- United Kingdom

- /

- Consumer Services

- /

- AIM:ANX

Here's Why Anexo Group (LON:ANX) Can Manage Its Debt Responsibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Anexo Group Plc (LON:ANX) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Anexo Group

How Much Debt Does Anexo Group Carry?

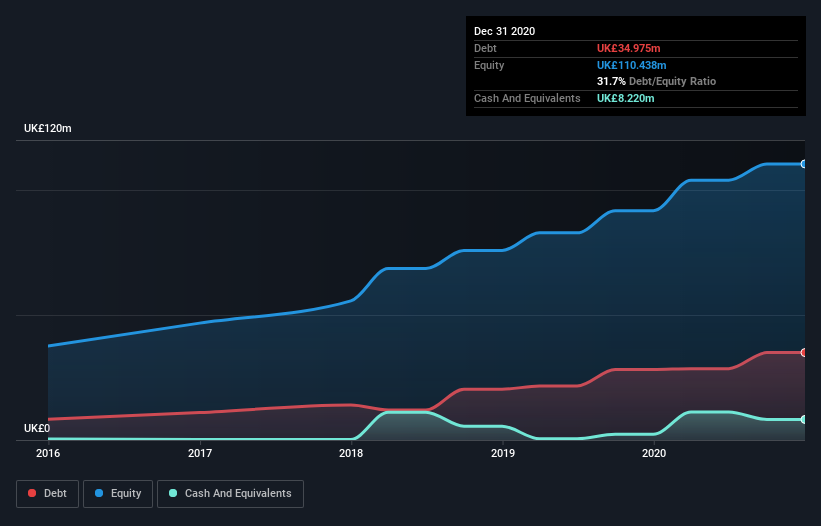

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Anexo Group had UK£35.0m of debt, an increase on UK£28.2m, over one year. However, it also had UK£8.22m in cash, and so its net debt is UK£26.8m.

How Strong Is Anexo Group's Balance Sheet?

According to the last reported balance sheet, Anexo Group had liabilities of UK£49.1m due within 12 months, and liabilities of UK£12.7m due beyond 12 months. Offsetting this, it had UK£8.22m in cash and UK£147.8m in receivables that were due within 12 months. So it actually has UK£94.2m more liquid assets than total liabilities.

This surplus liquidity suggests that Anexo Group's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 1.4 times EBITDA, Anexo Group is arguably pretty conservatively geared. And it boasts interest cover of 7.0 times, which is more than adequate. The modesty of its debt load may become crucial for Anexo Group if management cannot prevent a repeat of the 27% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Anexo Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Anexo Group burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

We weren't impressed with Anexo Group's conversion of EBIT to free cash flow, and its EBIT growth rate made us cautious. But like a ballerina ending on a perfect pirouette, it has not trouble staying on top of its total liabilities. Looking at all this data makes us feel a little cautious about Anexo Group's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - Anexo Group has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Anexo Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ANX

Anexo Group

Anexo Group Plc, along with its subsidiaries, provides integrated credit hire and legal services in the United Kingdom.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives