- United Kingdom

- /

- Consumer Durables

- /

- AIM:SPR

Springfield Properties (LON:SPR) Will Pay A Larger Dividend Than Last Year At UK£0.044

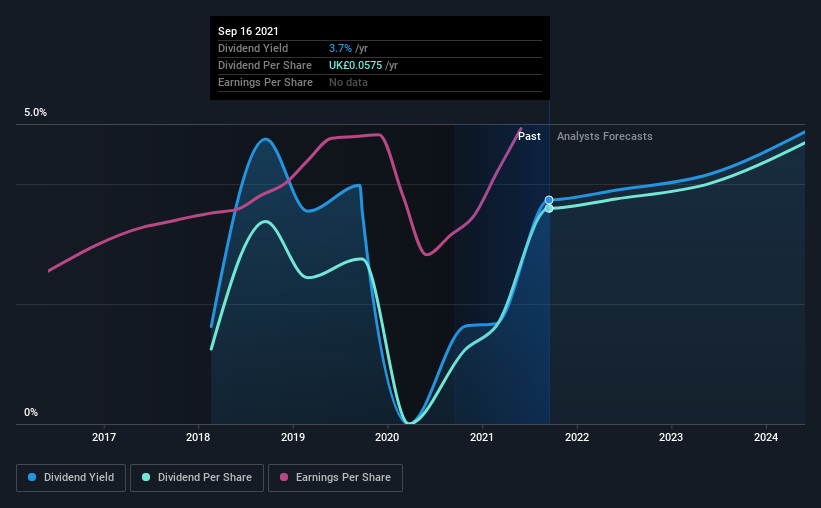

Springfield Properties Plc (LON:SPR) has announced that it will be increasing its dividend on the 9th of December to UK£0.044. Based on the announced payment, the dividend yield for the company will be 3.7%, which is fairly typical for the industry.

See our latest analysis for Springfield Properties

Springfield Properties' Payment Has Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, Springfield Properties' dividend was comfortably covered by both cash flow and earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

The next year is set to see EPS grow by 7.3%. If the dividend continues along recent trends, we estimate the payout ratio will be 37%, which is in the range that makes us comfortable with the sustainability of the dividend.

Springfield Properties' Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. The first annual payment during the last 4 years was UK£0.02 in 2017, and the most recent fiscal year payment was UK£0.058. This works out to be a compound annual growth rate (CAGR) of approximately 30% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see Springfield Properties has been growing its earnings per share at 14% a year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

We Really Like Springfield Properties' Dividend

Overall, a dividend increase is always good, and we think that Springfield Properties is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 3 warning signs for Springfield Properties that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade Springfield Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SPR

Springfield Properties

Engages in the residential housebuilding and land development in the United Kingdom.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026