Stock Analysis

- United Kingdom

- /

- Specialty Stores

- /

- AIM:VTU

PowerHouse Energy Group Leads Our Selection Of 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting ongoing global economic challenges. In such a climate, identifying stocks with strong fundamentals becomes crucial for investors looking to navigate uncertainty. Penny stocks, though an older term, still represent smaller or less-established companies that might offer value and potential growth; we've selected three promising options that could provide stability alongside opportunity.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.925 | £70.05M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.65 | £192.41M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.255 | £107.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.27 | £195.87M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.41 | £179.57M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.325 | £425.48M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.40 | £209.85M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

PowerHouse Energy Group (AIM:PHE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PowerHouse Energy Group Plc designs facilities to convert non-recyclable waste into electricity, heat, and gases such as hydrogen and methane, with a market cap of £45.11 million.

Operations: PowerHouse Energy Group Plc does not currently report any revenue segments.

Market Cap: £45.11M

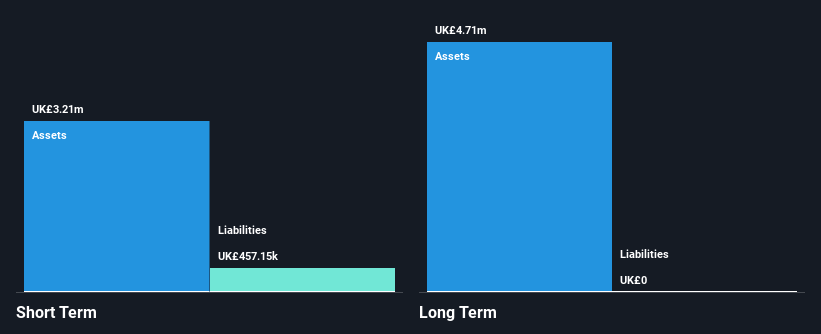

PowerHouse Energy Group, with a market cap of £45.11 million, is pre-revenue and debt-free but faces increasing losses, which have grown by 28.9% annually over the past five years. Its short-term assets (£3.2M) comfortably cover its liabilities (£457.2K), yet it has less than a year of cash runway. The company’s board is relatively inexperienced with an average tenure of 2.7 years, while management shows more stability at 3.4 years tenure. Recent developments include a FEED study contract in Australia underlining its global reach and potential for future projects despite current financial challenges and high share price volatility.

- Take a closer look at PowerHouse Energy Group's potential here in our financial health report.

- Explore historical data to track PowerHouse Energy Group's performance over time in our past results report.

Tavistock Investments (AIM:TAVI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tavistock Investments Plc, with a market cap of £22.14 million, offers financial advisory and investment management services in the United Kingdom through its subsidiaries.

Operations: The company generates its revenue primarily from its Advisory Business, which accounts for £38.64 million, and also earns £0.73 million from Investment Management services.

Market Cap: £22.14M

Tavistock Investments Plc, with a market cap of £22.14 million, has shown revenue growth from £33.95 million to £39.49 million over the past year despite being unprofitable and reporting a net loss of £1.27 million. The company's short-term assets (£14.4M) exceed both its short-term (£7.5M) and long-term liabilities (£7.2M), indicating sound liquidity management, though negative operating cash flow suggests debt is not well covered by income streams yet. The board's average tenure of 8.9 years reflects seasoned oversight, while recent earnings announcements highlight ongoing efforts to stabilize financial performance amid high share price volatility.

- Unlock comprehensive insights into our analysis of Tavistock Investments stock in this financial health report.

- Assess Tavistock Investments' previous results with our detailed historical performance reports.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer operating in the United Kingdom with a market cap of £199.47 million.

Operations: The company's revenue is primarily derived from its gasoline and auto dealership operations, totaling £4.79 billion.

Market Cap: £199.47M

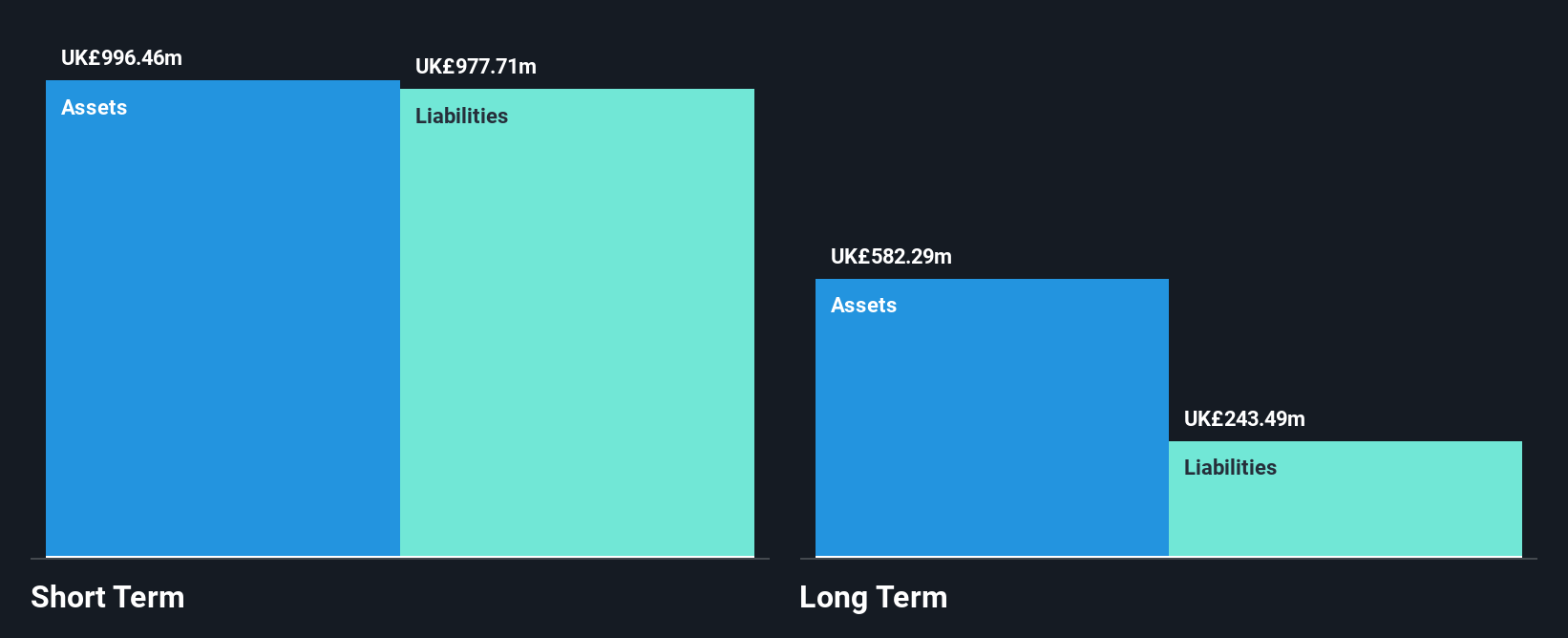

Vertu Motors plc, with a market cap of £199.47 million, is actively engaged in share repurchases, having recently announced a buyback program worth up to £3 million. The company's revenue stands at £4.79 billion, though recent earnings show a decline in net income to £15.96 million from the previous year. Despite this, Vertu maintains stable weekly volatility and has short-term assets exceeding its liabilities, reflecting solid liquidity management. However, profit margins have decreased slightly and significant insider selling has been noted recently. The management team and board are experienced with average tenures over five years.

- Jump into the full analysis health report here for a deeper understanding of Vertu Motors.

- Understand Vertu Motors' earnings outlook by examining our growth report.

Next Steps

- Embark on your investment journey to our 464 UK Penny Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VTU

Vertu Motors

Operates as an automotive retailer in the United Kingdom.