- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

3 UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

Over the last 7 days, the UK market has dropped 2.3%. In contrast to the last week, the market is up 7.4% over the past year with earnings forecast to grow by 14% annually. In such a fluctuating environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| RUA Life Sciences (AIM:RUA) | 13.3% | 97.2% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Let's explore several standout options from the results in the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £817.91 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

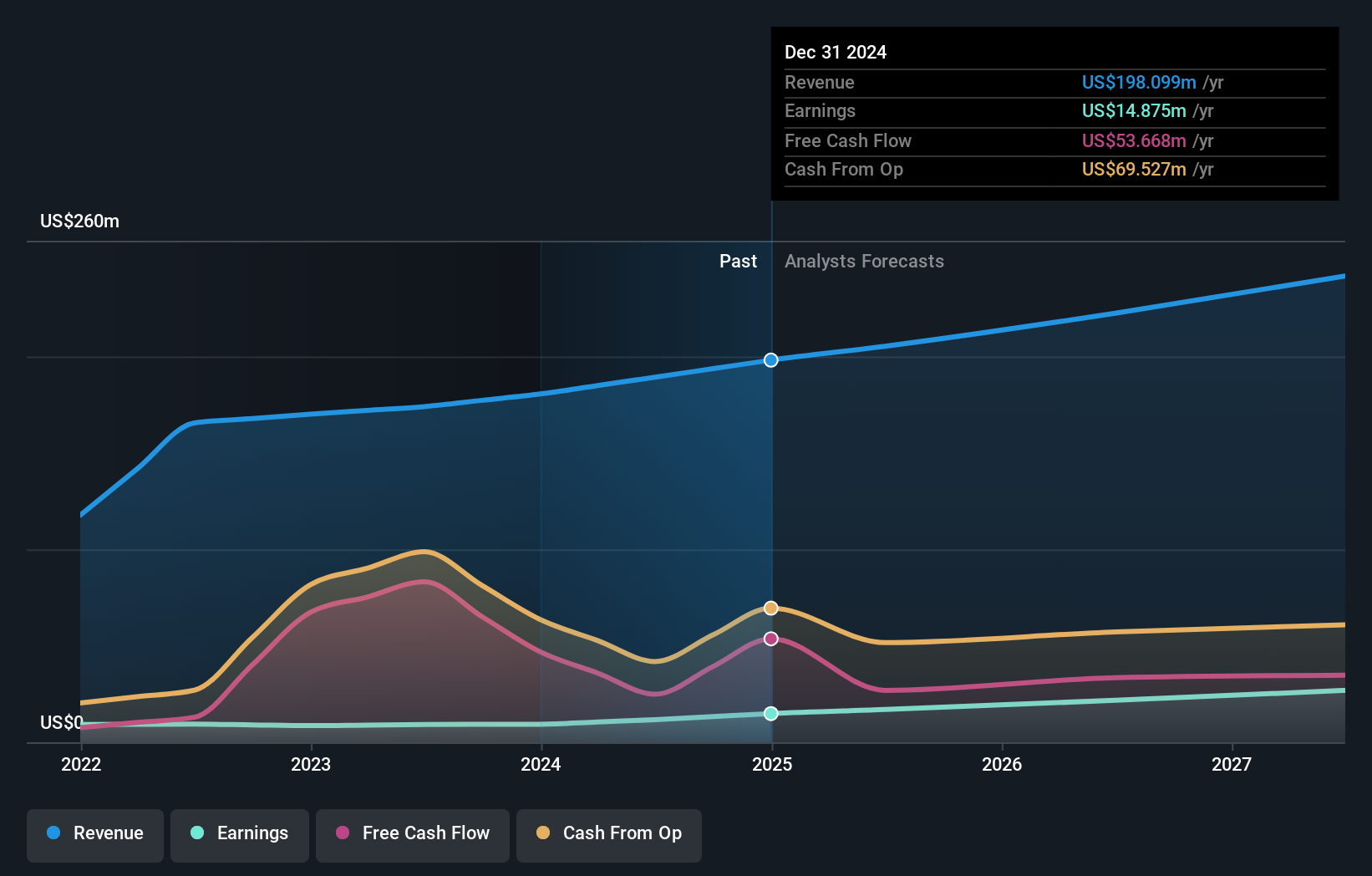

Operations: The company generates $189.27 million in revenue from its healthcare software segment.

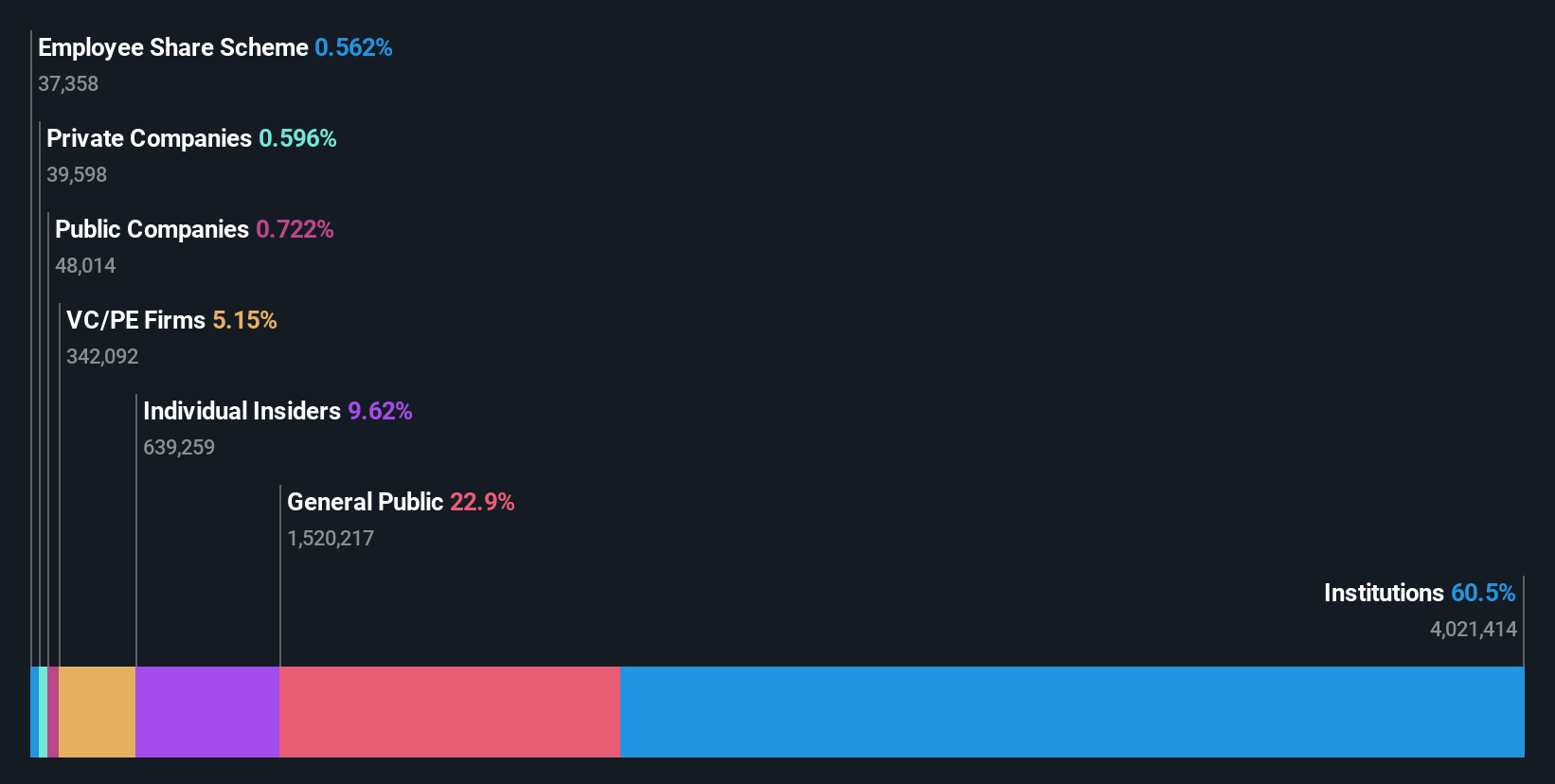

Insider Ownership: 17%

Craneware, a UK-based company with significant insider ownership, has shown robust earnings growth of 26.8% over the past year and is forecast to grow earnings by 25.58% annually. Recent full-year results reported sales of US$189.27 million and net income of US$11.7 million, reflecting strong financial performance. The company is actively seeking acquisitions to accelerate its growth strategy while leveraging its collaboration with Microsoft Azure to enhance its platform's capabilities and market reach in the healthcare sector.

- Delve into the full analysis future growth report here for a deeper understanding of Craneware.

- According our valuation report, there's an indication that Craneware's share price might be on the expensive side.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments and has a market cap of £707.30 million.

Operations: The company generates revenue from two main segments: Vacuum (£63.60 million) and Materials Sciences (£72.50 million).

Insider Ownership: 11.9%

Judges Scientific, a UK-based company with substantial insider ownership, is forecast to grow earnings by 26.88% per year and revenue by 6.3% annually, outpacing the UK market's average growth rates. Despite recent volatility in its share price and a decline in profit margins from 11% to 7%, the company's Return on Equity is expected to reach 20.9%. The appointment of Dr. Ian Wilcock as Group Commercial Director brings valuable expertise in technology commercialisation and innovation to support future growth initiatives.

- Take a closer look at Judges Scientific's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Judges Scientific is trading beyond its estimated value.

Stelrad Group (LSE:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £191.03 million.

Operations: The company generates £294.27 million from the manufacture and distribution of radiators in various regions including the United Kingdom, Ireland, Europe, Turkey, and internationally.

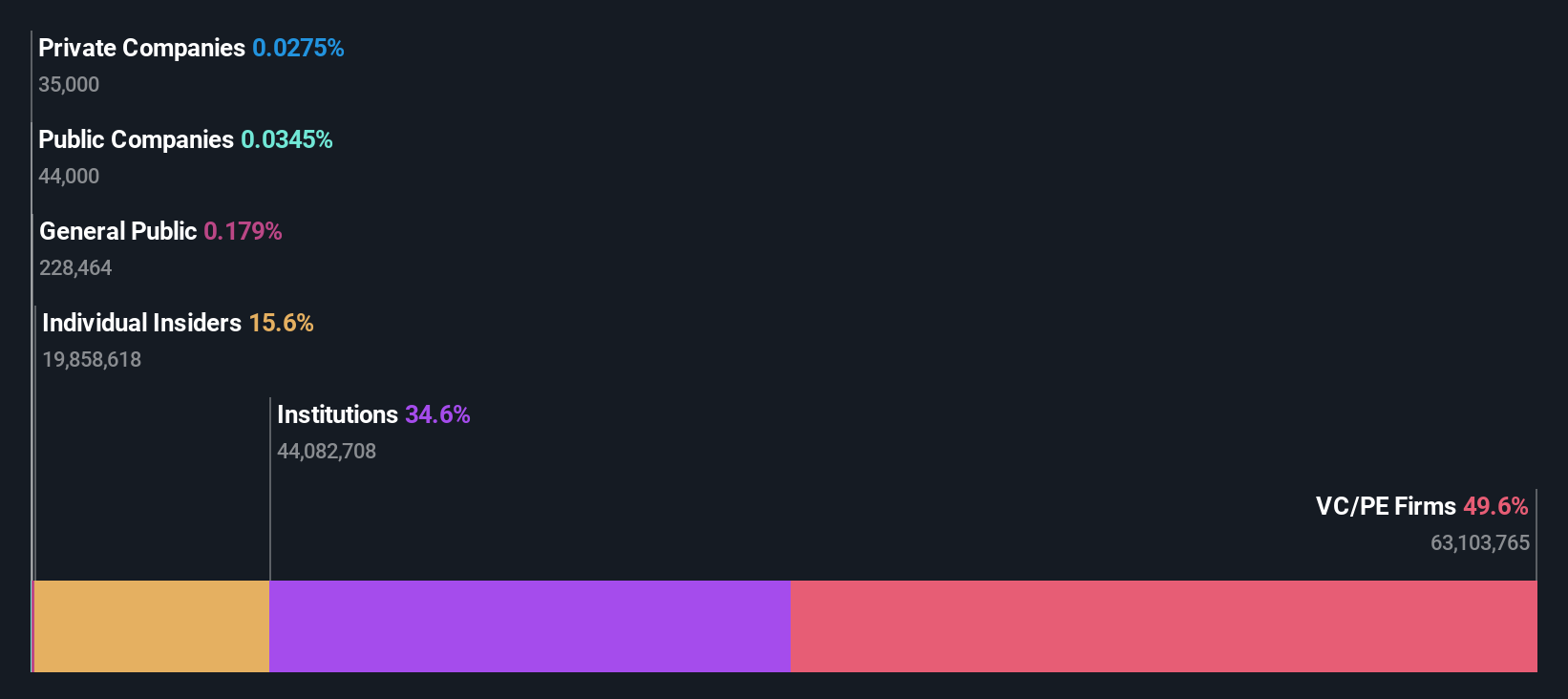

Insider Ownership: 15.6%

Stelrad Group, a growth company in the UK with high insider ownership, reported H1 2024 earnings of £8.02 million on sales of £143.12 million, reflecting stable profits despite a revenue decline. The company's earnings are forecast to grow at 14.52% annually, slightly above the UK market average. However, it has significant debt and an unstable dividend track record despite recently increasing its interim dividend by 2%. The recent CFO transition may impact financial stability short-term.

- Unlock comprehensive insights into our analysis of Stelrad Group stock in this growth report.

- Upon reviewing our latest valuation report, Stelrad Group's share price might be too pessimistic.

Next Steps

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 65 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Reasonable growth potential with proven track record.