- United Kingdom

- /

- Commercial Services

- /

- LSE:RTO

Should You Be Adding Rentokil Initial (LON:RTO) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Rentokil Initial (LON:RTO). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Rentokil Initial

How Fast Is Rentokil Initial Growing Its Earnings Per Share?

In the last three years Rentokil Initial's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Rentokil Initial's EPS soared from UK£0.10 to UK£0.14, in just one year. That's a commendable gain of 41%.

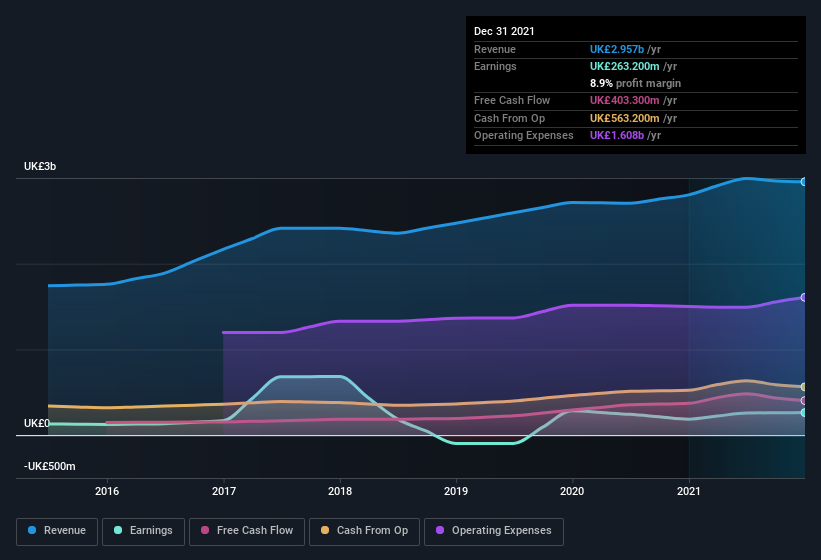

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Rentokil Initial's EBIT margins were flat over the last year, revenue grew by a solid 5.5% to UK£3.0b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Rentokil Initial's forecast profits?

Are Rentokil Initial Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent UK£833k buying Rentokil Initial shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the CEO & Executive Director, Andrew Ransom, who made the biggest single acquisition, paying UK£242k for shares at about UK£5.38 each.

The good news, alongside the insider buying, for Rentokil Initial bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have UK£10.0m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Rentokil Initial Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Rentokil Initial's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. It is worth noting though that we have found 1 warning sign for Rentokil Initial that you need to take into consideration.

As a growth investor I do like to see insider buying. But Rentokil Initial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RTO

Rentokil Initial

Provides route-based services in North America, the United Kingdom, rest of Europe, Asia, the Pacific, and internationally.

Solid track record average dividend payer.