- United Kingdom

- /

- Commercial Services

- /

- LSE:RTO

Rentokil Initial plc's (LON:RTO) P/E Still Appears To Be Reasonable

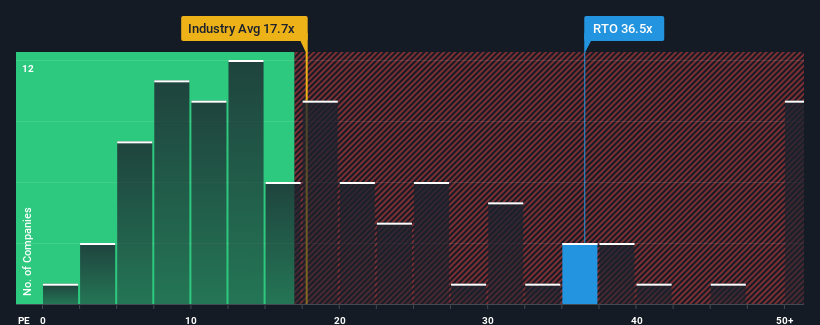

With a price-to-earnings (or "P/E") ratio of 36.5x Rentokil Initial plc (LON:RTO) may be sending very bearish signals at the moment, given that almost half of all companies in the United Kingdom have P/E ratios under 15x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Rentokil Initial has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Rentokil Initial

Is There Enough Growth For Rentokil Initial?

Rentokil Initial's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 11% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 35% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 12% each year, which is noticeably less attractive.

In light of this, it's understandable that Rentokil Initial's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Rentokil Initial's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Rentokil Initial's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Rentokil Initial has 3 warning signs (and 1 which is potentially serious) we think you should know about.

Of course, you might also be able to find a better stock than Rentokil Initial. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RTO

Rentokil Initial

Provides route-based services in North America, the United Kingdom, rest of Europe, Asia, the Pacific, and internationally.

Solid track record average dividend payer.