- United Kingdom

- /

- Hospitality

- /

- LSE:EVOK

3 UK Growth Companies With Insider Ownership Up To 20%

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100 and broader market concerns tied to China's economic struggles, investors in the United Kingdom are increasingly seeking growth companies with strong fundamentals. In such uncertain times, high insider ownership can be an indicator of confidence in a company's potential, making it an attractive trait for those looking to navigate the current market volatility.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 86.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Enteq Technologies (AIM:NTQ) | 23.8% | 53.8% |

| Facilities by ADF (AIM:ADF) | 12.9% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Underneath we present a selection of stocks filtered out by our screen.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC manages and leases residential real estate properties in the United Kingdom, with a market cap of £279.50 million.

Operations: The company's revenue segments include £8.28 million from Financial Services and £31.64 million from Property Franchising.

Insider Ownership: 12.9%

Property Franchise Group, despite recent insider selling, demonstrates strong growth potential with projected revenue and earnings growth significantly outpacing the UK market. Recent half-year results show sales of £26.85 million, a substantial increase from the previous year. The company appointed Ben Dodds as CFO, who has a track record of driving profitability and strategic growth at Lotus Cars. However, shareholders experienced dilution over the past year and dividends are not well covered by free cash flows.

- Dive into the specifics of Property Franchise Group here with our thorough growth forecast report.

- According our valuation report, there's an indication that Property Franchise Group's share price might be on the expensive side.

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc, along with its subsidiaries, offers online betting and gaming products and solutions in the United Kingdom, Ireland, Italy, Spain, and internationally with a market cap of £265.89 million.

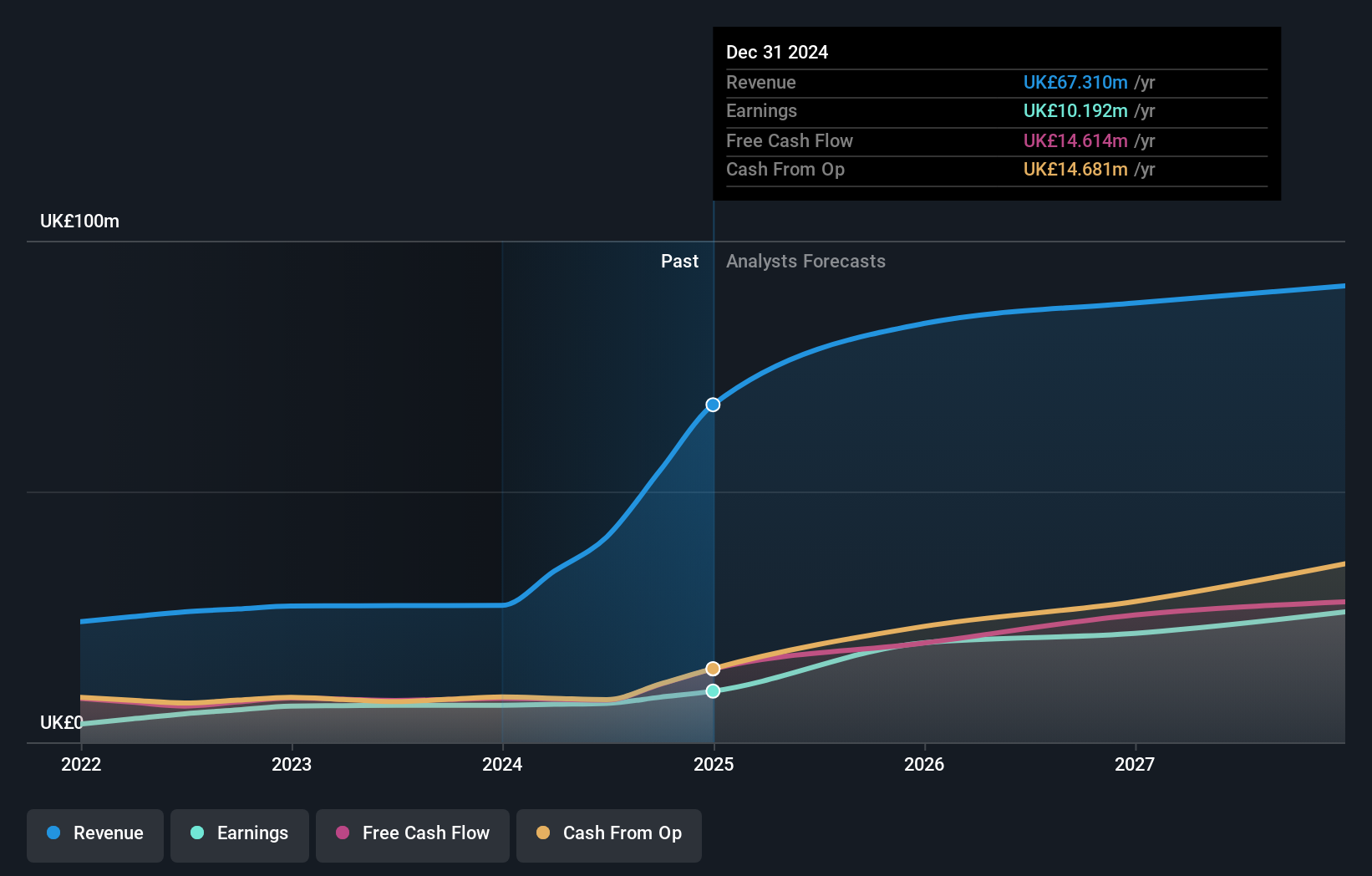

Operations: The company's revenue segments include £514 million from Retail, £661.20 million from UK&I Online, and £516.10 million from International operations.

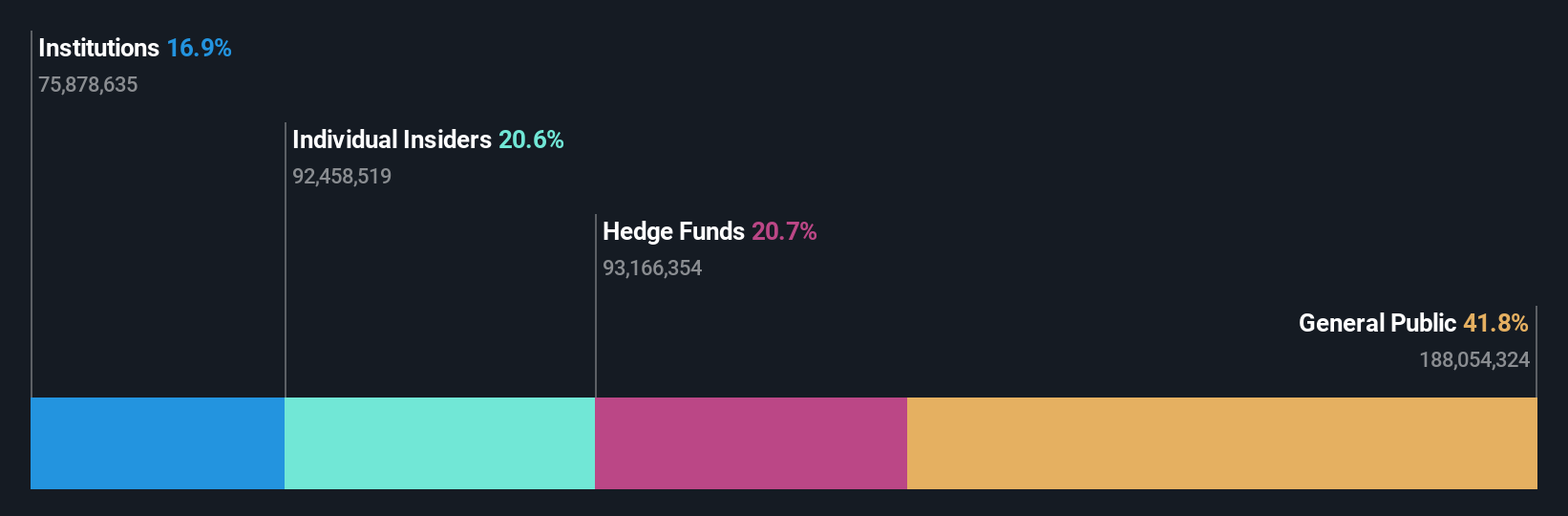

Insider Ownership: 20.5%

Evoke plc, trading significantly below its estimated fair value, shows promising growth potential with insider buying activity over the past three months. Despite a volatile share price and negative equity, revenue is forecasted to grow faster than the UK market at 5.9% annually. Recent results indicate a revenue increase to £417 million for Q3 2024, marking year-over-year growth driven by international market gains. The company anticipates profitability within three years amidst ongoing strategic initiatives.

- Get an in-depth perspective on Evoke's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Evoke is trading behind its estimated value.

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited is involved in owning, co-owning, developing, leasing, operating, and franchising upscale hotels across several European countries including the Netherlands and the United Kingdom, with a market cap of £505.65 million.

Operations: The company's revenue segments include Owned Hotel Operations in the United Kingdom (£236.99 million), Croatia (£81.63 million), The Netherlands (£65.92 million), and Germany, Hungary, and Serbia (£24.10 million), along with Management and Central Services contributing £50.09 million.

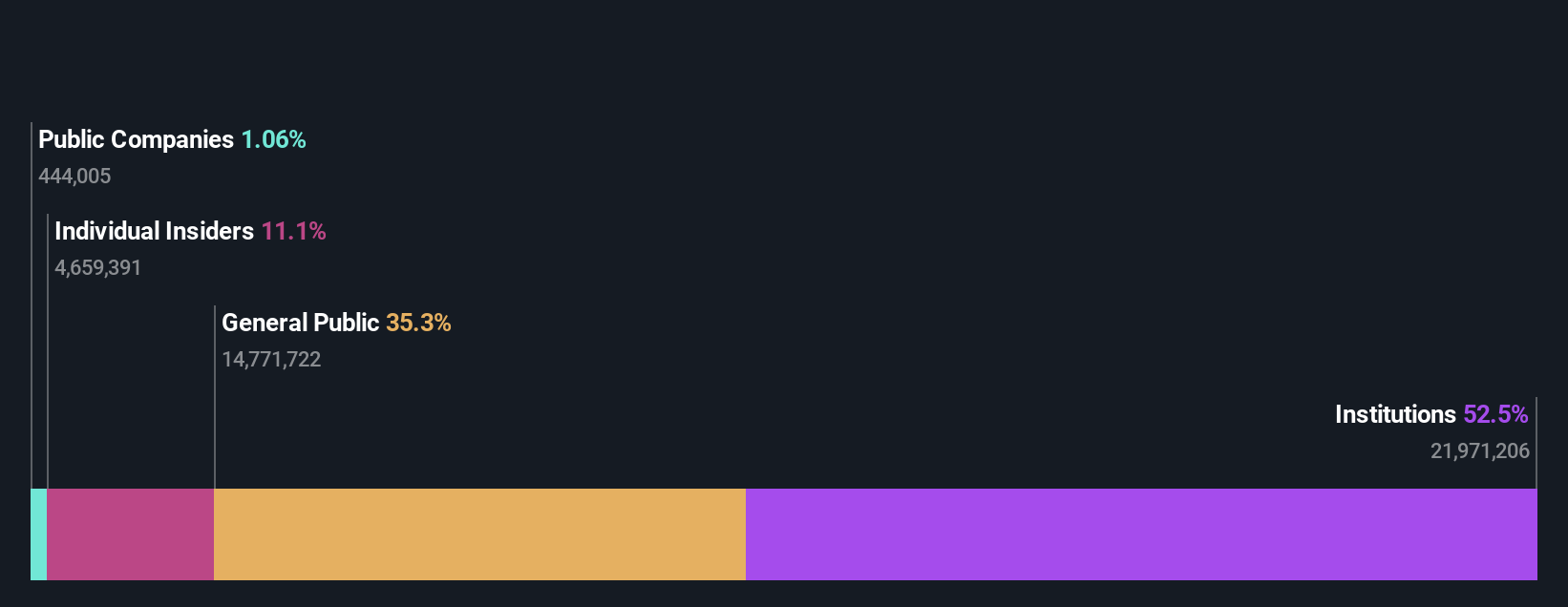

Insider Ownership: 14.8%

PPHE Hotel Group, trading well below its estimated fair value, shows potential with forecasted earnings growth of 31.6% annually, outpacing the UK market. Recent refinancing extends debt maturity to 2031, potentially easing financial pressures despite interest payments being poorly covered by earnings. While revenue is expected to grow faster than the market at 5.4% per year, profit margins have decreased from last year. No substantial insider trading activity has been reported recently.

- Unlock comprehensive insights into our analysis of PPHE Hotel Group stock in this growth report.

- According our valuation report, there's an indication that PPHE Hotel Group's share price might be on the cheaper side.

Key Takeaways

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 62 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Evoke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EVOK

Evoke

Provides online betting and gaming products and solutions in the United Kingdom, Ireland Italy, Spain, and internationally.

Undervalued with high growth potential.