- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

RWS Holdings And 2 Other UK Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces downward pressure due to weak trade data from China, investors are increasingly seeking resilient growth opportunities amidst global economic uncertainties. In this environment, companies with high insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially offering stability and confidence in their long-term strategies.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 86.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 23.8% | 53.8% |

| Facilities by ADF (AIM:ADF) | 12.9% | 144.7% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's uncover some gems from our specialized screener.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services with a market capitalization of £571.47 million.

Operations: The company's revenue is derived from four main segments: IP Services (£105.10 million), Language Services (£325.40 million), Regulated Industry (£149.40 million), and Language & Content Technology (£137.90 million).

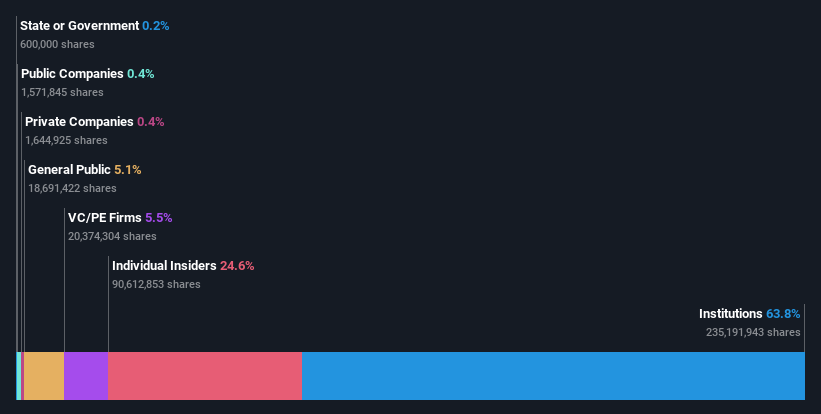

Insider Ownership: 24.6%

Earnings Growth Forecast: 67.4% p.a.

RWS Holdings, trading significantly below its estimated fair value, is expected to see substantial earnings growth of 67.35% annually, outpacing the UK market's revenue growth projections. Despite a high dividend yield of 7.9%, it is not well covered by earnings or cash flows. Recent executive changes include Jacqui Taylor as Chief People Officer and Mark Lawyer leading Regulated Industries & Linguistic AI, both bringing extensive industry experience to drive strategic initiatives and innovation within the company.

- Get an in-depth perspective on RWS Holdings' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that RWS Holdings is priced lower than what may be justified by its financials.

Henry Boot (LSE:BOOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £307.37 million.

Operations: The company's revenue is derived from three main segments: Property Investment and Development (£170.56 million), Construction (£87.90 million), and Land Promotion (£28.37 million).

Insider Ownership: 31.2%

Earnings Growth Forecast: 25.5% p.a.

Henry Boot demonstrates potential as a growth company with high insider ownership, despite recent challenges. The company's earnings are forecasted to grow at 25.5% annually, surpassing UK market averages, though revenue growth remains moderate at 10.7%. Recent developments include a £15M industrial unit completion and further expansion plans at Airport Business Park Southend. However, the dividend yield of 3.25% is not well covered by cash flows, and return on equity is projected to remain low in coming years.

- Take a closer look at Henry Boot's potential here in our earnings growth report.

- According our valuation report, there's an indication that Henry Boot's share price might be on the expensive side.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £1.23 billion.

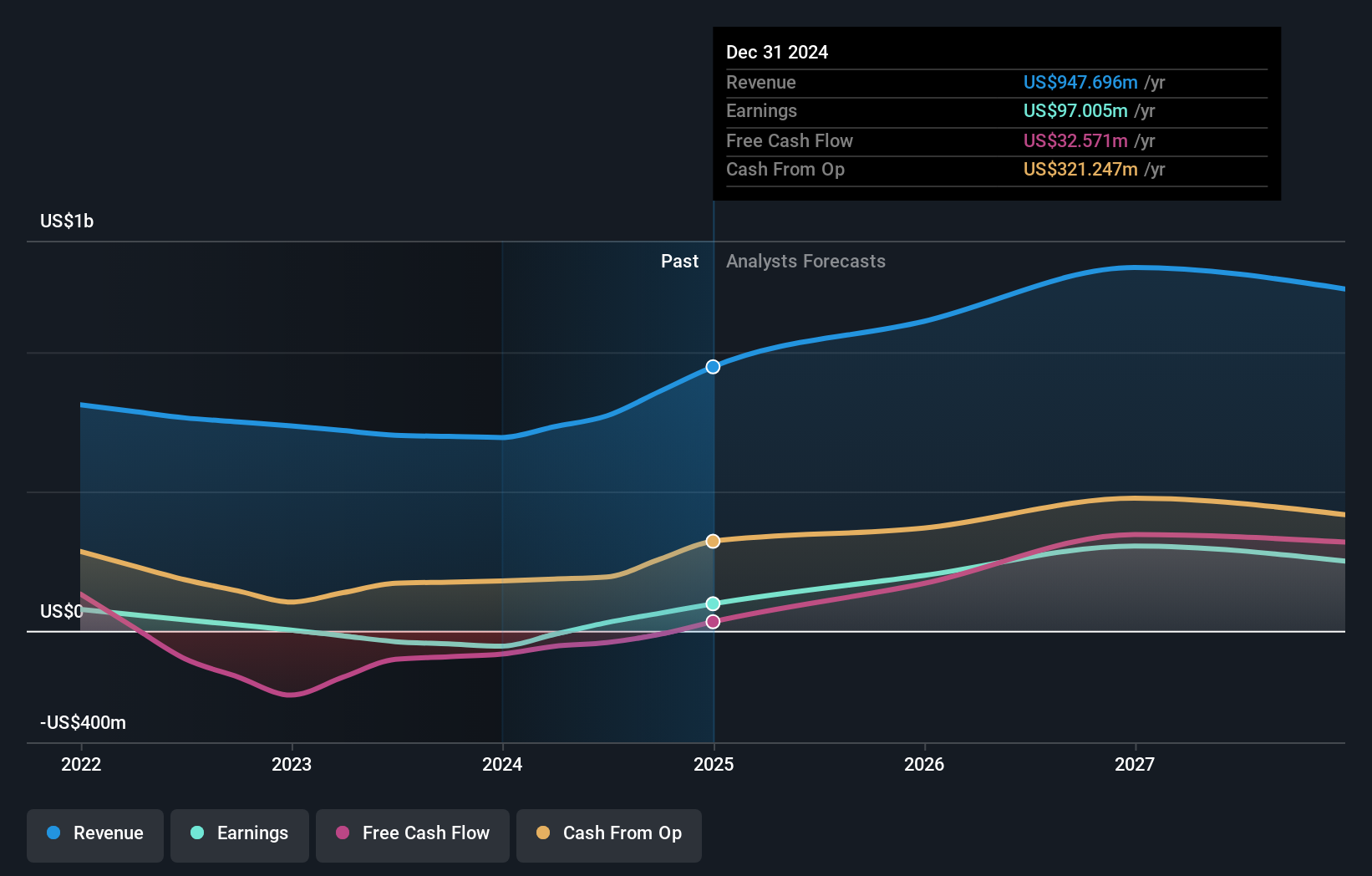

Operations: The company's revenue primarily comes from its San Jose segment, generating $266.70 million, and its Inmaculada segment, contributing $451.91 million.

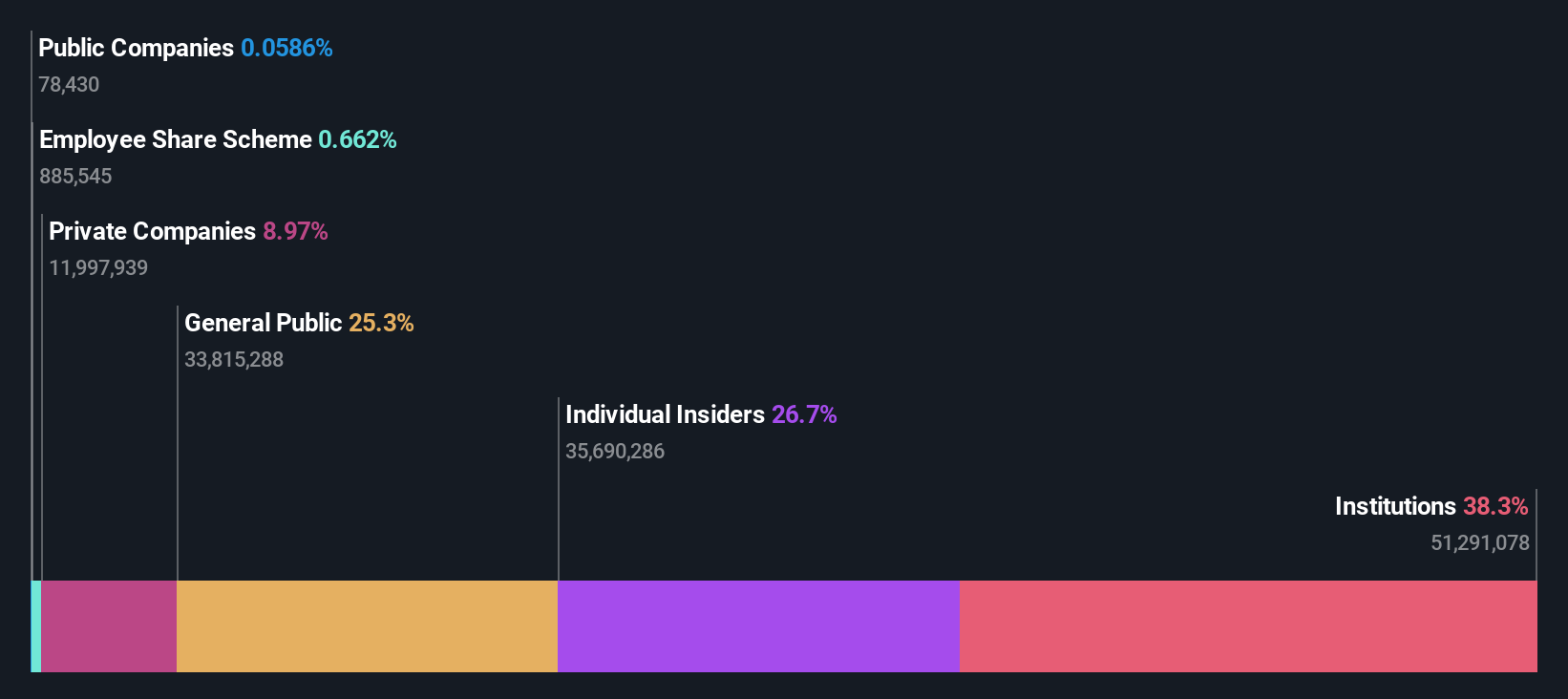

Insider Ownership: 38.4%

Earnings Growth Forecast: 50.4% p.a.

Hochschild Mining shows potential with significant earnings growth forecasted at 50.39% annually, outpacing the UK market. Despite high debt levels and a volatile share price, it trades at 58.5% below its estimated fair value. Recent results highlight increased gold production and improved profitability, reporting a net income of US$39.52 million for the first half of 2024 compared to a loss last year, although one-off items affect earnings quality.

- Delve into the full analysis future growth report here for a deeper understanding of Hochschild Mining.

- Our expertly prepared valuation report Hochschild Mining implies its share price may be too high.

Next Steps

- Embark on your investment journey to our 64 Fast Growing UK Companies With High Insider Ownership selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.