- United Kingdom

- /

- Professional Services

- /

- LSE:STEM

3 High-Yielding UK Dividend Stocks With Returns From 3% to 6.9%

Reviewed by Simply Wall St

As the United Kingdom navigates through a period of political transition and economic recalibration, with attention on Chancellor Rachel Reeves' forthcoming policies and market responses, investors are keenly observing shifts in the financial landscape. In this context, identifying high-yielding dividend stocks becomes particularly pertinent, offering potential stability and steady returns amidst broader market fluctuations.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.25% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 6.82% | ★★★★★☆ |

| Epwin Group (AIM:EPWN) | 5.82% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.87% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.38% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.67% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.92% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.26% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.75% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.79% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

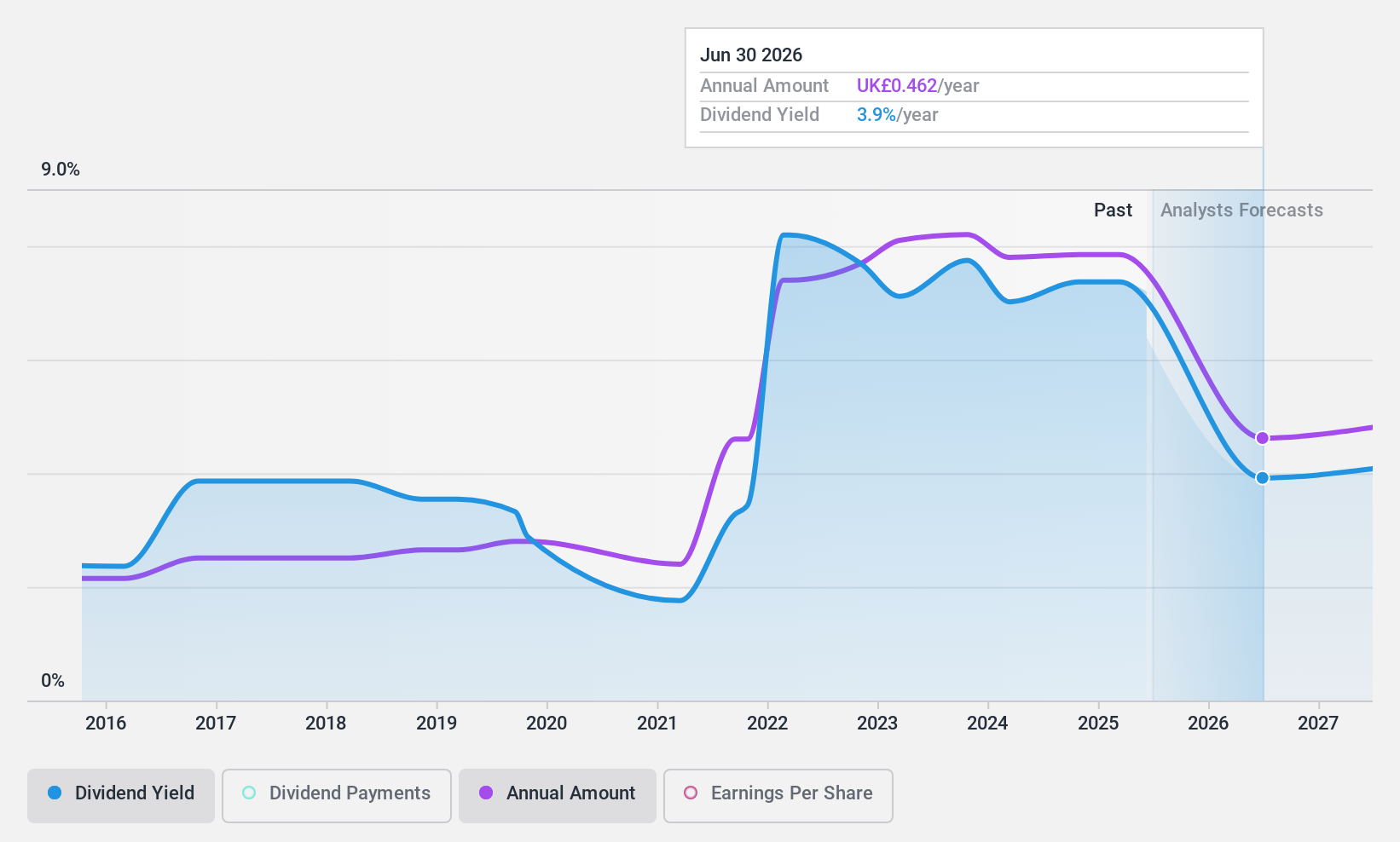

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc is a retailer specializing in homewares across the United Kingdom, with a market capitalization of approximately £2.28 billion.

Operations: Dunelm Group plc generates its revenue primarily through the sale of homewares, totaling £1.68 billion.

Dividend Yield: 6.9%

Dunelm Group's dividend yield stands at 6.92%, ranking in the top 25% of UK dividend payers. Despite a reasonable payout ratio of 58.1% and cash payout ratio of 74.8%, indicating coverage by earnings and cash flows, the company's dividend history has been marked by volatility over the past decade, with no consistent growth pattern. Trading at a 9.4% discount to its estimated fair value, DNLM offers potential value but comes with an unstable dividend track record, reflecting both opportunities and risks for investors focused on income stability.

- Take a closer look at Dunelm Group's potential here in our dividend report.

- According our valuation report, there's an indication that Dunelm Group's share price might be on the expensive side.

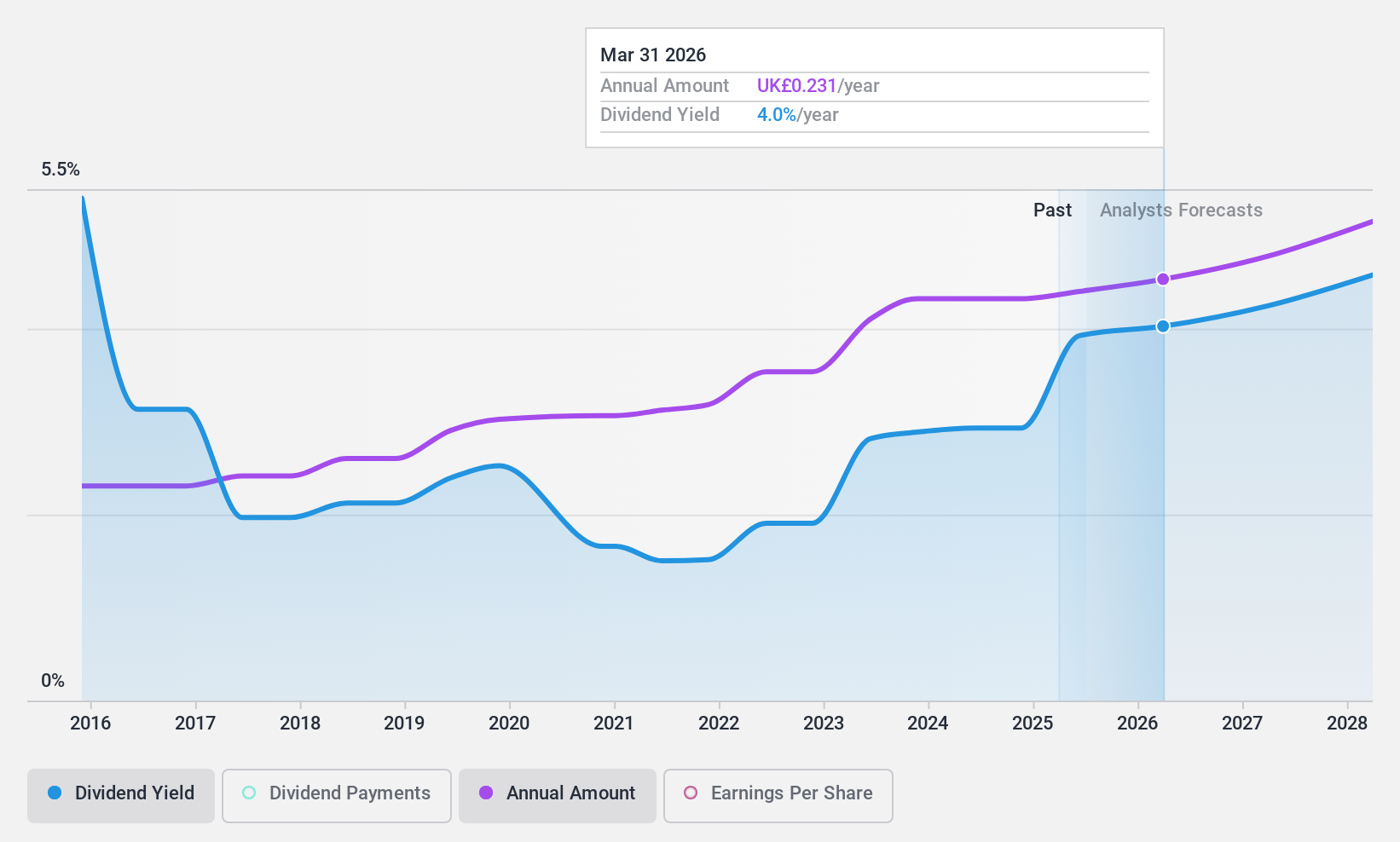

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc operates globally in distributing maintenance, repair, and operations products and service solutions across various countries including the UK, US, France, Germany, Italy, and Mexico, with a market capitalization of approximately £3.44 billion.

Operations: RS Group plc generates revenue primarily through its own-brand products, which brought in £404.80 million, and other product and service solutions, contributing £2.54 billion.

Dividend Yield: 3%

RS Group's dividend yield of 3.03% is lower than the top UK dividend payers, yet it has demonstrated reliability and growth over the past decade, with a payout ratio of 56.7% and cash payout ratio of 71.9%, suggesting sustainability from both earnings and cash flows. Despite recent drops from the FTSE 100 to the FTSE 250 Index, RS Group continues to pursue value through targeted M&A activities, as evidenced by their recent acquisition aimed at enhancing their Australian operations.

- Dive into the specifics of RS Group here with our thorough dividend report.

- The valuation report we've compiled suggests that RS Group's current price could be quite moderate.

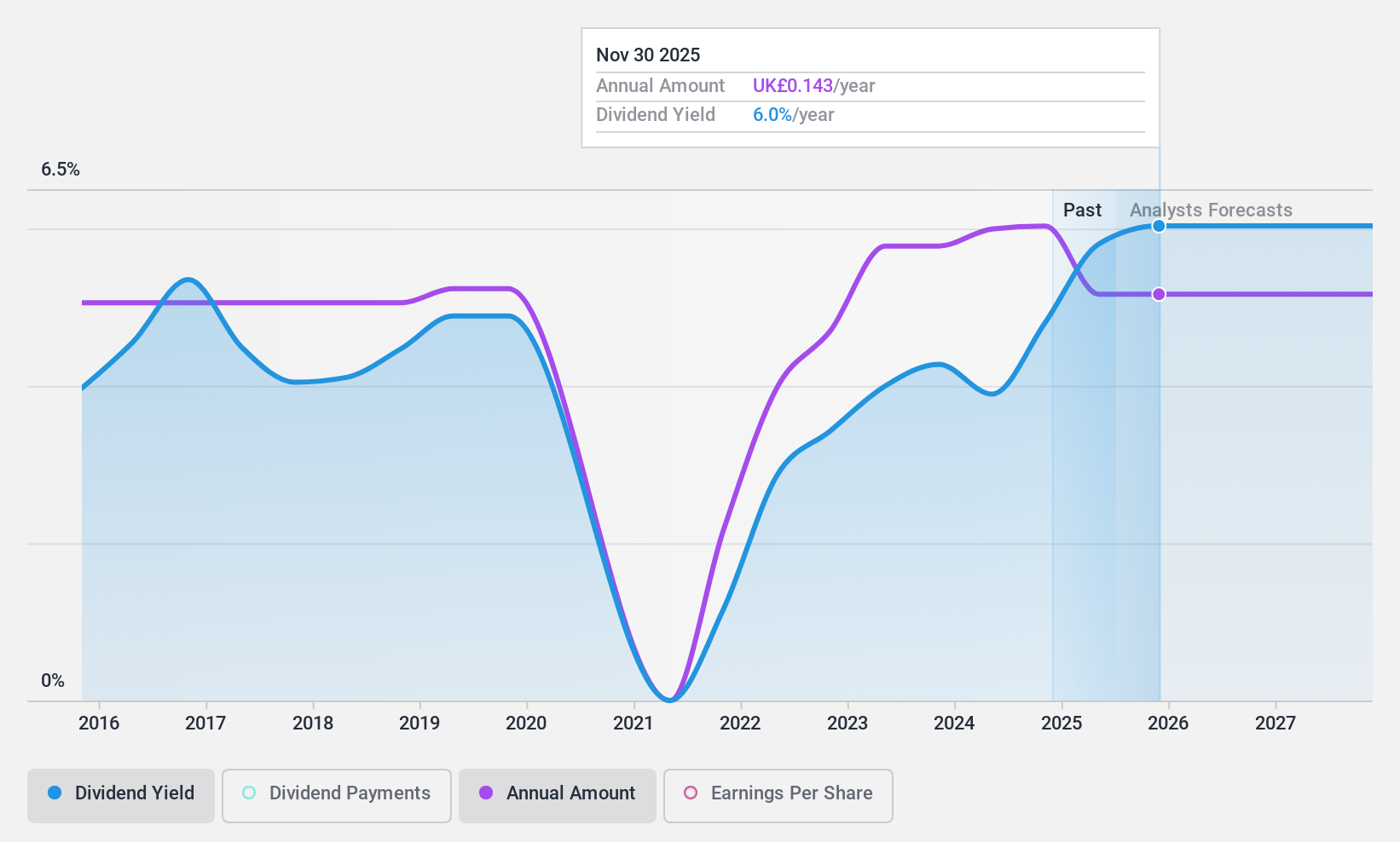

SThree (LSE:STEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SThree plc is a specialist recruitment firm operating in the STEM sectors across multiple countries including the UK, Germany, and the US, with a market capitalization of approximately £0.59 billion.

Operations: SThree plc generates its revenue primarily from the USA (£328.29 million), DACH region (£524.73 million), Rest of Europe (£399.86 million), and the Netherlands including Spain (£367.64 million), with additional contributions from the Middle East & Asia (£42.64 million).

Dividend Yield: 3.8%

SThree's dividends, while covered by earnings with a payout ratio of 39.1% and cash flows at 32.6%, show a history of volatility over the past decade, raising questions about their reliability. Despite this, dividends have grown in the last ten years and are seen as sustainable given current financial health. Recent approval of an increased final dividend to £0.116 per share signals confidence in future payouts, though its yield at 3.77% remains below many top UK dividend stocks.

- Navigate through the intricacies of SThree with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that SThree is trading behind its estimated value.

Make It Happen

- Delve into our full catalog of 56 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:STEM

SThree

Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan.

Outstanding track record with flawless balance sheet and pays a dividend.