- United Kingdom

- /

- Building

- /

- AIM:EPWN

Top UK Dividend Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face pressure from weak trade data out of China, investors in the UK are navigating a challenging landscape marked by global economic uncertainties. In such an environment, dividend stocks can offer a measure of stability and potential income, making them an attractive option for those looking to balance risk with reward.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Impax Asset Management Group (AIM:IPX) | 7.49% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.85% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.40% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.37% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.76% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.90% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.65% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.50% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 4.23% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 5.75% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, Europe, and internationally, with a market cap of £148.75 million.

Operations: Epwin Group Plc generates revenue through its Extrusion and Moulding segment, which accounts for £233.30 million, and its Fabrication and Distribution segment, contributing £130.40 million.

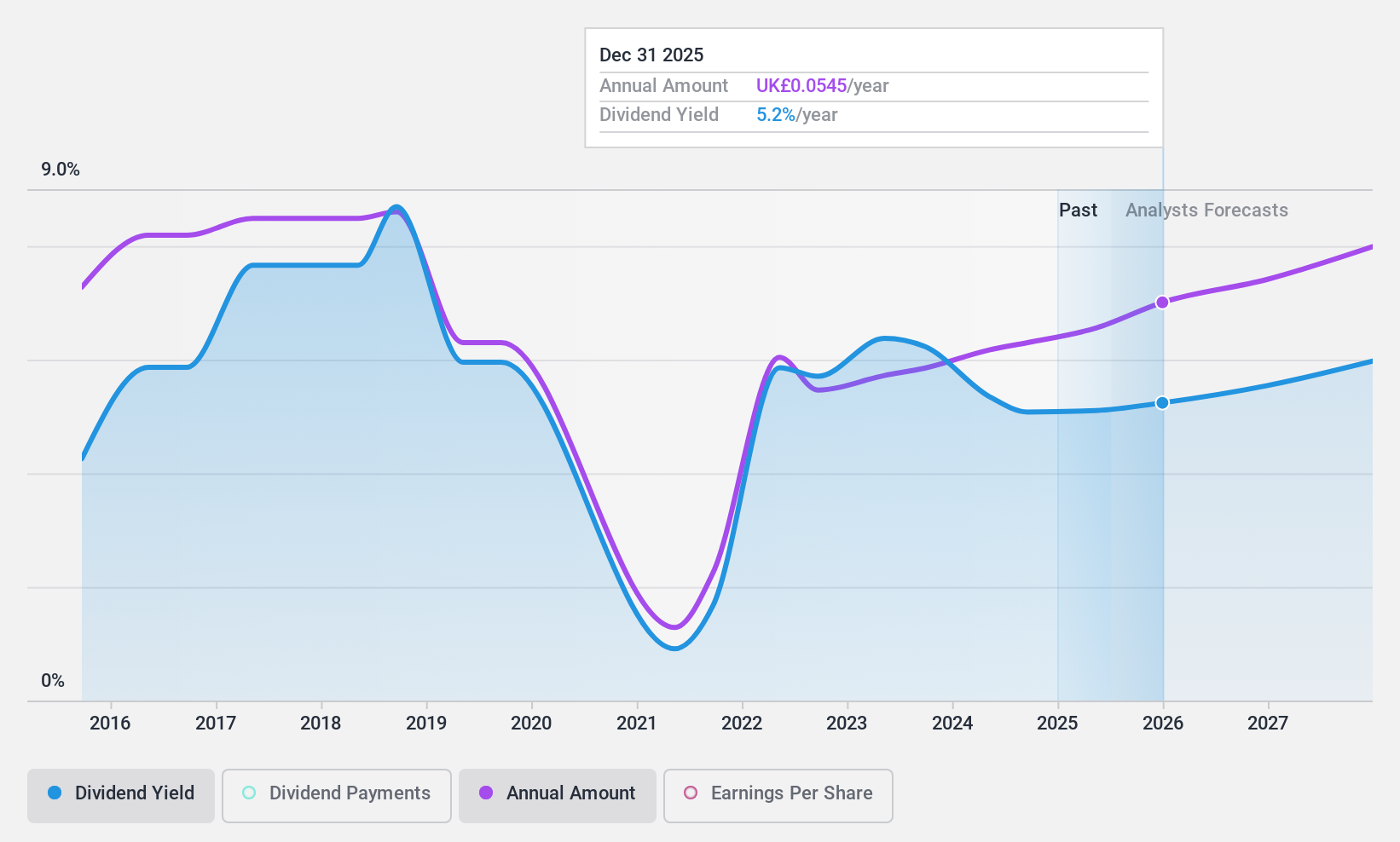

Dividend Yield: 4.6%

Epwin Group's interim dividend increased by 5% to 2.10 pence per share, indicating a commitment to returning value to shareholders despite a slight decline in sales and net income for the half year ending June 2024. The company's dividend is well-covered by both earnings and cash flows, with payout ratios of 77.5% and 27.4%, respectively, though its dividend history has been volatile over the past decade. Recent buyback activities may enhance shareholder value further.

- Unlock comprehensive insights into our analysis of Epwin Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Epwin Group is trading beyond its estimated value.

Oxford Metrics (AIM:OMG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oxford Metrics plc is a smart sensing and software company operating in the United Kingdom and internationally, with a market capitalization of £77.18 million.

Operations: Oxford Metrics plc generates revenue through its Vicon UK segment, contributing £23.62 million, and its Vicon USA segment, adding £21.09 million.

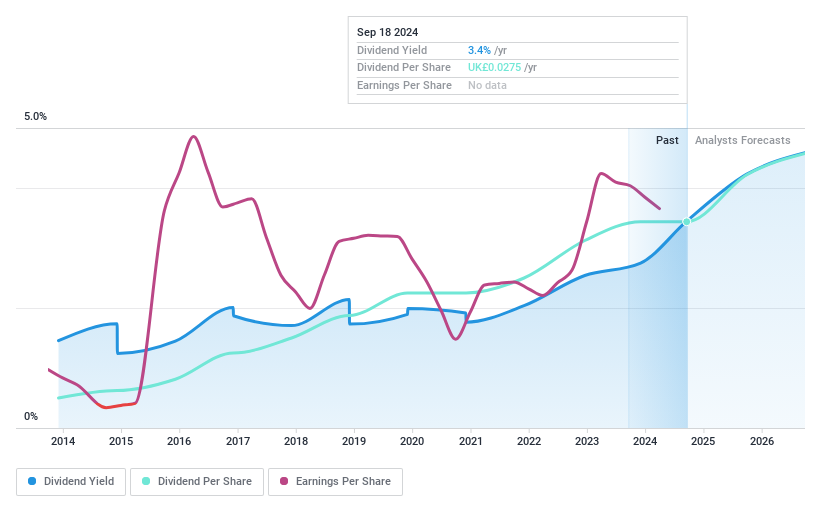

Dividend Yield: 4.7%

Oxford Metrics' dividend yield of 4.66% is lower than the top UK payers and not well-covered by free cash flows, with a high cash payout ratio of 735.7%. Despite stable dividends over the past decade, profit margins have declined from 15.8% to 10.9%, and share price volatility remains high. The company trades at a good value compared to peers, but its dividends are not fully supported by earnings or cash flow sustainability measures despite a reasonable payout ratio of 70.7%.

- Get an in-depth perspective on Oxford Metrics' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Oxford Metrics is trading behind its estimated value.

Bodycote (LSE:BOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bodycote plc offers heat treatment and thermal processing services globally, with a market cap of £1.02 billion.

Operations: Bodycote's revenue segments are comprised of Aerospace, Defence & Energy (ADE) with £194.50 million from North America, £160 million from Western Europe, and £8 million from Emerging Markets; and Automotive & General Industrial (AGI) with £97.60 million from North America, £237.30 million from Western Europe, and £84 million from Emerging Markets.

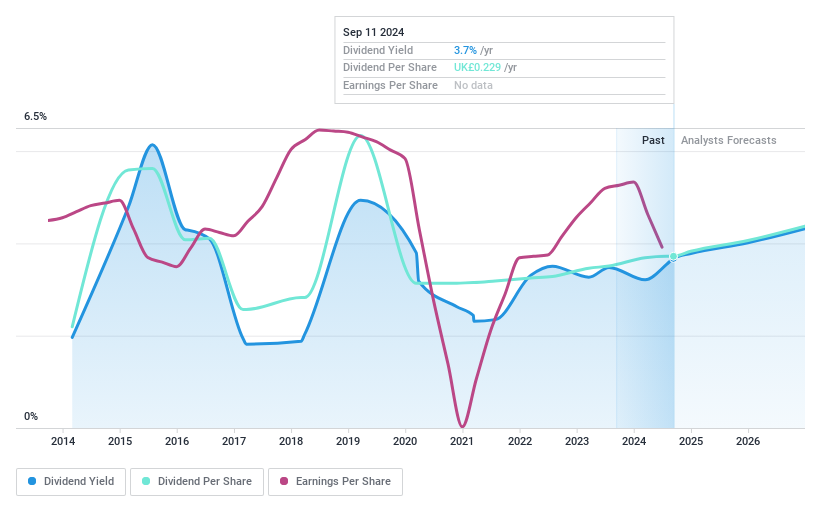

Dividend Yield: 4.1%

Bodycote's dividend yield of 4.1% is lower than the top UK payers, but dividends are well-covered by earnings with a payout ratio of 69% and cash flows at 45.4%. Despite past volatility in dividend payments, they have grown over the last decade. The stock trades significantly below its estimated fair value and offers good relative value compared to peers, though large one-off items have impacted financial results recently.

- Click here and access our complete dividend analysis report to understand the dynamics of Bodycote.

- Our expertly prepared valuation report Bodycote implies its share price may be lower than expected.

Where To Now?

- Unlock our comprehensive list of 58 Top UK Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epwin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EPWN

Epwin Group

Manufactures and sells building products in the United Kingdom, rest of Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.