- United Kingdom

- /

- Oil and Gas

- /

- LSE:ENOG

Top UK Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has risen 1.2%, and over the past 12 months, it is up 8.7%, with earnings forecasted to grow by 14% annually. In this favorable market environment, companies that exhibit strong growth potential and high insider ownership often stand out as compelling investment opportunities due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Energean (LSE:ENOG) | 10.6% | 30.4% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.7% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Judges Scientific (AIM:JDG) | 11% | 23% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Enteq Technologies (AIM:NTQ) | 20.1% | 53.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Here's a peek at a few of the choices from the screener.

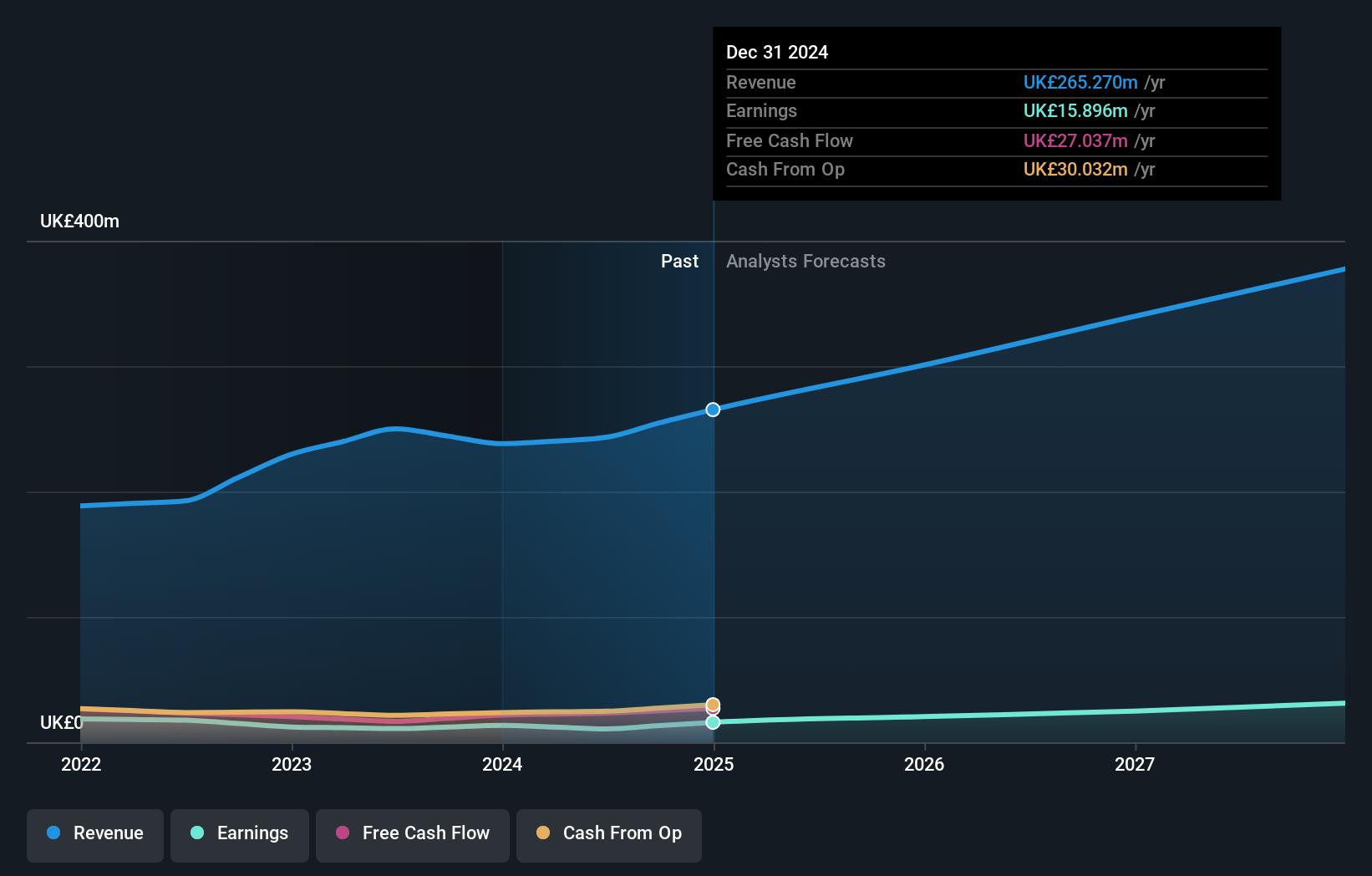

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £357.01 million, offers mortgage advice services across the United Kingdom through its subsidiaries.

Operations: The company's revenue from the provision of financial services amounts to £243.31 million.

Insider Ownership: 19.8%

Earnings Growth Forecast: 29.6% p.a.

Mortgage Advice Bureau (Holdings) shows promising growth potential with earnings forecasted to grow 29.6% annually, significantly outpacing the UK market's 14.4%. Despite a recent dip in net income to £3.7 million for H1 2024 from £6.42 million a year ago, revenue is expected to grow at 15.3% per year, faster than the UK market's average of 3.7%. Insider activity has been positive with more shares bought than sold in the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of Mortgage Advice Bureau (Holdings).

- In light of our recent valuation report, it seems possible that Mortgage Advice Bureau (Holdings) is trading beyond its estimated value.

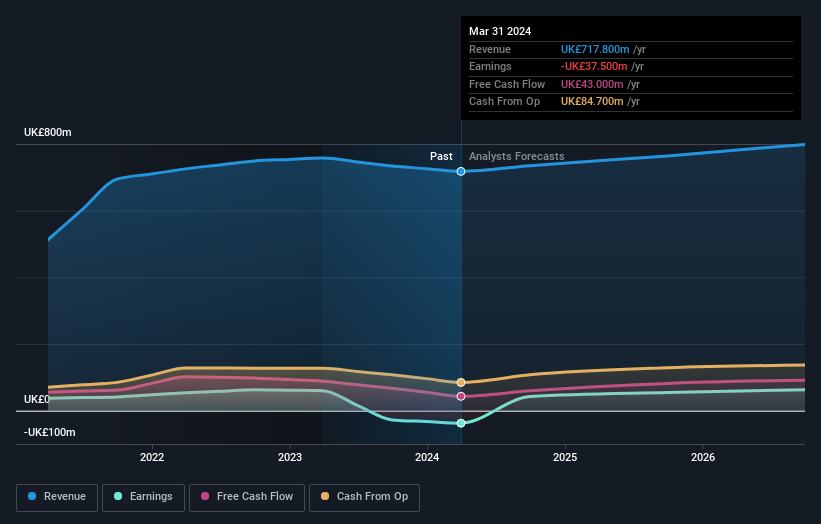

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property (IP) services with a market cap of £623.82 million.

Operations: The company's revenue segments include IP Services (£105.10 million), Language Services (£325.40 million), Regulated Industry (£149.40 million), and Language & Content Technology (L&CT) (£137.90 million).

Insider Ownership: 24.6%

Earnings Growth Forecast: 67.4% p.a.

RWS Holdings, trading at 71.5% below its estimated fair value, is forecast to grow revenue by 4.2% annually, outpacing the UK market's 3.7%. Despite a low projected return on equity of 8.7% in three years and a dividend yield of 7.24% not well covered by earnings or free cash flows, RWS is expected to achieve profitability within the next three years with earnings growth forecasted at 67.35% per year. Recent executive changes include Mark Lawyer joining as President of Regulated Industries & Linguistic AI, bringing extensive industry experience and a strong track record in developing AI solutions for Fortune 500 companies.

- Click to explore a detailed breakdown of our findings in RWS Holdings' earnings growth report.

- In light of our recent valuation report, it seems possible that RWS Holdings is trading behind its estimated value.

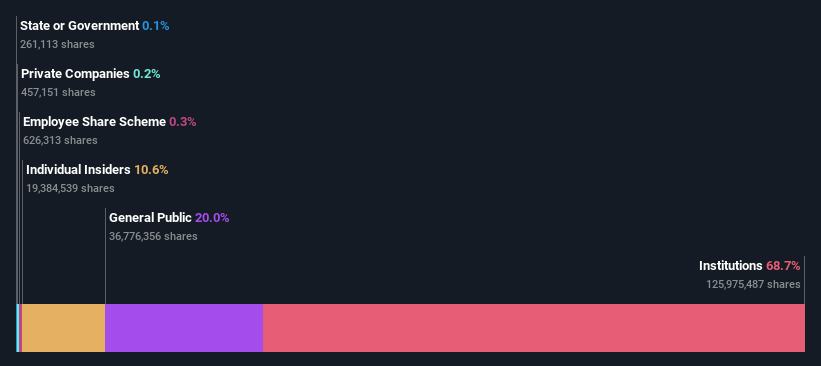

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Energean plc engages in the exploration, production, and development of oil and gas, with a market cap of £1.64 billion.

Operations: Energean's revenue from oil and gas exploration and production is $1.69 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 30.4% p.a.

Energean, with significant insider ownership, has reported record production and robust financial performance. For the first half of 2024, production increased by 38% year-on-year to 146 kboed, driving sales up to US$642.41 million from US$375.89 million a year ago. Earnings grew to US$88.54 million with basic earnings per share from continuing operations at US$0.63. Despite high debt levels and recent shareholder dilution, Energean's earnings are forecasted to grow significantly at 30.41% annually over the next three years.

- Delve into the full analysis future growth report here for a deeper understanding of Energean.

- Our valuation report here indicates Energean may be undervalued.

Key Takeaways

- Get an in-depth perspective on all 65 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Energean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENOG

Energean

Engages in the exploration, production, and development of oil and gas.

Average dividend payer and fair value.