- United Kingdom

- /

- Consumer Durables

- /

- AIM:AIEA

AIREA plc (LON:AIEA) Looks Just Right With A 26% Price Jump

AIREA plc (LON:AIEA) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

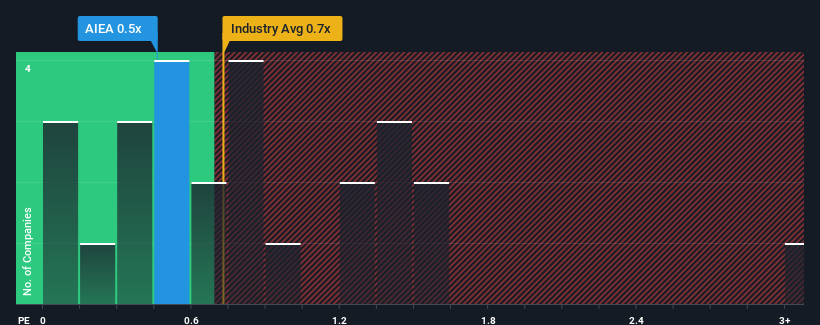

In spite of the firm bounce in price, it's still not a stretch to say that AIREA's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in the United Kingdom, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for AIREA

What Does AIREA's P/S Mean For Shareholders?

The recent revenue growth at AIREA would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. Those who are bullish on AIREA will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for AIREA, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like AIREA's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 4.0%. The latest three year period has also seen an excellent 38% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 12% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why AIREA's P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

AIREA's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we've seen, AIREA's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

And what about other risks? Every company has them, and we've spotted 5 warning signs for AIREA (of which 2 are a bit concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AIEA

AIREA

Designs, manufactures, and sells floor coverings in the United Kingdom and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives