- United Kingdom

- /

- Renewable Energy

- /

- LSE:DRX

3 Dividend Stocks On UK Exchange Yielding Up To 8.4%

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting concerns about global economic recovery. In such uncertain times, dividend stocks can offer a measure of stability and potential income for investors, as they often represent companies with strong fundamentals capable of weathering economic fluctuations.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.14% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.24% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.97% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.14% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.34% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.95% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.93% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.55% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.86% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.33% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.46 billion, operates in the United Kingdom focusing on renewable power generation through its subsidiaries.

Operations: Drax Group's revenue is primarily derived from its Generation segment at £5.99 billion, followed by Customers at £4.38 billion, and Pellet Production contributing £878.40 million.

Dividend Yield: 3.7%

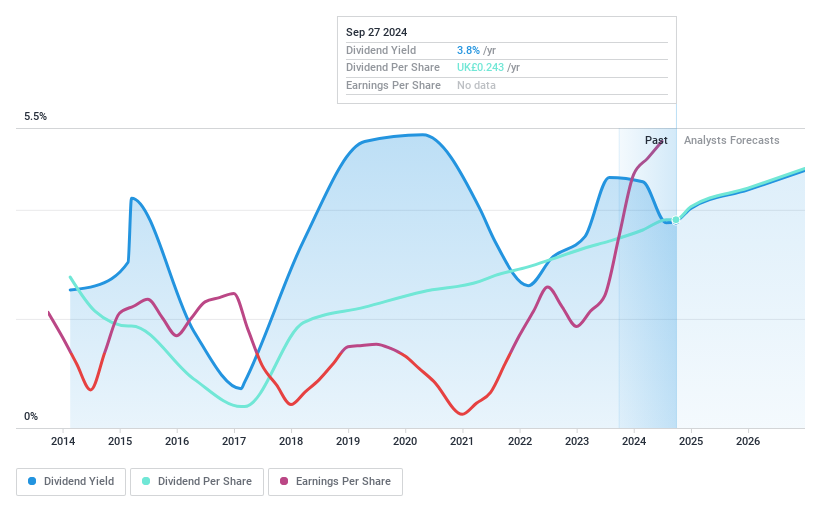

Drax Group's dividend payments have been volatile over the past decade, reflecting an unstable track record. Despite this, the dividends are well-covered by earnings and cash flows with low payout ratios of 14.4% and 22.7%, respectively. The dividend yield of 3.69% is below the top tier in the UK market, but Drax trades at a significant discount to its estimated fair value and peers. Recent partnerships in carbon offsetting highlight its commitment to sustainability amidst executive changes.

- Navigate through the intricacies of Drax Group with our comprehensive dividend report here.

- Our expertly prepared valuation report Drax Group implies its share price may be lower than expected.

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £849.60 million.

Operations: ME Group International plc generates revenue of £304.20 million from its Personal Services - Others segment.

Dividend Yield: 3.5%

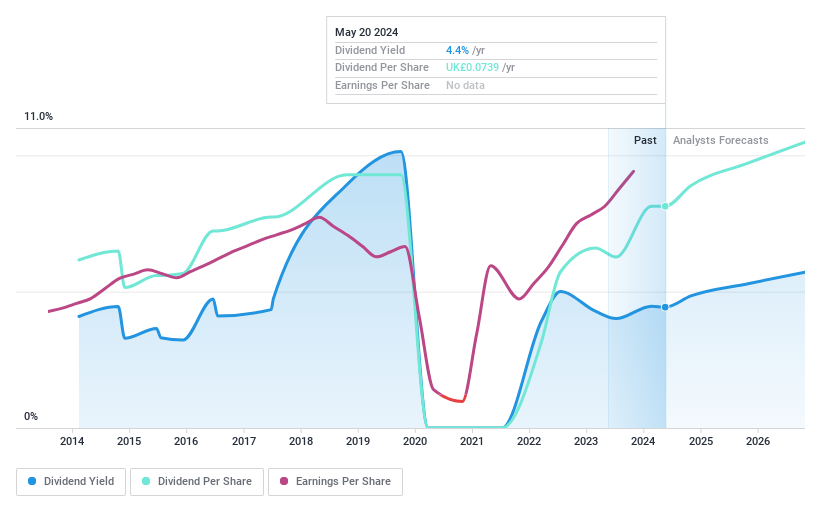

ME Group International's dividend payments have been volatile over the past decade, indicating an unstable track record. Despite this, dividends are covered by earnings and cash flows with payout ratios of 56.1% and 87.4%, respectively. The dividend yield of 3.49% is lower than the top UK payers, but MEGP trades at a substantial discount to its estimated fair value and peers. Recent board changes include Camille Claverie stepping down as a Non-Executive Director today.

- Unlock comprehensive insights into our analysis of ME Group International stock in this dividend report.

- Our valuation report here indicates ME Group International may be undervalued.

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Record plc, with a market cap of £118.30 million, offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets.

Operations: Record plc generates its revenue primarily from the provision of currency and derivatives management services, amounting to £45.02 million.

Dividend Yield: 8.5%

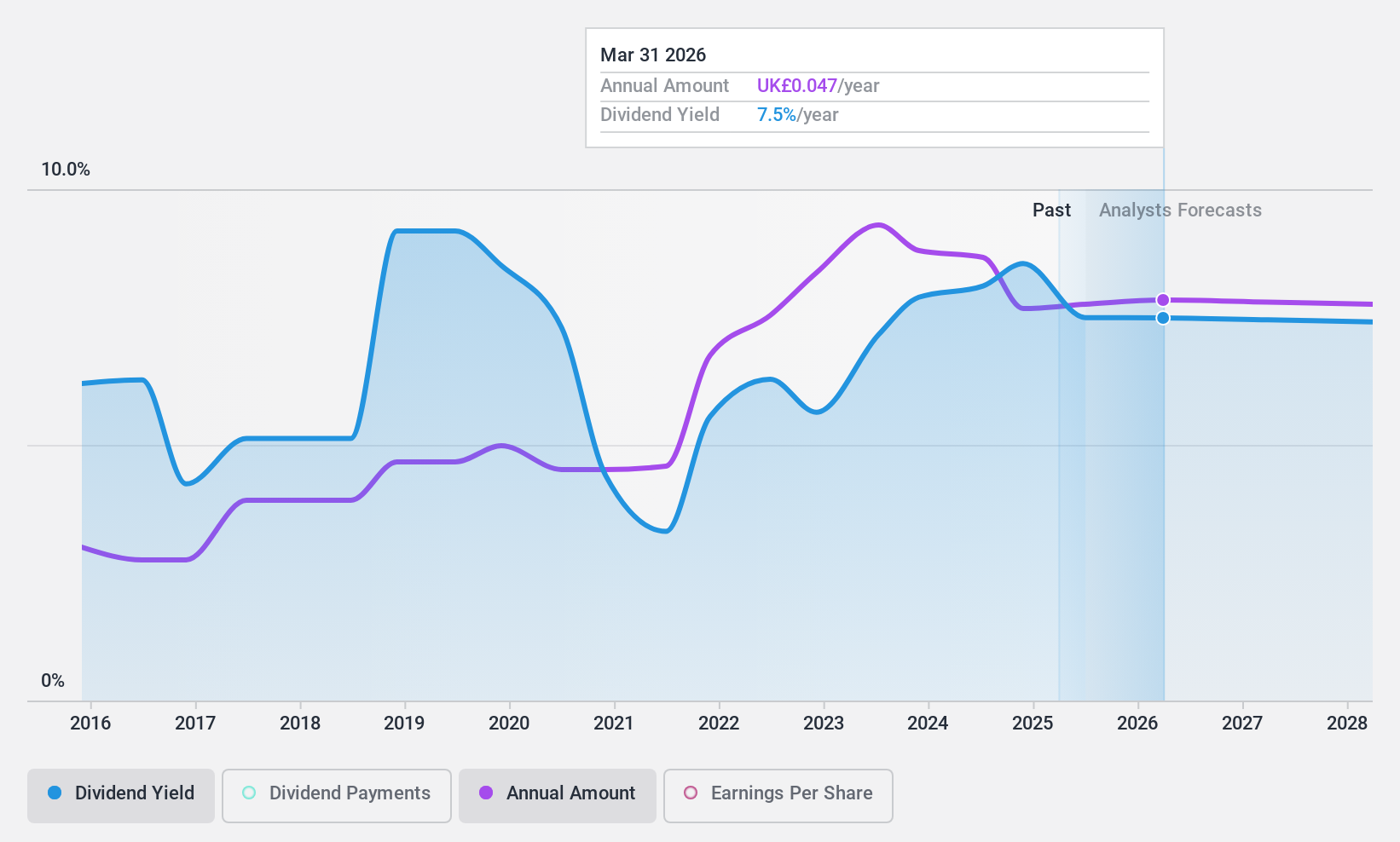

Record plc offers a high dividend yield of 8.46%, ranking in the top 25% of UK dividend payers. However, its dividends are not well covered by earnings or cash flows, with payout ratios at 93.1% and 116.3%, respectively, raising sustainability concerns despite a decade of stable and growing payments. Recent earnings showed slight growth in net income to £4.96 million for H1 2025, while maintaining the interim dividend at 2.15 pence per share amidst notable insider selling activity recently.

- Click here and access our complete dividend analysis report to understand the dynamics of Record.

- The valuation report we've compiled suggests that Record's current price could be quite moderate.

Seize The Opportunity

- Access the full spectrum of 62 Top UK Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DRX

Outstanding track record, undervalued and pays a dividend.