- United Kingdom

- /

- Machinery

- /

- AIM:MPAC

The Compensation For Mpac Group plc's (LON:MPAC) CEO Looks Deserved And Here's Why

The performance at Mpac Group plc (LON:MPAC) has been quite strong recently and CEO Tony Steels has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 05 May 2021. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Mpac Group

How Does Total Compensation For Tony Steels Compare With Other Companies In The Industry?

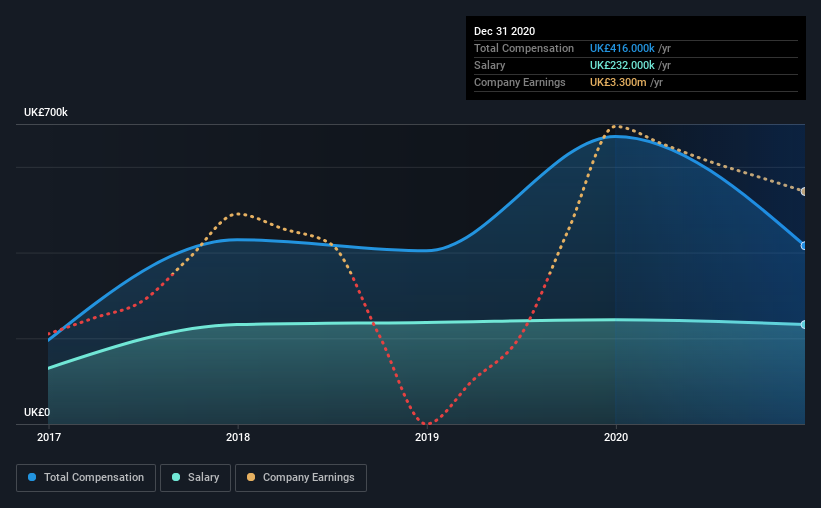

At the time of writing, our data shows that Mpac Group plc has a market capitalization of UK£111m, and reported total annual CEO compensation of UK£416k for the year to December 2020. We note that's a decrease of 38% compared to last year. In particular, the salary of UK£232.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from UK£72m to UK£287m, the reported median CEO total compensation was UK£383k. From this we gather that Tony Steels is paid around the median for CEOs in the industry. What's more, Tony Steels holds UK£611k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£232k | UK£243k | 56% |

| Other | UK£184k | UK£428k | 44% |

| Total Compensation | UK£416k | UK£671k | 100% |

On an industry level, roughly 76% of total compensation represents salary and 24% is other remuneration. It's interesting to note that Mpac Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Mpac Group plc's Growth Numbers

Mpac Group plc has seen its earnings per share (EPS) increase by 11% a year over the past three years. It saw its revenue drop 5.7% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Mpac Group plc Been A Good Investment?

Boasting a total shareholder return of 157% over three years, Mpac Group plc has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Mpac Group that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Mpac Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:MPAC

Mpac Group

Provides packaging and automation solutions to healthcare, clean energy, and food and beverage sectors worldwide.

Reasonable growth potential and fair value.

Market Insights

Community Narratives