Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Tesco PLC (LON:TSCO) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Tesco

What Is Tesco's Net Debt?

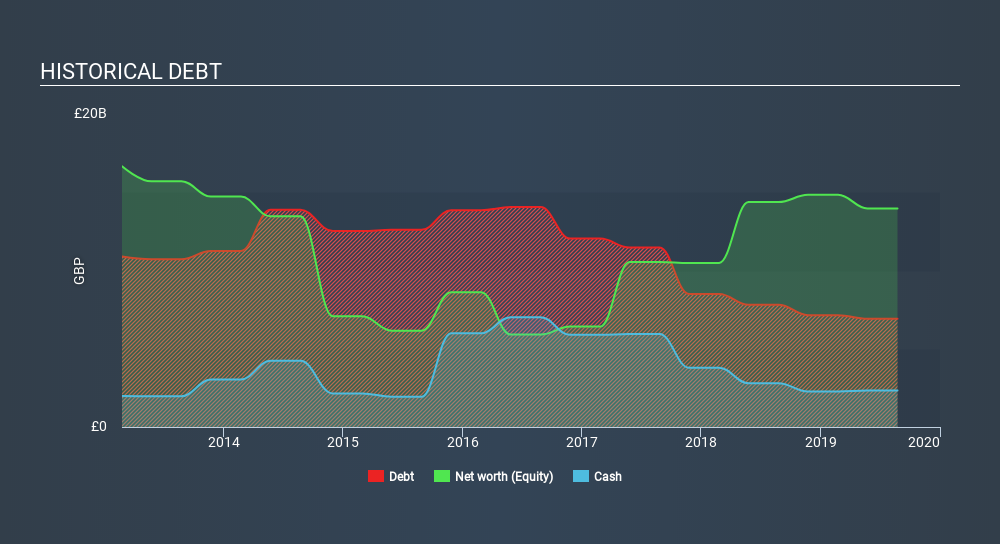

You can click the graphic below for the historical numbers, but it shows that as of August 2019 Tesco had UK£6.92b of debt, an increase on UK£7.8k, over one year. However, because it has a cash reserve of UK£2.33b, its net debt is less, at about UK£4.59b.

A Look At Tesco's Liabilities

We can see from the most recent balance sheet that Tesco had liabilities of UK£20.6b falling due within a year, and liabilities of UK£22.6b due beyond that. Offsetting this, it had UK£2.33b in cash and UK£1.62b in receivables that were due within 12 months. So it has liabilities totalling UK£39.3b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the UK£23.9b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Tesco would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Tesco's net debt is only 1.3 times its EBITDA. And its EBIT covers its interest expense a whopping 11.2 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Another good sign is that Tesco has been able to increase its EBIT by 26% in twelve months, making it easier to pay down debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Tesco's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Tesco produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Tesco's struggle to handle its total liabilities had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example its interest cover was refreshing. Looking at all the angles mentioned above, it does seem to us that Tesco is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for Tesco you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:TSCO

Tesco

Operates as a grocery retailer in the United Kingdom, Republic of Ireland, the Czech Republic, Slovakia, and Hungary.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives