Stock Analysis

- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

UK Growth Companies With High Insider Ownership To Watch In June 2024

Reviewed by Simply Wall St

As the FTSE 100 shows signs of rebounding and the broader UK market adjusts to changing economic signals, investors are closely monitoring opportunities within growth companies. High insider ownership can be a strong indicator of confidence in a company's future prospects, especially in a landscape marked by regulatory and economic shifts.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 30.9% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

| Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 99.2% |

We're going to check out a few of the best picks from our screener tool.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc focuses on developing, licensing, and supporting computer software for the healthcare industry primarily in the United States, with a market capitalization of approximately £838.88 million.

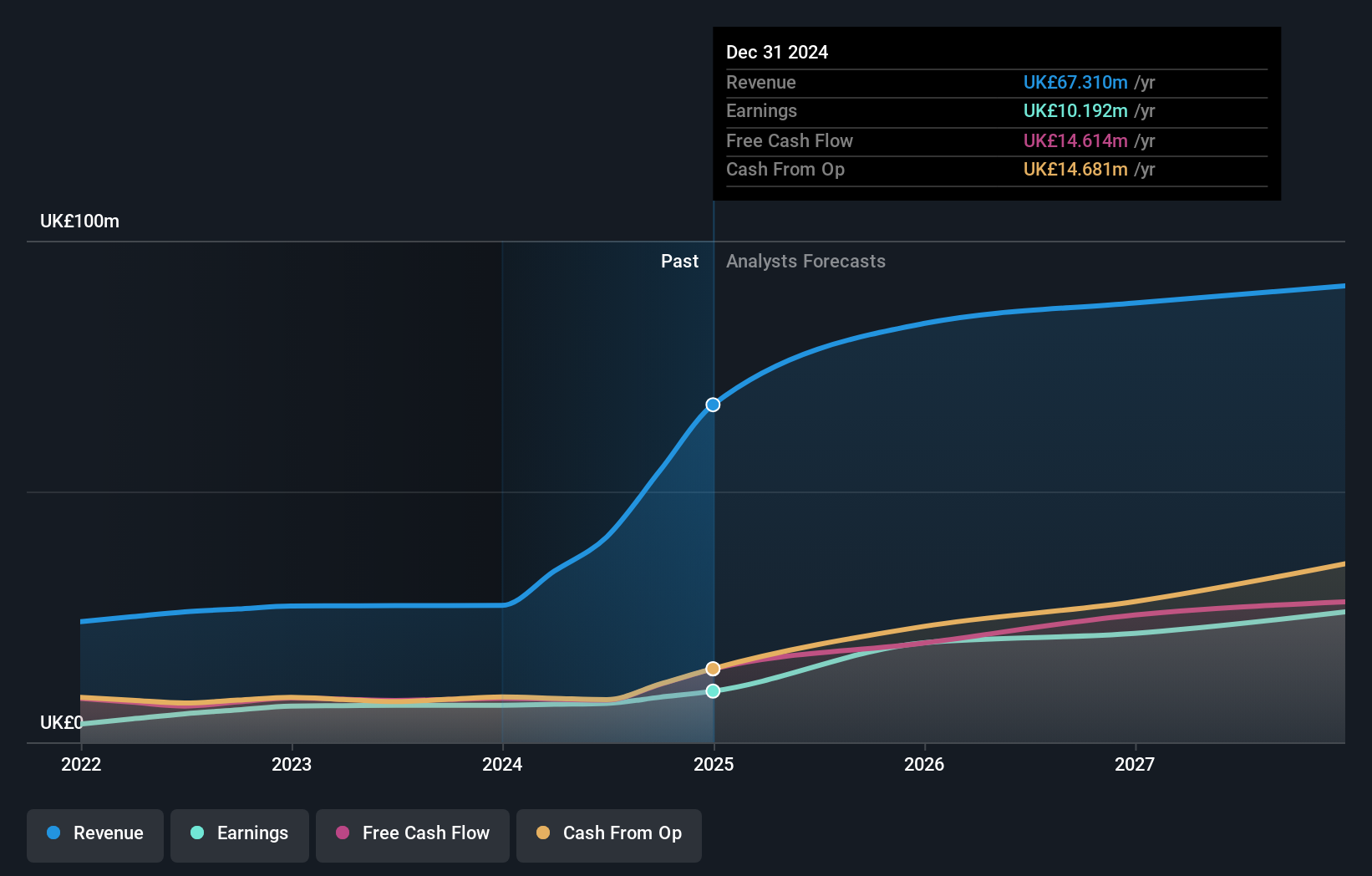

Operations: The company generates revenue primarily through its healthcare software segment, which brought in $180.56 million.

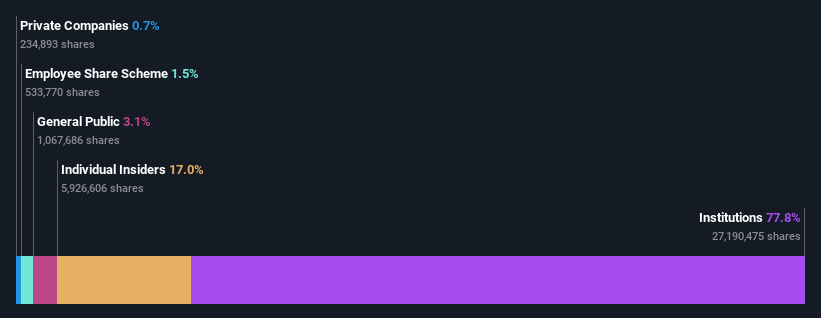

Insider Ownership: 17%

Earnings Growth Forecast: 28.5% p.a.

Craneware, a UK-based company, demonstrates strong growth potential with its earnings expected to increase by 28.52% annually over the next three years, outpacing the UK market's average of 13.3%. Despite this robust profit outlook, its forecasted Return on Equity is relatively low at 11.2%. Recent activities include extending a buyback plan and presenting at several international conferences, signaling active engagement in expanding market presence and investor relations.

- Click here to discover the nuances of Craneware with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Craneware's current price could be inflated.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, focuses on managing and leasing residential real estate properties with a market capitalization of approximately £269.57 million.

Operations: The company generates revenue primarily through two segments: Financial Services at £1.50 million and Property Franchising at £25.78 million.

Insider Ownership: 12.7%

Earnings Growth Forecast: 36.7% p.a.

Property Franchise Group, a UK-based entity, reported a slight year-over-year increase in sales to £27.28 million and net income to £7.4 million for 2023. Despite trading at 56.2% below estimated fair value and showing earnings growth of 2.3% over the past year, TPFG's future looks promising with expected annual earnings growth of 36.71% and revenue growth of 44.7%, significantly outstripping the UK market projections. However, concerns include a low forecasted Return on Equity at 13% and an unstable dividend track record.

- Navigate through the intricacies of Property Franchise Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Property Franchise Group's share price might be too pessimistic.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a global technology company that offers gambling software, services, content, and platform technologies with a market capitalization of approximately £1.46 billion.

Operations: The company's revenue is primarily derived from its Gaming B2B and Gaming B2C segments, which generated €684.10 million and €946.60 million respectively, along with contributions from B2C - HAPPYBET and Sun Bingo totaling €91.60 million.

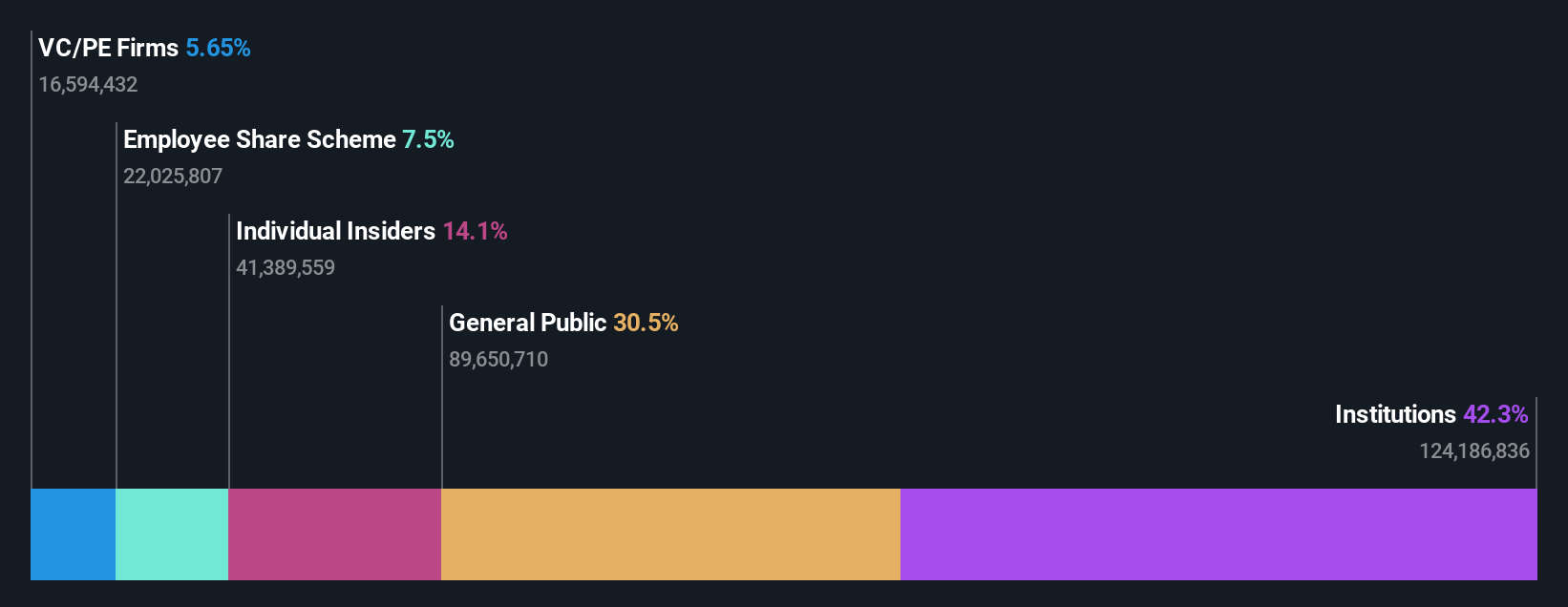

Insider Ownership: 13.5%

Earnings Growth Forecast: 21.5% p.a.

Playtech, a gaming software development company, is trading at 55.1% below its estimated fair value, signaling potential undervaluation. The company's earnings have surged by 158.9% over the past year and are projected to grow by 21.46% annually over the next three years, outpacing the UK market's average. However, its revenue growth forecast of 4.4% per year is modest compared to high-growth sectors but still exceeds the UK market prediction of 3.7%. Recent board restructuring aims to enhance governance efficiency and compliance oversight, positioning Playtech for sustained operational improvements amidst competitive pressures.

- Get an in-depth perspective on Playtech's performance by reading our analyst estimates report here.

- The analysis detailed in our Playtech valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Reveal the 67 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Craneware is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record.