- United Kingdom

- /

- Specialty Stores

- /

- AIM:VIC

3 UK Stocks Estimated To Be Up To 47.5% Below Intrinsic Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery and its impact on global trade. As London markets respond to these global cues, investors might find opportunities in stocks that are currently trading below their intrinsic value, offering potential for long-term growth despite short-term volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.236 | £11.87 | 47.5% |

| Topps Tiles (LSE:TPT) | £0.3845 | £0.71 | 45.5% |

| TBC Bank Group (LSE:TBCG) | £48.35 | £95.75 | 49.5% |

| Moonpig Group (LSE:MOON) | £2.145 | £4.04 | 46.9% |

| Marlowe (AIM:MRL) | £4.42 | £8.37 | 47.2% |

| LSL Property Services (LSE:LSL) | £2.98 | £5.87 | 49.2% |

| Gooch & Housego (AIM:GHH) | £6.04 | £11.14 | 45.8% |

| Franchise Brands (AIM:FRAN) | £1.41 | £2.69 | 47.5% |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £2.26 | 45.9% |

| AstraZeneca (LSE:AZN) | £108.02 | £194.02 | 44.3% |

Here we highlight a subset of our preferred stocks from the screener.

Franchise Brands (AIM:FRAN)

Overview: Franchise Brands plc operates in franchising and related activities across the United Kingdom, Ireland, North America, and Continental Europe, with a market cap of £271.48 million.

Operations: The company's revenue is primarily derived from its segments: Azura (£0.81 million), Pirtek (£63.91 million), B2C Division (£5.75 million), Filta International (£25.60 million), and Water & Waste Services (£46.05 million).

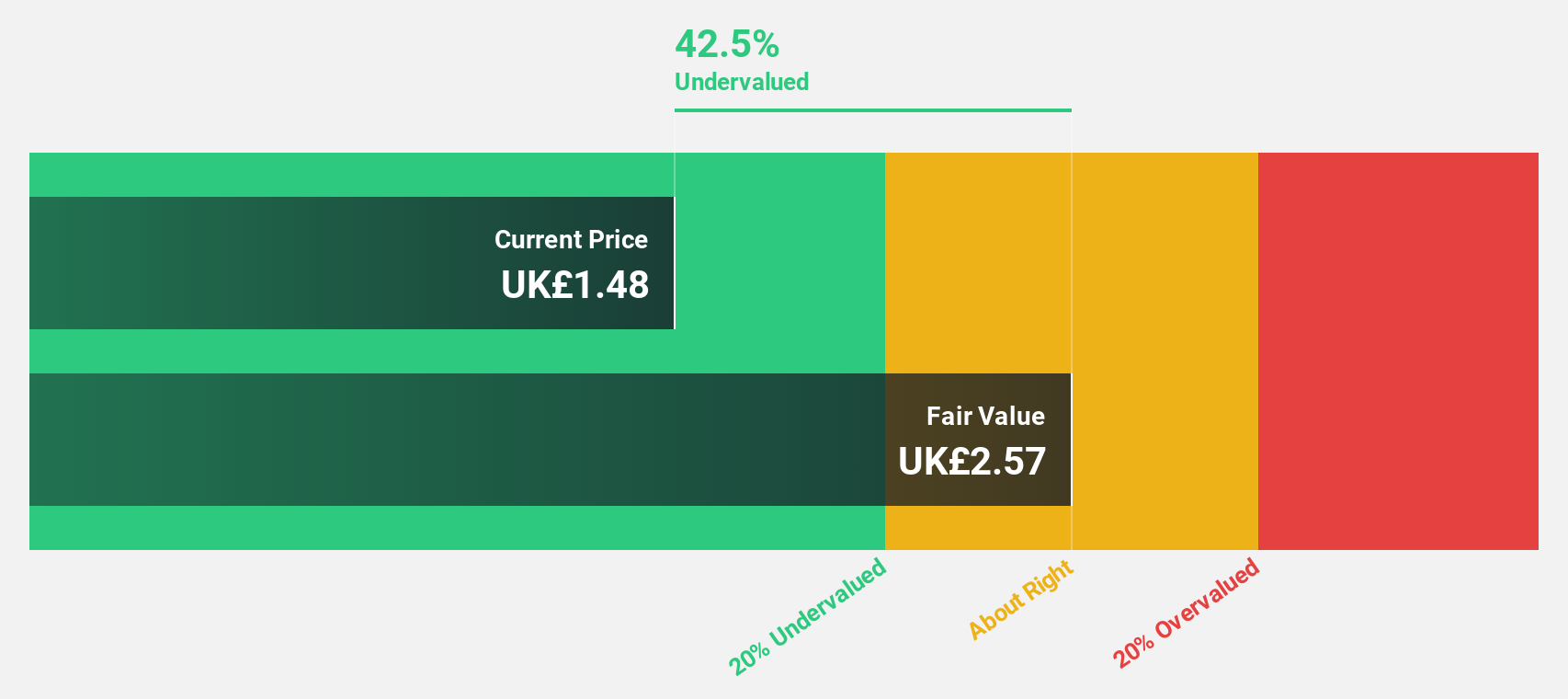

Estimated Discount To Fair Value: 47.5%

Franchise Brands is trading at £1.41, significantly below its estimated fair value of £2.69, suggesting it is undervalued based on cash flows. Earnings are expected to grow 29.39% annually, outpacing the UK market's 14.7%. Although revenue growth at 7.4% per year is slower than desired, it still exceeds the UK market average of 3.6%. Recent earnings growth was substantial at 143.9%, highlighting strong financial performance potential.

- According our earnings growth report, there's an indication that Franchise Brands might be ready to expand.

- Unlock comprehensive insights into our analysis of Franchise Brands stock in this financial health report.

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories for both B2C and trade customers in the United Kingdom, with a market cap of £237.09 million.

Operations: Victorian Plumbing Group generates revenue through its online retail sales of bathroom products and accessories to both consumer and trade markets in the UK.

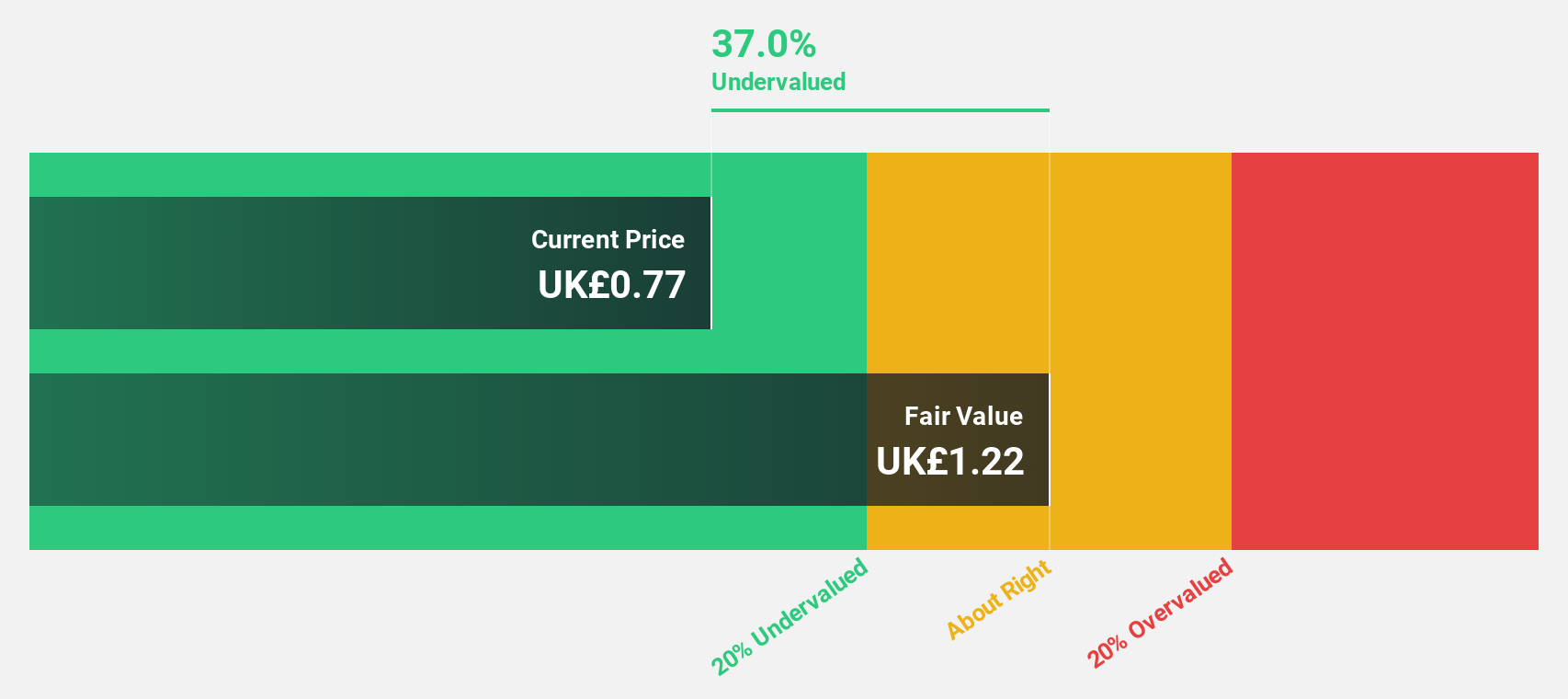

Estimated Discount To Fair Value: 39.5%

Victorian Plumbing Group is trading at £0.72, considerably below its estimated fair value of £1.2, highlighting its potential undervaluation based on cash flows. Despite a volatile share price and insider selling, earnings are forecast to grow significantly at 29.7% annually, surpassing the UK market's growth rate. However, profit margins have declined from last year and dividends remain inadequately covered by free cash flows despite a recent increase in payout to shareholders.

- Insights from our recent growth report point to a promising forecast for Victorian Plumbing Group's business outlook.

- Take a closer look at Victorian Plumbing Group's balance sheet health here in our report.

Wickes Group (LSE:WIX)

Overview: Wickes Group plc is a UK-based retailer specializing in home improvement products and services, with a market cap of £532.73 million.

Operations: The company generates revenue of £1.54 billion from its retail operations in home improvement products and services within the UK.

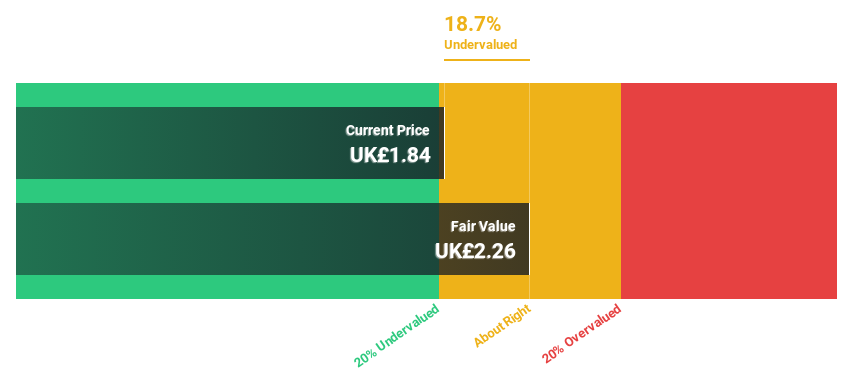

Estimated Discount To Fair Value: 28.0%

Wickes Group, trading at £2.25, is undervalued compared to its fair value estimate of £3.12, reflecting a discount greater than 20% based on discounted cash flow analysis. The company forecasts robust earnings growth of 26.8% annually, outpacing the UK market's average. Despite this potential, dividends are not well-covered by earnings and recent results show declining profit margins from last year. Recent index additions signal increased visibility among investors.

- In light of our recent growth report, it seems possible that Wickes Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Wickes Group's balance sheet health report.

Make It Happen

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 50 more companies for you to explore.Click here to unveil our expertly curated list of 53 Undervalued UK Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VIC

Victorian Plumbing Group

Operates as an online retailer of bathroom products and accessories for B2C and trade customers in the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives