- United Kingdom

- /

- Machinery

- /

- LSE:GDWN

Undiscovered Gems in the UK for November 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces headwinds from weak trade data out of China, impacting companies with significant exposure to the Chinese market, investors are increasingly turning their attention to smaller-cap stocks that may offer unique opportunities in a challenging global environment. In this context, identifying promising small-cap stocks involves looking for those that demonstrate resilience and potential growth despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

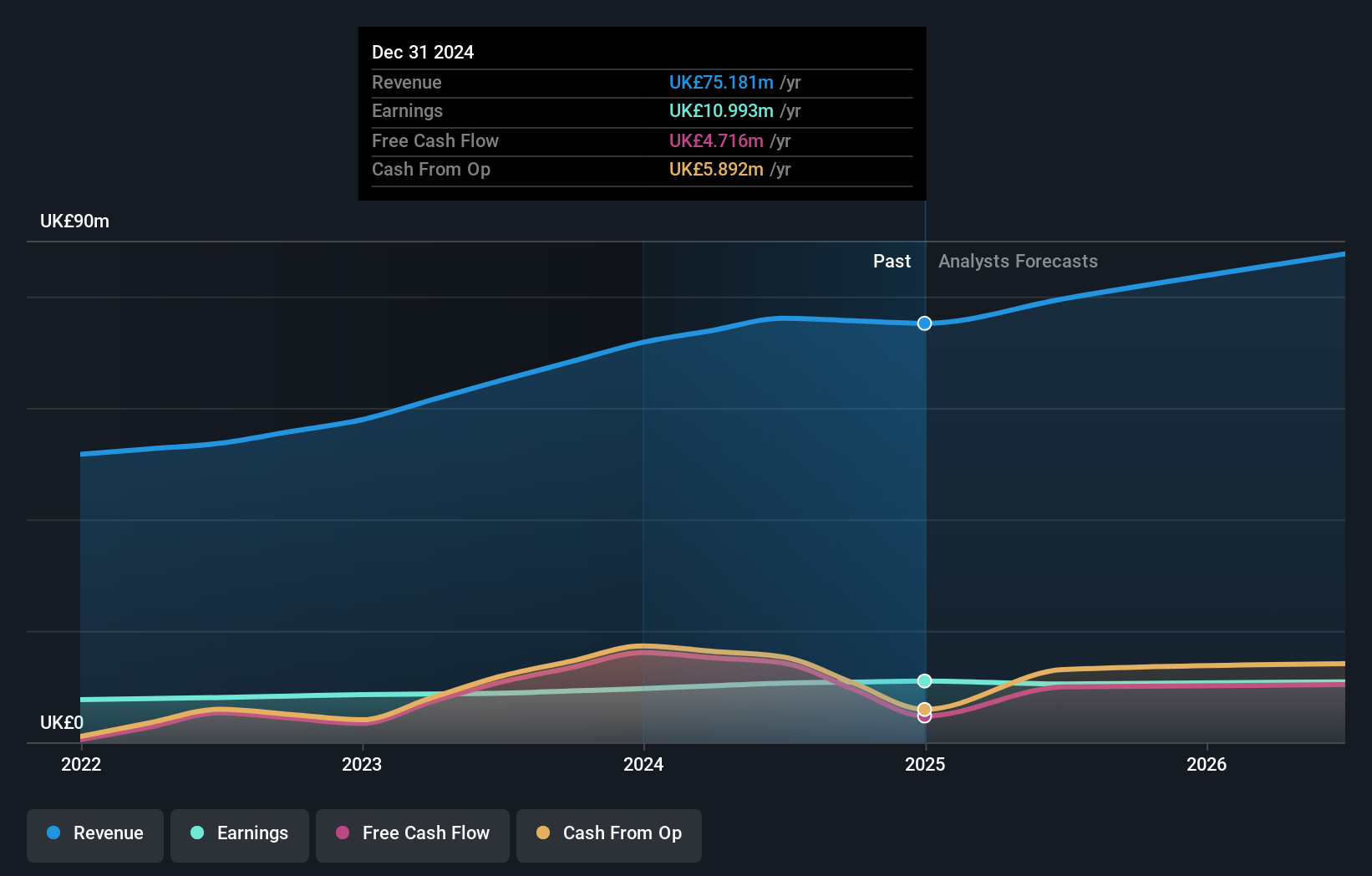

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

Overview: Fonix Plc offers mobile payments, messaging, and managed services for sectors such as media, charity, gaming, e-mobility, and other digital services across the United Kingdom and Europe with a market cap of £190.28 million.

Operations: Revenue primarily comes from facilitating mobile payments and messaging, amounting to £72.78 million.

Fonix, a nimble player in the UK market, has shown impressive financial discipline with no debt over the past five years. Its earnings have grown annually by 14% over this period, though recent growth of 5% lagged behind the industry's 14%. Trading at a discount of 10.5% to its estimated fair value suggests potential upside for investors. The company reported net income of £11.15 million for the year ending June 2025, up from £10.62 million previously, and increased its final dividend to 5.9 pence per share. Expansion into Portugal and new product rollouts highlight strategic growth moves in its pipeline.

- Dive into the specifics of Fonix here with our thorough health report.

Explore historical data to track Fonix's performance over time in our Past section.

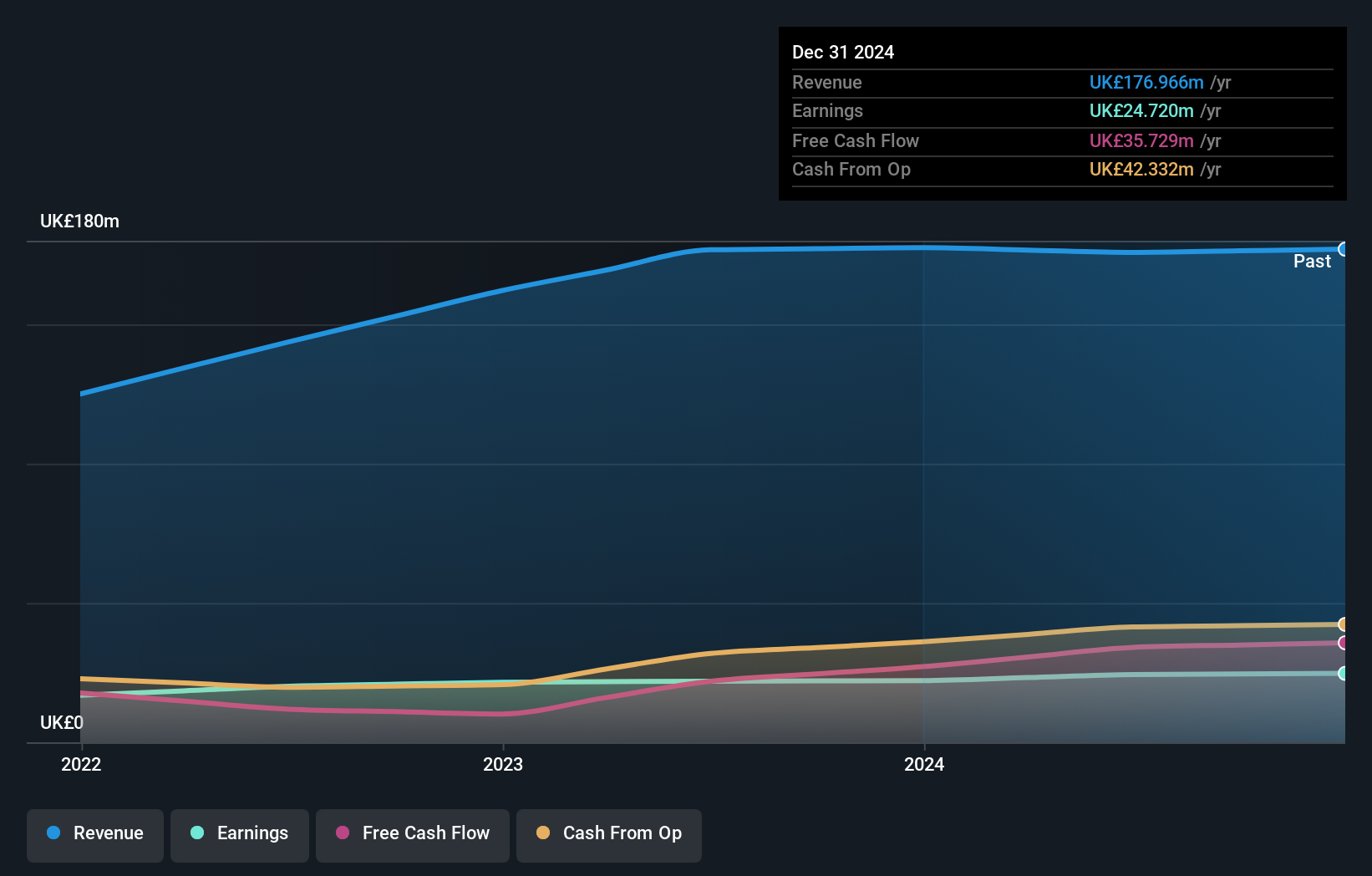

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc designs, manufactures, and supplies professional lighting equipment across various regions including the United Kingdom, the Netherlands, Germany, and internationally, with a market cap of £334.96 million.

Operations: Revenue primarily comes from Thorlux (£105.10 million) and Netherlands Companies (£34.59 million), with additional contributions from the Zemper Group and other companies.

Thorpe, a promising player in the UK market, boasts a price-to-earnings ratio of 13.2x, offering good value against the broader UK market at 15.9x. Over the past five years, earnings have grown an impressive 13% annually, although last year's growth of 4.5% lagged behind its industry peers at 11%. With more cash than total debt and positive free cash flow reaching £34.90 million as of September 2024, financial stability seems assured despite a rising debt-to-equity ratio from 1.5 to 2.1 over five years. The company recently increased its dividend to £0.0712 per share for fiscal year-end June 2025, reflecting robust profitability with net income climbing to £25 million from £24 million previously.

- Take a closer look at FW Thorpe's potential here in our health report.

Examine FW Thorpe's past performance report to understand how it has performed in the past.

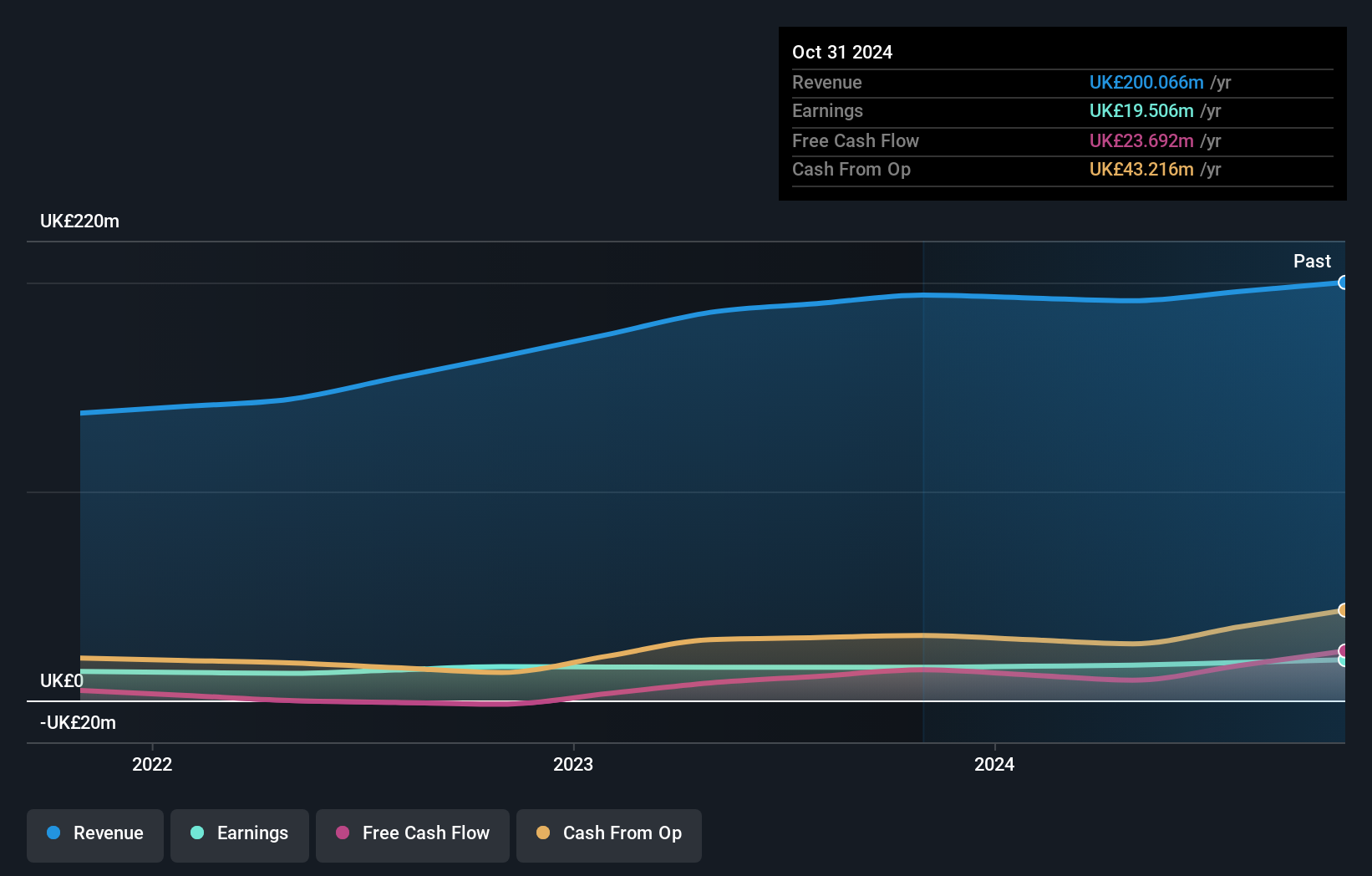

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★★

Overview: Goodwin PLC, with a market cap of £1.47 billion, offers mechanical and refractory engineering solutions across the UK, Europe, the US, the Pacific Basin, and other international markets.

Operations: Goodwin PLC generates revenue primarily from its Mechanical Engineering segment (£193.05 million) and Refractory Engineering segment (£78.16 million).

Goodwin, a standout in the UK market, has been making waves with its impressive financials and strategic moves. The company's earnings surged by 45% last year, outpacing the machinery industry’s -11% performance. Its debt to equity ratio improved from 25% to 19.8% over five years, highlighting effective debt management. Trading at 32% below its estimated fair value suggests potential upside for investors. Recent appointments of Adam Deeth as Finance Director and Anthony Thomas as Director bolster leadership strength, while a special dividend of £5.32 per share underscores shareholder value focus amid volatile share price movements recently observed.

- Click here and access our complete health analysis report to understand the dynamics of Goodwin.

Gain insights into Goodwin's historical performance by reviewing our past performance report.

Make It Happen

- Reveal the 59 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GDWN

Goodwin

Provides mechanical and refractory engineering solutions in the United Kingdom, rest of Europe, the United States, the Pacific Basin, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success