- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Rolls-Royce Holdings (LSE:RR.) Valuation in Focus After Exceptional 12-Month Rally

Reviewed by Simply Wall St

Rolls-Royce Holdings (LSE:RR.) shares have held steady over the past month, even as investor sentiment in the broader capital goods sector has shifted. The company’s valuation continues to attract attention from those watching for long-term recovery signs.

See our latest analysis for Rolls-Royce Holdings.

After an extraordinary rally this year that pushed Rolls-Royce’s share price up nearly 93.5% year-to-date and delivered a staggering 108.4% total shareholder return over the past twelve months, the stock has cooled off a bit in recent weeks. While price momentum has paused, the long-term picture remains impressive and continues to draw attention to the company’s sustained turnaround story and evolving valuation narrative.

If you’re curious to see what else is gaining traction beyond industrial names like Rolls-Royce, now’s a great opportunity to discover See the full list for free.

With shares trading just shy of analyst targets after an exceptional run, investors are left wondering whether Rolls-Royce is still undervalued or if the market has already priced in all the optimism ahead.

Most Popular Narrative: 4.5% Undervalued

Rolls-Royce’s most widely followed narrative puts its fair value at £11.93, modestly above the recent close of £11.39. This suggests some headroom remains for long-term investors, beyond the latest analyst consensus.

The growing investor enthusiasm for Rolls-Royce's sustainable technology initiatives (SMRs, UltraFan, hydrogen propulsion, advanced battery storage) is increasingly priced into the stock. These projects, however, remain in early commercialization stages and carry material execution, regulatory, and capex risks. If adoption lags or investor timelines prove optimistic, anticipated new revenue streams are likely to be delayed, impacting long-term earnings visibility.

Want to know what underpins this valuation? It’s a blueprint built on bold earnings targets for years ahead, with profit multiples worthy of market darlings. Which fundamental forecast is driving the price higher than most investors expected? You’ll want to see how margin expectations and industry growth trends are shaping fair value in the full breakdown.

Result: Fair Value of £11.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cost pressures or a slowdown in data center power demand could undermine recent margin gains and challenge optimistic long-term forecasts.

Find out about the key risks to this Rolls-Royce Holdings narrative.

Another View: Testing the Valuation with a DCF Model

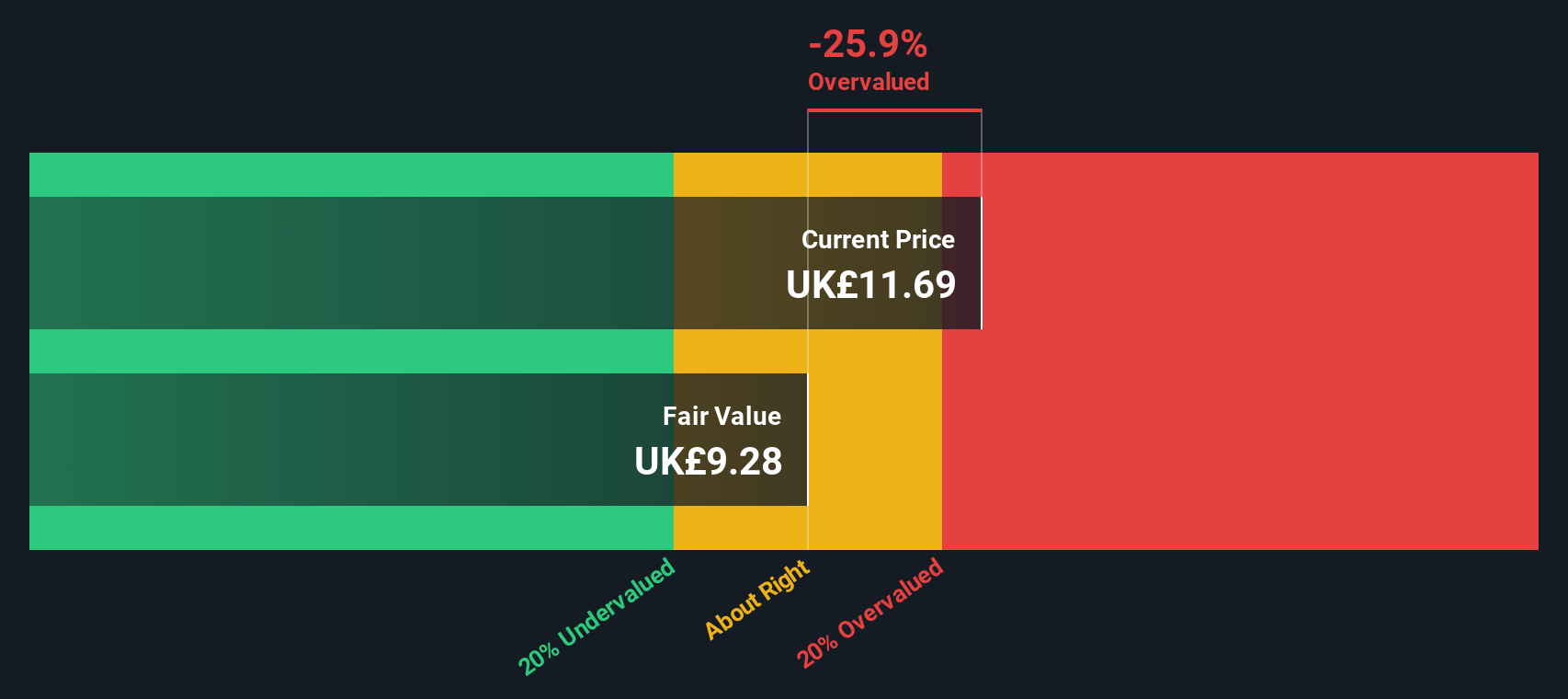

While the consensus fair value suggests Rolls-Royce is slightly undervalued, our DCF model reaches a different conclusion. The SWS DCF model puts fair value at £9.89 per share, which is below the current market price. If the market leans toward this approach, shares could be considered overvalued at today's levels. Which method will win out in the longer run: analysts’ expectations or this more conservative cash flow view?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rolls-Royce Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rolls-Royce Holdings Narrative

If you see the story differently, or would rather dive into the numbers firsthand, you can assemble your own narrative in just a few minutes, with Do it your way.

A great starting point for your Rolls-Royce Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t sit on the sidelines. Move ahead of the crowd by looking into stocks poised for tomorrow’s opportunities, all tailored to your strategy on Simply Wall St.

- Catch the momentum of high-yielding companies and scan the market for income-focused opportunities with these 16 dividend stocks with yields > 3% that pay more than 3%.

- Put yourself at the forefront of the digital currency revolution by checking out these 82 cryptocurrency and blockchain stocks driving innovation in blockchain and secure payments.

- Unlock tomorrow’s growth leaders by searching for these 24 AI penny stocks shaping the way technology powers industries large and small.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives