- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:VEL

Health Check: How Prudently Does Velocity Composites (LON:VEL) Use Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Velocity Composites plc (LON:VEL) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Velocity Composites

What Is Velocity Composites's Debt?

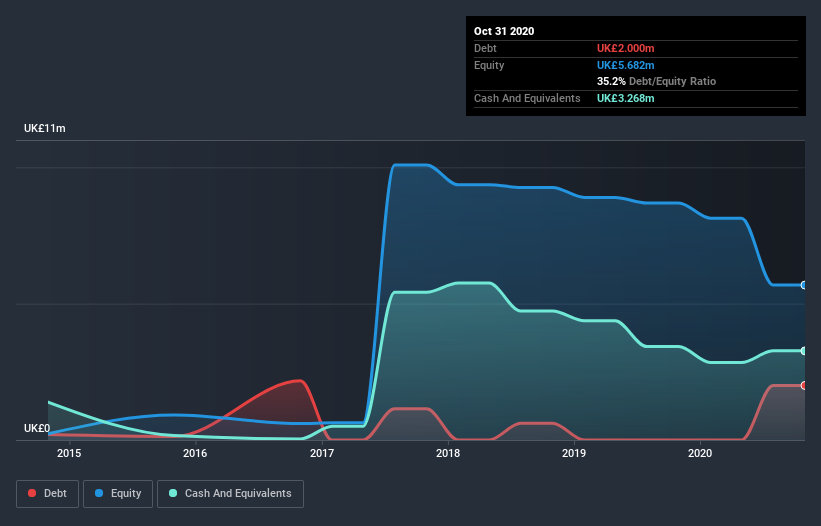

You can click the graphic below for the historical numbers, but it shows that as of October 2020 Velocity Composites had UK£2.00m of debt, an increase on UK£4.0k, over one year. However, it does have UK£3.27m in cash offsetting this, leading to net cash of UK£1.27m.

How Healthy Is Velocity Composites' Balance Sheet?

We can see from the most recent balance sheet that Velocity Composites had liabilities of UK£2.42m falling due within a year, and liabilities of UK£2.56m due beyond that. On the other hand, it had cash of UK£3.27m and UK£2.46m worth of receivables due within a year. So it actually has UK£757.0k more liquid assets than total liabilities.

This surplus suggests that Velocity Composites has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Velocity Composites boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Velocity Composites will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Velocity Composites had a loss before interest and tax, and actually shrunk its revenue by 44%, to UK£14m. To be frank that doesn't bode well.

So How Risky Is Velocity Composites?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Velocity Composites lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of UK£1.9m and booked a UK£3.1m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of UK£1.27m. That kitty means the company can keep spending for growth for at least two years, at current rates. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Velocity Composites (2 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Velocity Composites or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:VEL

Velocity Composites

Provides engineered composite material kits and related products to the aerospace industry in the United Kingdom, Europe, the United States, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026