- United Kingdom

- /

- Leisure

- /

- LSE:GAW

Here's Why Games Workshop Group (LON:GAW) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Games Workshop Group (LON:GAW). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Games Workshop Group's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Games Workshop Group has grown EPS by 13% per year. That growth rate is fairly good, assuming the company can keep it up.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Games Workshop Group shareholders is that EBIT margins have grown from 38% to 41% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

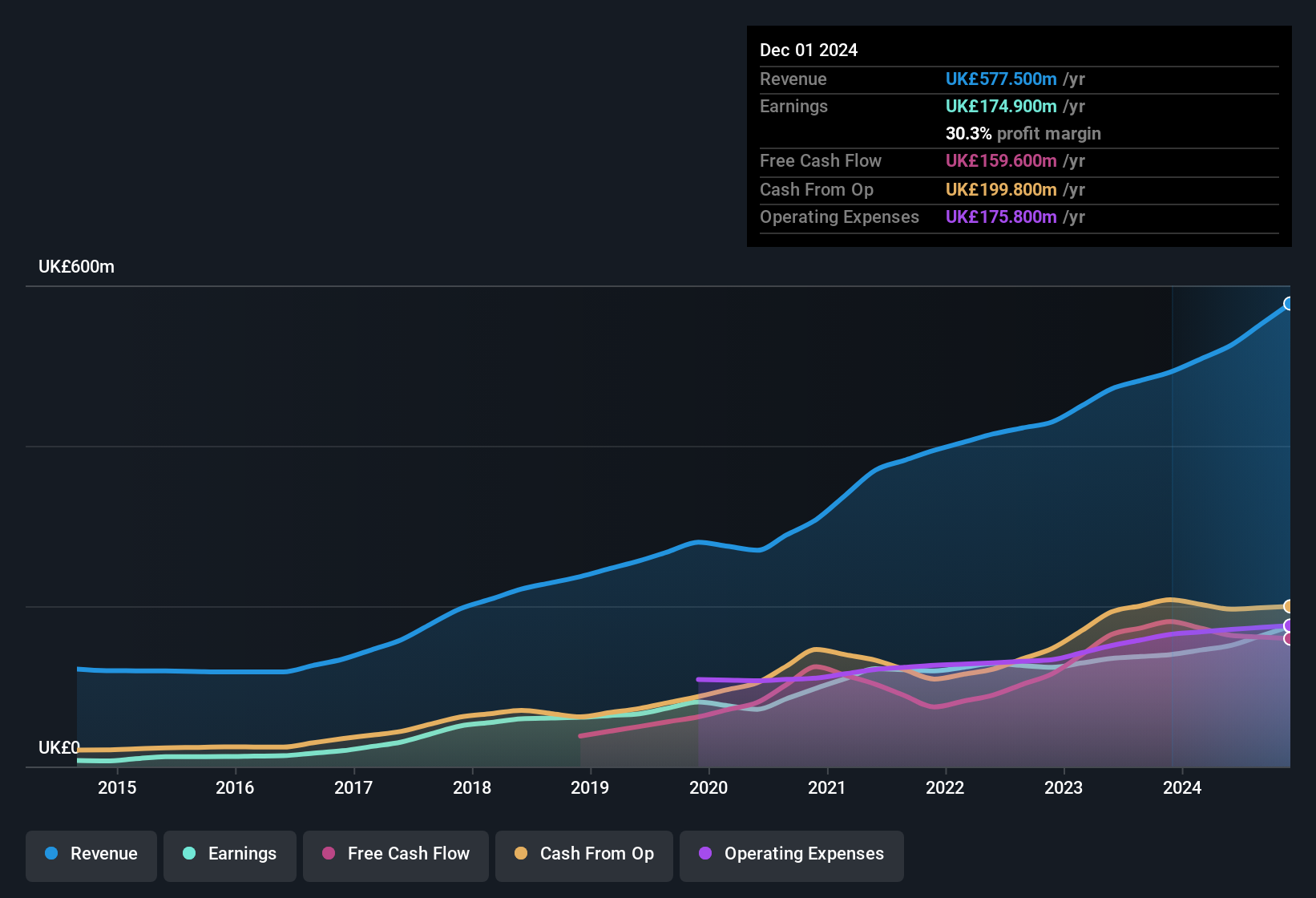

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for Games Workshop Group

Fortunately, we've got access to analyst forecasts of Games Workshop Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Games Workshop Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that Games Workshop Group insiders spent a staggering UK£643k on acquiring shares in just one year, without single share being sold in the meantime. Knowing this, Games Workshop Group will have have all eyes on them in anticipation for the what could happen in the near future. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Kevin Rountree for UK£367k worth of shares, at about UK£100 per share.

Recent insider purchases of Games Workshop Group stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, Games Workshop Group has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Games Workshop Group with market caps between UK£3.0b and UK£8.9b is about UK£3.0m.

Games Workshop Group's CEO took home a total compensation package worth UK£1.8m in the year leading up to June 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Games Workshop Group To Your Watchlist?

One positive for Games Workshop Group is that it is growing EPS. That's nice to see. And that's not all. We've also seen insiders buying stock, and noted modest executive pay. The sum of all that, points to a quality business, and a genuine prospect for further research. Even so, be aware that Games Workshop Group is showing 1 warning sign in our investment analysis , you should know about...

Keen growth investors love to see insider activity. Thankfully, Games Workshop Group isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GAW

Games Workshop Group

Engages in the design, manufacture, distribution, and sale of fantasy miniature figures and games in the United Kingdom, Continental Europe, North America, Australia, New Zealand, Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success