Stock Analysis

- United Kingdom

- /

- Electrical

- /

- AIM:PPS

Recent 21% pullback isn't enough to hurt long-term Proton Motor Power Systems (LON:PPS) shareholders, they're still up 96% over 5 years

Some Proton Motor Power Systems Plc (LON:PPS) shareholders are probably rather concerned to see the share price fall 33% over the last three months. Looking further back, the stock has generated good profits over five years. Its return of 96% has certainly bested the market return! While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 83% in the last three years.

While the stock has fallen 21% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Proton Motor Power Systems

Proton Motor Power Systems wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Proton Motor Power Systems can boast revenue growth at a rate of 25% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 14%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at Proton Motor Power Systems. Opportunity lies where the market hasn't fully priced growth in the underlying business.

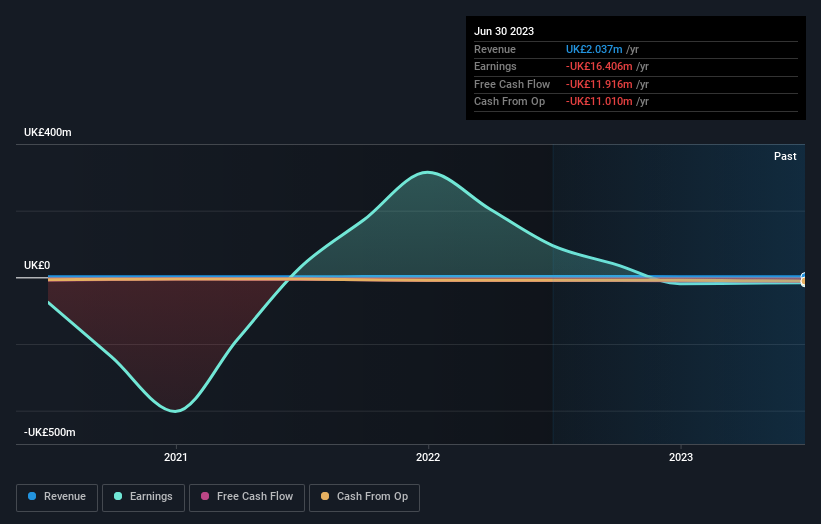

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 6.2% in the last year, Proton Motor Power Systems shareholders lost 39%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 14% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Proton Motor Power Systems is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Proton Motor Power Systems is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PPS

Proton Motor Power Systems

Designs, develops, manufactures, and tests fuel cells and fuel cell hybrid systems, and related technical components in the United Kingdom, Germany, and rest of Europe.

Medium-low with limited growth.