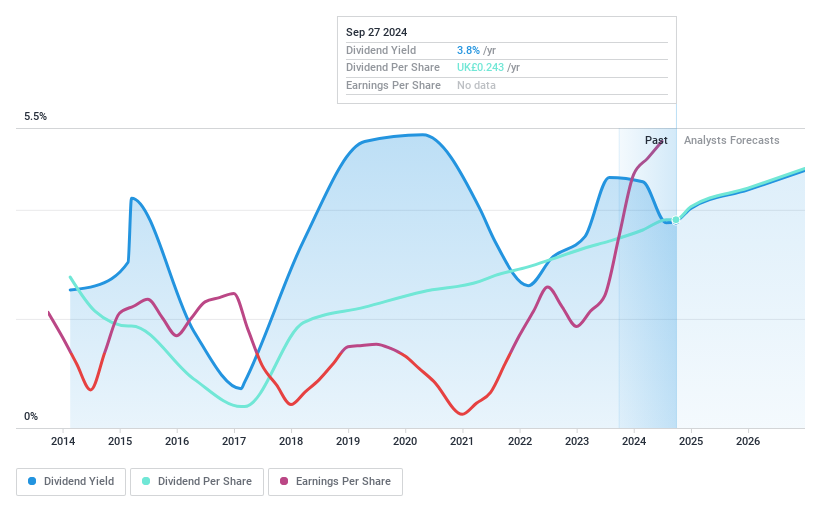

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc operates in the renewable power generation sector in the United Kingdom, with a market capitalization of approximately £2.00 billion.

Operations: Drax Group plc generates revenue through three primary segments: Customers (£4.96 billion), Generation (£6.79 billion), and Pellet Production (£0.82 billion).

Dividend Yield: 4.5%

Drax Group recently approved a final dividend of 13.9 pence per share for 2023, indicating a commitment to returning value to shareholders despite its historically unstable dividend track record. The dividends are well-supported by earnings and cash flows, with payout ratios of 16.2% and 22.6% respectively, suggesting sustainability from a financial perspective. However, the company's high level of debt and forecasted average earnings decline of 15.3% per year over the next three years could pose challenges to future dividend reliability and growth.

- Navigate through the intricacies of Drax Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Drax Group is priced lower than what may be justified by its financials.

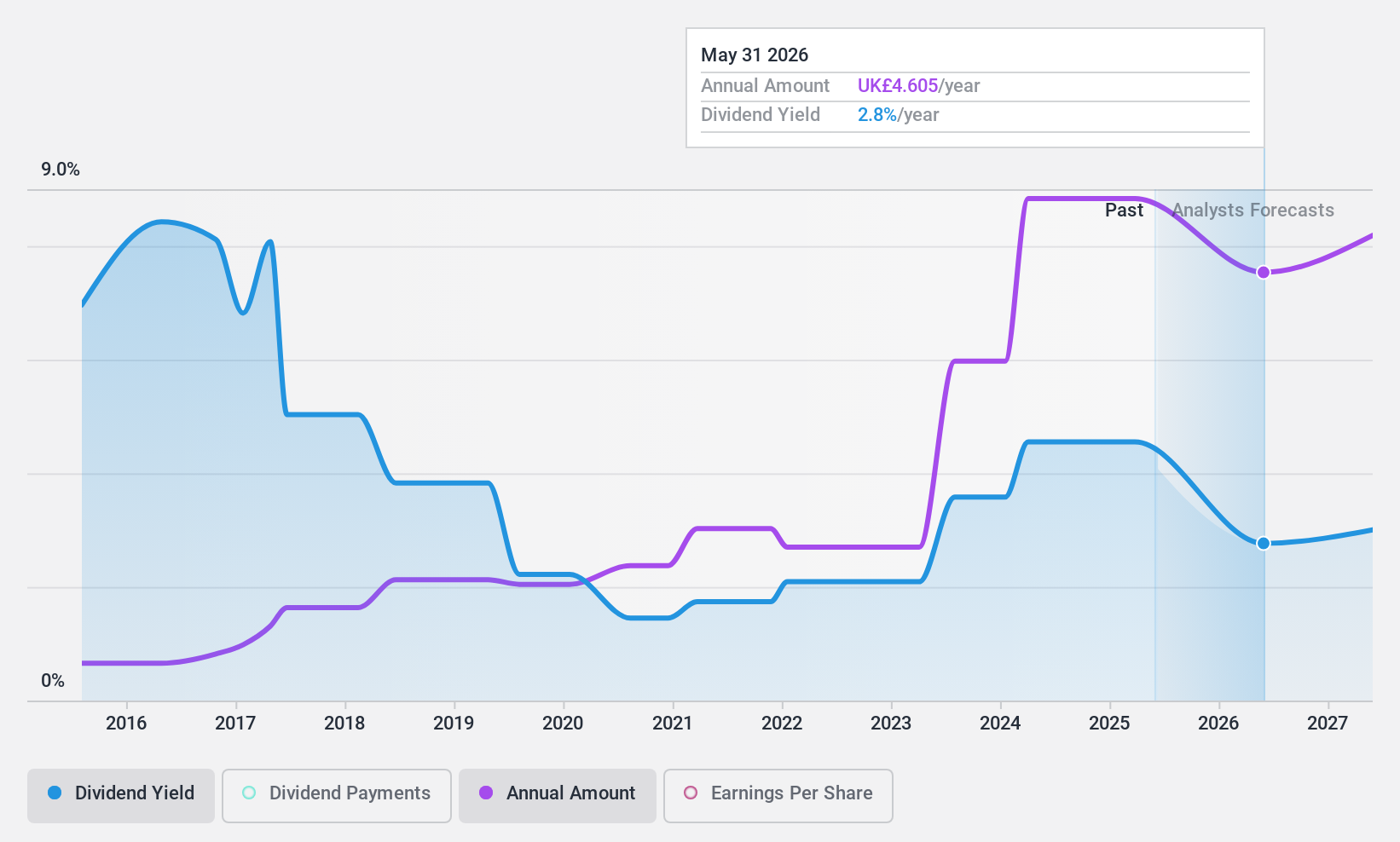

Games Workshop Group (LSE:GAW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Games Workshop Group PLC is a company that designs, manufactures, distributes, and sells miniature figures and games globally, with a market capitalization of approximately £3.29 billion.

Operations: Games Workshop Group PLC generates revenue primarily through its core segment of £468.70 million and a licensing segment that contributes £23.20 million.

Dividend Yield: 4.4%

Games Workshop Group's recent dividend declaration of £4.20 per share reflects a modest increase from the previous year, despite earnings not fully covering these payments, indicating potential sustainability concerns with a payout ratio of 110.8%. However, dividends have shown reliability and growth over the past decade. The upcoming departure of CFO Rachel Tongue in 2025 could introduce uncertainties around financial leadership continuity as the company navigates its cash flow management to maintain dividend commitments.

- Delve into the full analysis dividend report here for a deeper understanding of Games Workshop Group.

- Upon reviewing our latest valuation report, Games Workshop Group's share price might be too optimistic.

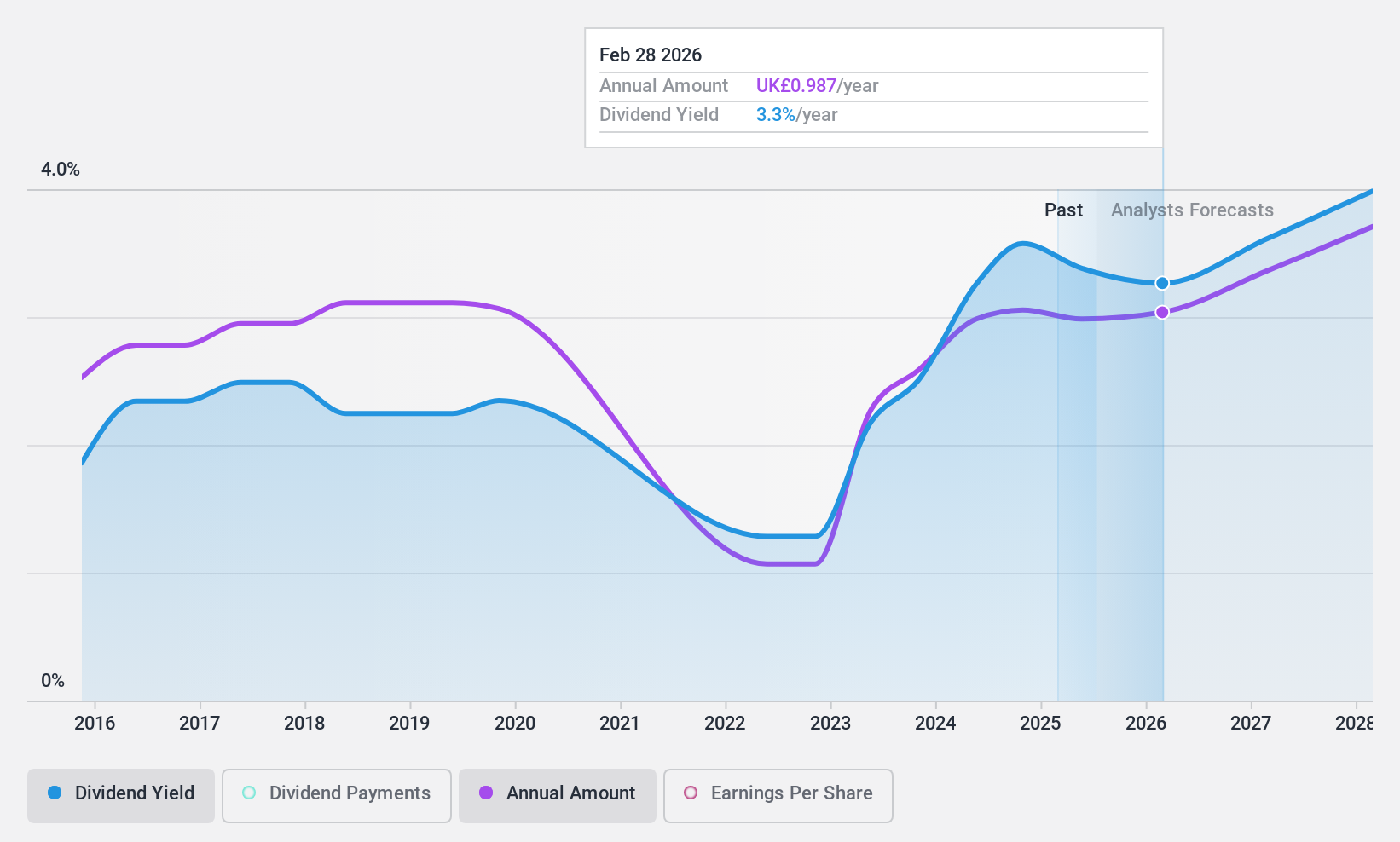

Whitbread (LSE:WTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whitbread plc is a hospitality company that operates hotels and restaurants primarily in the United Kingdom and Germany, with a market capitalization of approximately £5.36 billion.

Operations: Whitbread plc generates £2.96 billion in revenue from its accommodation, food, and beverage segments.

Dividend Yield: 3.3%

Whitbread's dividend yield stands at 3.28%, lower than the UK market's top quartile, yet it has a history of increasing dividends over the past decade. Despite this growth, dividend payments have been volatile. Currently, dividends are supported by earnings and cash flows with payout ratios of 60.3% and 47.7%, respectively. Recent initiatives include a £150 million share repurchase program and a proposed 26% dividend increase to 97 pence per share for fiscal year 2024, signaling confidence in future cash flow management despite past inconsistencies in dividend stability.

- Click to explore a detailed breakdown of our findings in Whitbread's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Whitbread shares in the market.

Summing It All Up

- Embark on your investment journey to our 56 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Drax Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DRX

Outstanding track record, undervalued and pays a dividend.