- United Kingdom

- /

- Hospitality

- /

- LSE:RNK

3 UK Stocks Estimated To Trade At Up To 42.2% Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China and falling commodity prices. In this challenging market environment, identifying undervalued stocks can be crucial for investors seeking opportunities; here are three UK stocks estimated to trade up to 42.2% below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £30.60 | £58.41 | 47.6% |

| Gaming Realms (AIM:GMR) | £0.40 | £0.76 | 47.6% |

| Liontrust Asset Management (LSE:LIO) | £6.47 | £12.31 | 47.4% |

| Topps Tiles (LSE:TPT) | £0.475 | £0.91 | 47.5% |

| Marks Electrical Group (AIM:MRK) | £0.65 | £1.27 | 49% |

| C&C Group (LSE:CCR) | £1.546 | £3.00 | 48.5% |

| AstraZeneca (LSE:AZN) | £130.00 | £250.41 | 48.1% |

| Mercia Asset Management (AIM:MERC) | £0.35 | £0.68 | 48.3% |

| Foxtons Group (LSE:FOXT) | £0.652 | £1.22 | 46.4% |

| Franchise Brands (AIM:FRAN) | £1.82 | £3.61 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

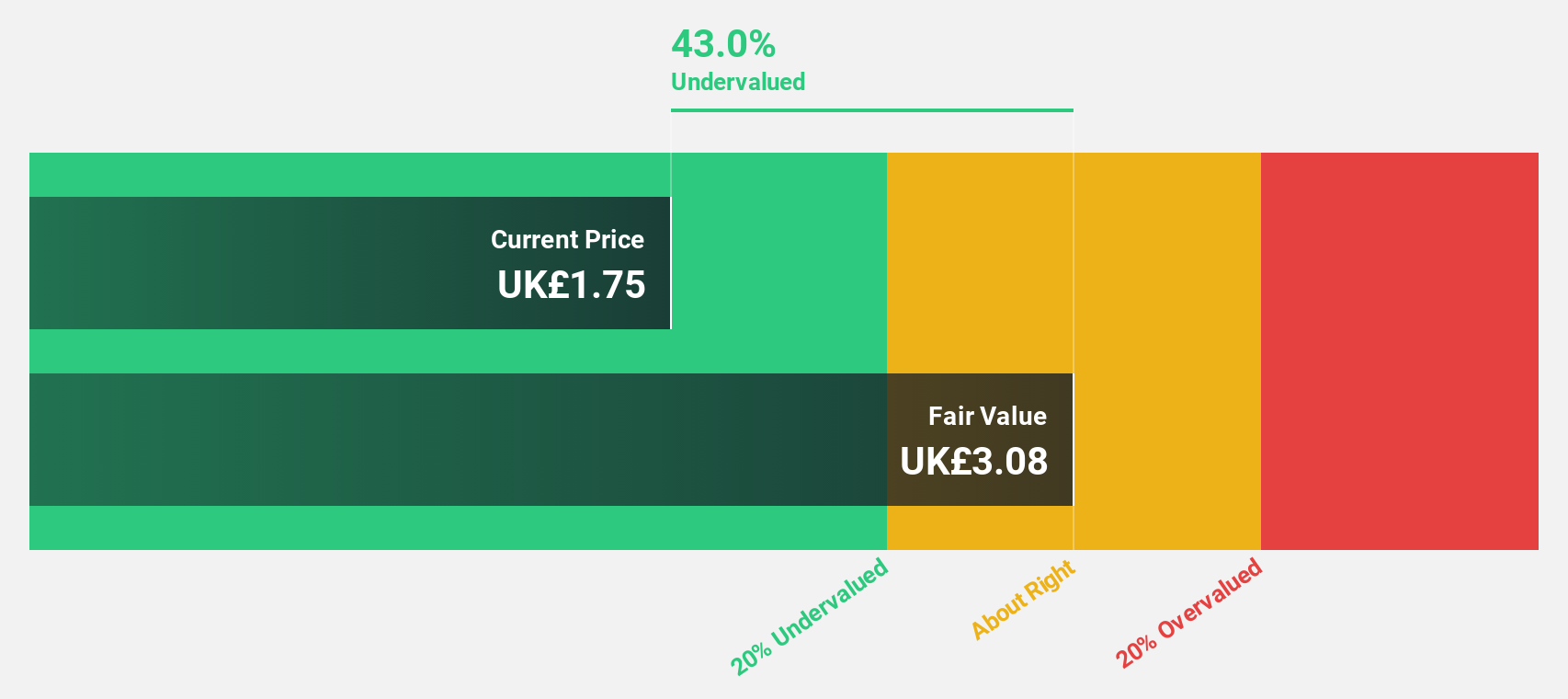

Airtel Africa (LSE:AAF)

Overview: Airtel Africa Plc, with a market cap of £4.23 billion, offers telecommunications and mobile money services across Nigeria, East Africa, and Francophone Africa.

Operations: The company's revenue segments include $858 million from Mobile Money and $4.10 billion from Mobile Services, with a segment adjustment of -$196 million.

Estimated Discount To Fair Value: 20.4%

Airtel Africa is trading at £1.14, significantly below its estimated fair value of £1.43, indicating it may be undervalued based on cash flows. Despite high debt levels and a dividend not well covered by earnings, the company shows strong profit growth forecasts of 39.42% per year, outpacing the UK market average. Recent buybacks and improved net income to $7 million from a $170 million loss last year further enhance its financial position.

- Our growth report here indicates Airtel Africa may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Airtel Africa's balance sheet health report.

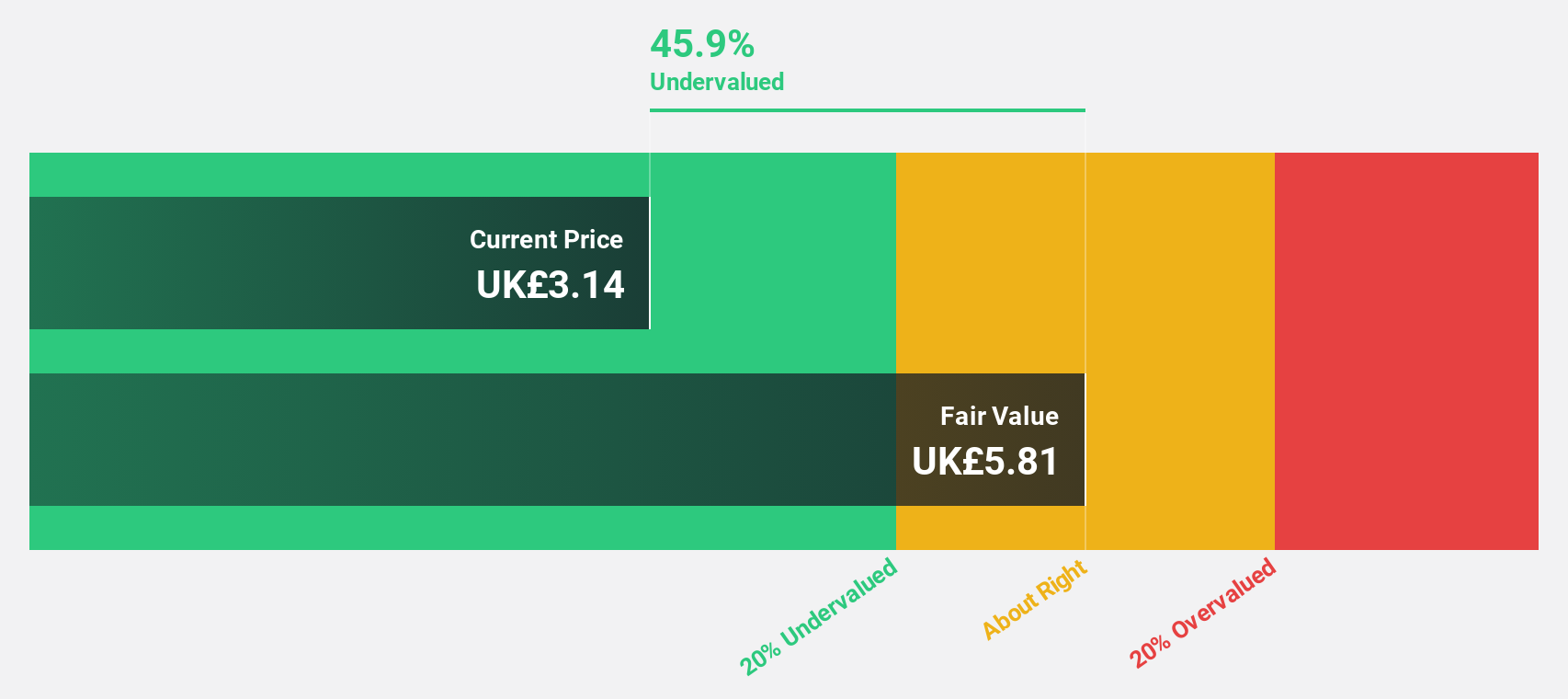

Rank Group (LSE:RNK)

Overview: The Rank Group Plc, with a market cap of £365.38 million, provides gaming services in Great Britain, Spain, and India through its subsidiaries.

Operations: The company's revenue segments include Mecca (£138.90 million), Digital (£226 million), Enracha Venues (£38.50 million), and Grosvenor Casinos (£331.30 million).

Estimated Discount To Fair Value: 42.2%

Rank Group's recent earnings report shows a significant turnaround, with net income of £12.5 million compared to a net loss of £96.2 million last year. Trading at 42.2% below its estimated fair value of £1.35, the stock appears undervalued based on discounted cash flows (DCF). Revenue growth is forecasted at 5.9% per year, outpacing the UK market average, while earnings are expected to grow significantly at 35.7% annually over the next three years despite low return on equity forecasts and high one-off items impacting results.

- Insights from our recent growth report point to a promising forecast for Rank Group's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Rank Group.

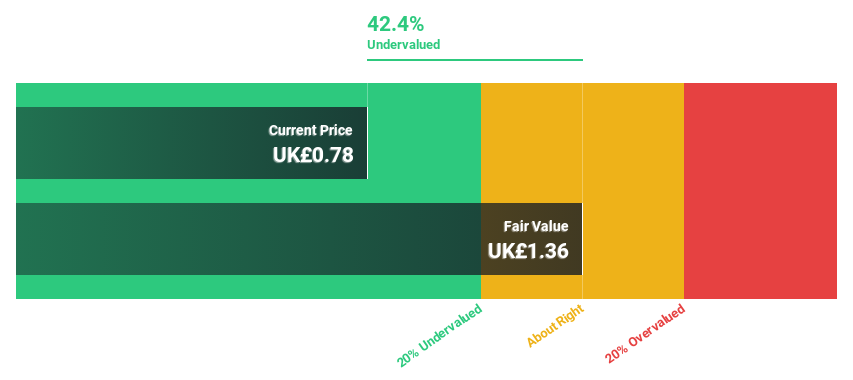

Deliveroo (LSE:ROO)

Overview: Deliveroo plc operates an online food delivery platform across multiple countries including the UK, Ireland, France, and others, with a market cap of £2.46 billion.

Operations: The company generates revenue of £2.03 billion from its on-demand food delivery platform operations.

Estimated Discount To Fair Value: 40.5%

Deliveroo is trading at £1.58, significantly below its estimated fair value of £2.65, indicating it may be undervalued based on discounted cash flows. The company reported a net income of £1.3 million for H1 2024, a turnaround from the previous year's loss of £82.9 million. Earnings are forecast to grow 67.6% annually over the next three years, with revenue expected to increase by 7.7% per year, outpacing the UK market's growth rate of 3.7%.

- Our comprehensive growth report raises the possibility that Deliveroo is poised for substantial financial growth.

- Get an in-depth perspective on Deliveroo's balance sheet by reading our health report here.

Seize The Opportunity

- Click through to start exploring the rest of the 54 Undervalued UK Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RNK

Rank Group

Engages in provision of gaming services in Great Britain, Spain, and India.

Reasonable growth potential with adequate balance sheet.