- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

Exploring Undiscovered Gems in the United Kingdom This November 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience declines due to weak trade data from China, the broader market sentiment remains cautious, particularly impacting sectors heavily reliant on global demand. In this environment, identifying undiscovered gems in the United Kingdom requires a focus on companies with resilient business models and growth potential that can withstand external economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 15.73% | 53.22% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Supreme (AIM:SUP)

Simply Wall St Value Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes fast-moving branded and discounted consumer goods across the UK, Ireland, the Netherlands, France, the rest of Europe, and internationally with a market capitalization of £202.37 million.

Operations: The company's primary revenue streams are from Vaping (£128.95 million), Electricals (£53.37 million), and Drinks & Wellness (£48.76 million).

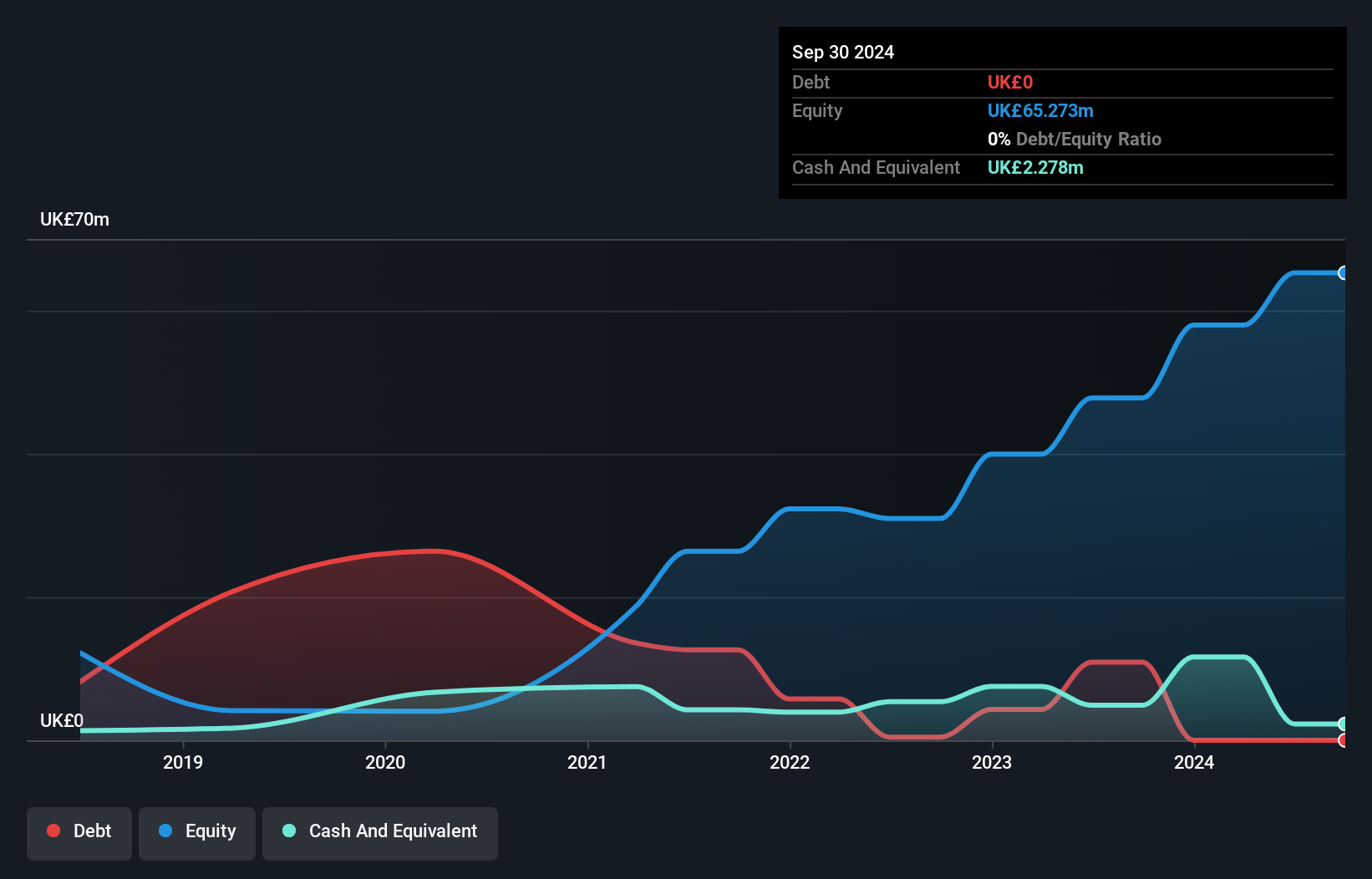

Supreme, a dynamic player in the UK market, has strategically positioned itself for growth through its acquisition of Clearly Drinks, aiming to boost revenue and margins in the Soft Drinks sector. The company is shifting its vaping segment focus towards higher-margin products to counter regulatory challenges. With earnings growing 21.8% annually over five years and a reduced debt-to-equity ratio from 649.6% to 2.7%, Supreme's financial health appears robust. Despite forecasts of a modest annual revenue growth of 3% and profit margin reduction from 10.2% to 8%, analysts see value potential beyond current market pricing, encouraging investors to weigh these insights carefully against their own evaluations.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering medical diagnostics services to patients, with a market cap of $395.30 million.

Operations: Integrated Diagnostics Holdings generates revenue primarily from its medical diagnostics services. The company has a market cap of $395.30 million, reflecting its position in the consumer healthcare sector.

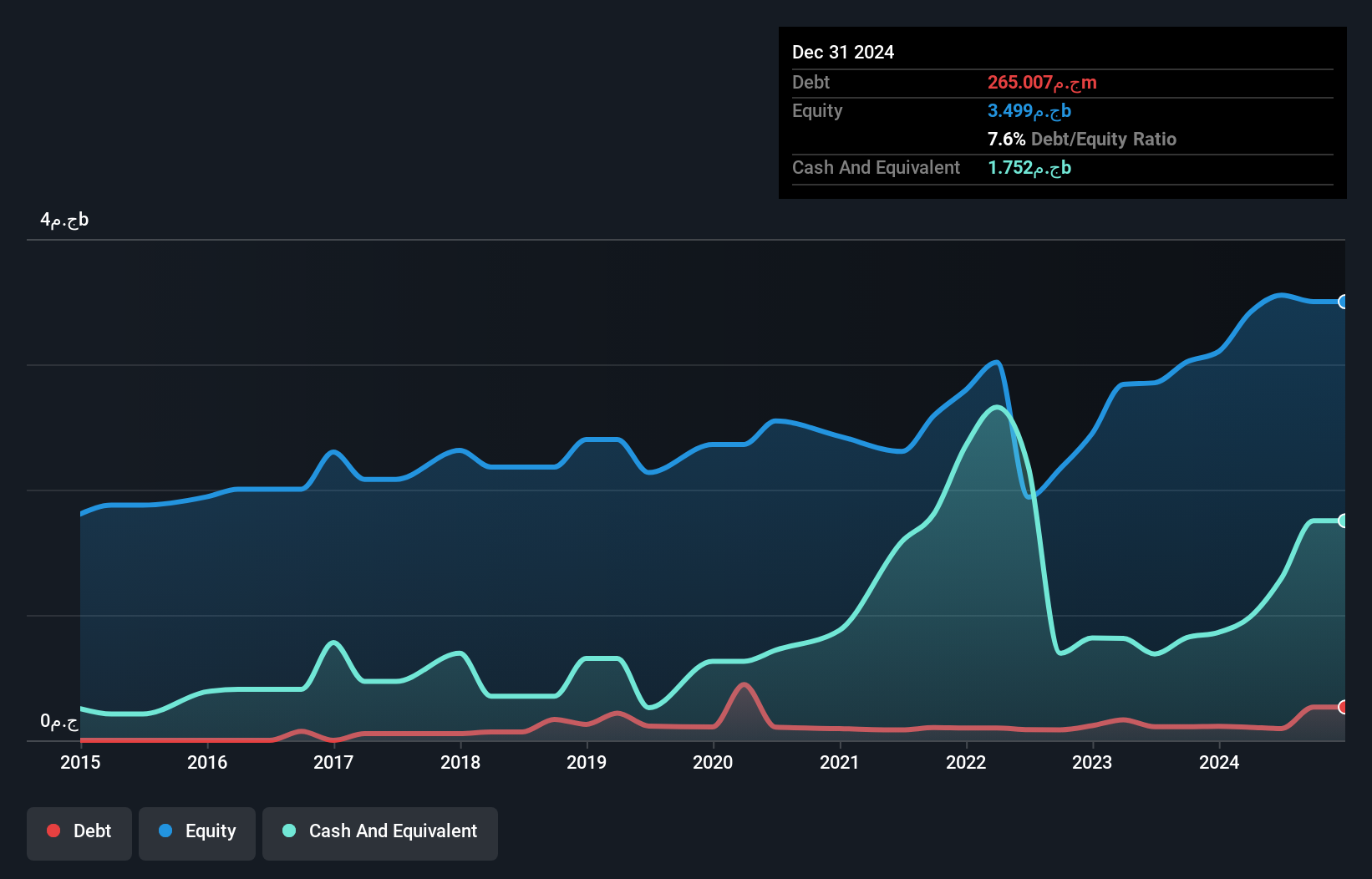

Integrated Diagnostics Holdings (IDH) is carving out a niche in the healthcare sector with its strategic growth endeavors. Over the past year, earnings have surged by 34%, outpacing the industry average of 9%. This performance is underpinned by a robust free cash flow position and high-quality earnings. Despite an increase in debt to equity from 4.1% to 4.7% over five years, IDH's financial health remains strong with more cash than total debt and sufficient interest coverage. Trading at approximately 75% below estimated fair value, IDH presents an intriguing opportunity for investors seeking undervalued stocks with solid growth prospects.

ME Group International (LSE:MEGP)

Simply Wall St Value Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a variety of instant-service equipment in the United Kingdom with a market cap of £590.76 million.

Operations: ME Group International generates revenue primarily from its personal services segment, amounting to £311.32 million. The company's market cap stands at approximately £590.76 million.

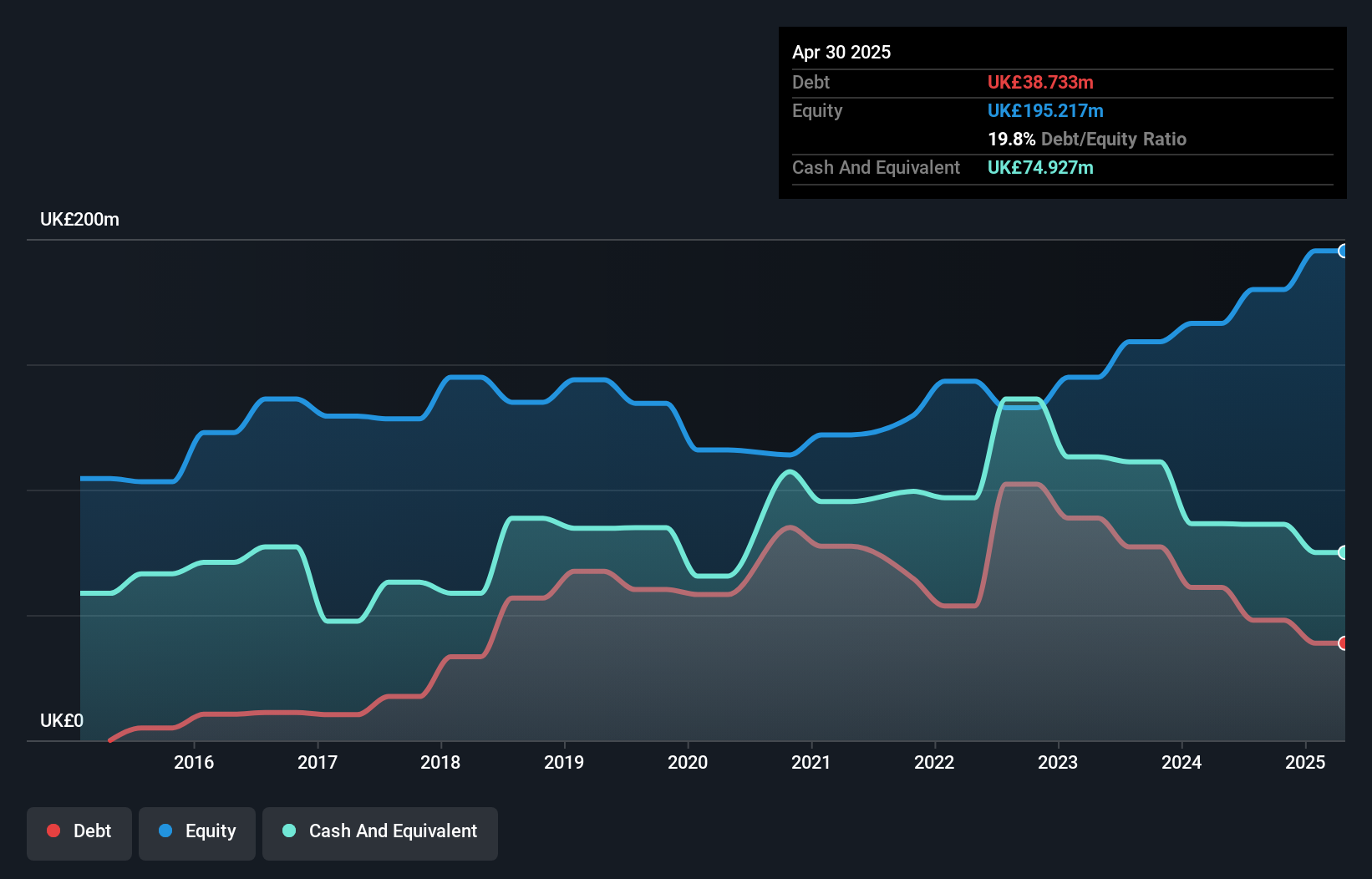

Focusing on innovation, ME Group International is expanding its self-service laundry operations and automated solutions to drive growth. The company's debt to equity ratio improved from 50.2% to 19.8% over five years, indicating a stronger balance sheet. Trading at 61.4% below estimated fair value, it offers potential upside despite challenges like reliance on declining photobooth revenues and regional concentration in Europe. Earnings have grown annually by 31.3%, though recent growth lagged behind the industry at 7.9%. Future earnings are projected to reach £70 million by September 2028, with revenue guidance for fiscal year ending October 2025 between £311 million and £318 million.

Seize The Opportunity

- Embark on your investment journey to our 56 UK Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MEGP

ME Group International

Operates, sells, and services a range of instant-service equipment in the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives