- United Kingdom

- /

- Machinery

- /

- LSE:WEIR

If You Had Bought Weir Group Stock Three Years Ago, You Could Pocket A 53% Gain Today

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the The Weir Group PLC (LON:WEIR) share price is up 53% in the last three years, clearly besting than the market return of around 15% (not including dividends).

See our latest analysis for Weir Group

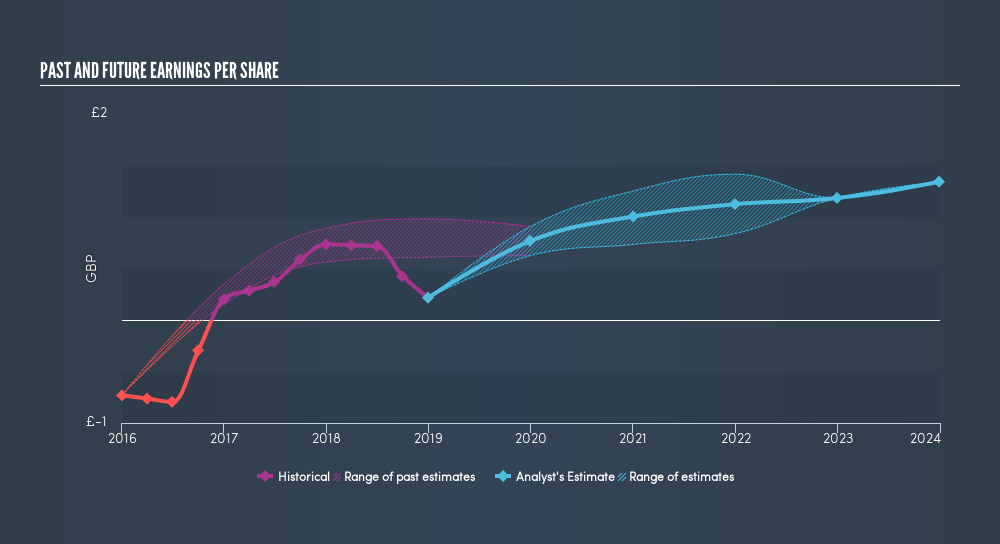

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Weir Group became profitable within the last three years. That would generally be considered a positive, so we'd expect the share price to be up.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Weir Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Weir Group the TSR over the last 3 years was 66%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Weir Group had a tough year, with a total loss of 12% (including dividends), against a market gain of about 3.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Weir Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:WEIR

Weir Group

Produces and sells highly engineered original equipment worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives