- United Kingdom

- /

- Hospitality

- /

- LSE:SSPG

The Independent Chairman of the Board of SSP Group plc (LON:SSPG), Michael Clasper, Just Bought 78% More Shares

Investors who take an interest in SSP Group plc (LON:SSPG) should definitely note that the Independent Chairman of the Board, Michael Clasper, recently paid UK£3.23 per share to buy UK£100k worth of the stock. That certainly has us anticipating the best, especially since they thusly increased their own holding by 78%, potentially signalling some real optimism.

See our latest analysis for SSP Group

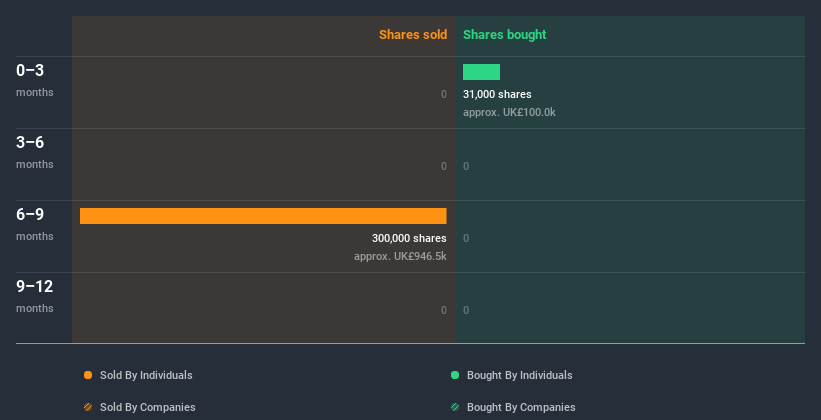

SSP Group Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the CFO & Executive Director, Jonathan Davies, sold UK£947k worth of shares at a price of UK£3.16 per share. That means that even when the share price was below the current price of UK£3.37, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 20% of Jonathan Davies's stake. Jonathan Davies was the only individual insider to sell shares in the last twelve months.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of SSP Group

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. SSP Group insiders own about UK£11m worth of shares. That equates to 0.6% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The SSP Group Insider Transactions Indicate?

The recent insider purchase is heartening. On the other hand the transaction history, over the last year, isn't so positive. The more recent transactions are a positive, but SSP Group insiders haven't shown the sustained enthusiasm that we look for, although they do own a decent number of shares, overall. So they seem pretty well aligned, overall. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 3 warning signs for SSP Group you should be aware of, and 1 of these is a bit concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade SSP Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SSPG

SSP Group

Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

Undervalued with high growth potential.