- United Kingdom

- /

- Hospitality

- /

- LSE:MAB

Mitchells & Butlers plc's (LON:MAB) Popularity With Investors Is Under Threat From Overpricing

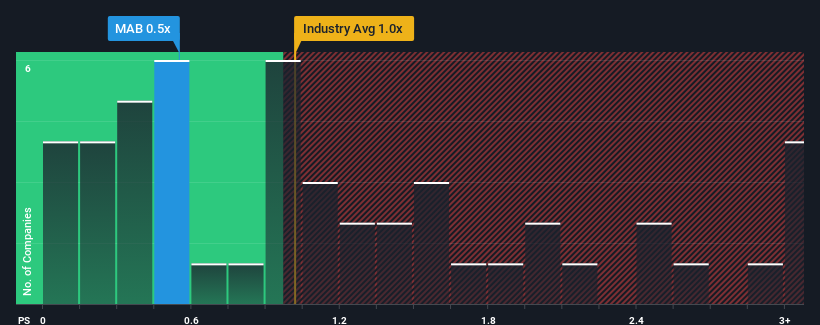

With a median price-to-sales (or "P/S") ratio of close to 1x in the Hospitality industry in the United Kingdom, you could be forgiven for feeling indifferent about Mitchells & Butlers plc's (LON:MAB) P/S ratio of 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Mitchells & Butlers

What Does Mitchells & Butlers' Recent Performance Look Like?

Recent times haven't been great for Mitchells & Butlers as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Mitchells & Butlers will help you uncover what's on the horizon.How Is Mitchells & Butlers' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Mitchells & Butlers' to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 70% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 3.5% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 8.7% per year, which is noticeably more attractive.

In light of this, it's curious that Mitchells & Butlers' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Mitchells & Butlers' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Mitchells & Butlers' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about this 1 warning sign we've spotted with Mitchells & Butlers.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MAB

Mitchells & Butlers

Engages in the management of pubs, bars, and restaurants in the United Kingdom and Germany.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives