- United Kingdom

- /

- Consumer Durables

- /

- AIM:SPR

Analysts' Revenue Estimates For Springfield Properties Plc (LON:SPR) Are Surging Higher

Springfield Properties Plc (LON:SPR) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

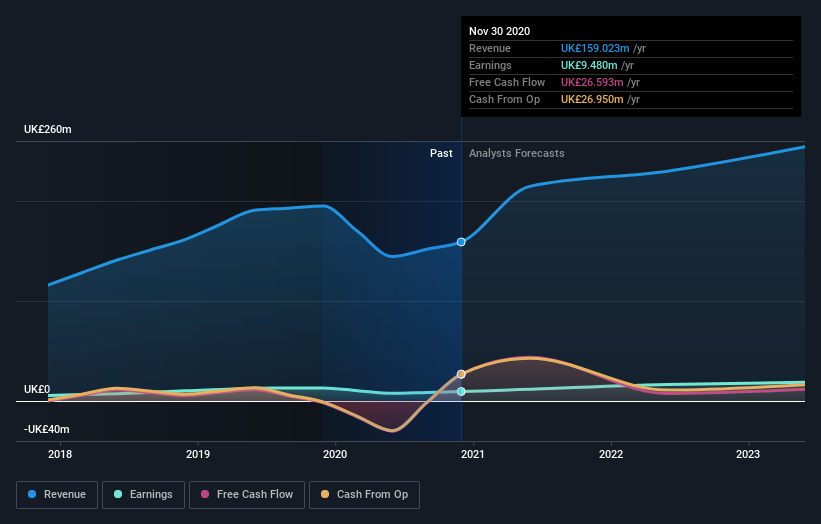

After this upgrade, Springfield Properties' three analysts are now forecasting revenues of UK£215m in 2021. This would be a huge 35% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing UK£194m of revenue in 2021. It looks like there's been a clear increase in optimism around Springfield Properties, given the nice gain to revenue forecasts.

See our latest analysis for Springfield Properties

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Springfield Properties' growth to accelerate, with the forecast 82% annualised growth to the end of 2021 ranking favourably alongside historical growth of 7.3% per annum over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 8.4% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Springfield Properties to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. The analysts also expect revenues to grow faster than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Springfield Properties.

Unanswered questions? At least one of Springfield Properties' three analysts has provided estimates out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Springfield Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SPR

Springfield Properties

Engages in the residential housebuilding and land development in the United Kingdom.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026