- United Kingdom

- /

- Machinery

- /

- AIM:MPAC

Cautious Investors Not Rewarding Mpac Group plc's (LON:MPAC) Performance Completely

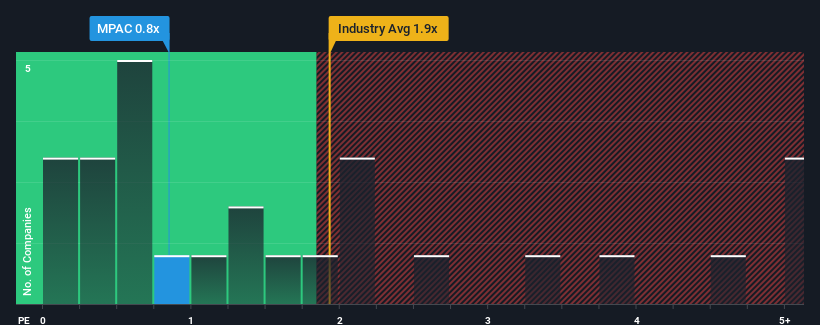

You may think that with a price-to-sales (or "P/S") ratio of 0.8x Mpac Group plc (LON:MPAC) is a stock worth checking out, seeing as almost half of all the Machinery companies in the United Kingdom have P/S ratios greater than 1.9x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Mpac Group

What Does Mpac Group's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Mpac Group has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mpac Group.How Is Mpac Group's Revenue Growth Trending?

In order to justify its P/S ratio, Mpac Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 33% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 30% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Mpac Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Mpac Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Mpac Group that you should be aware of.

If you're unsure about the strength of Mpac Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MPAC

Mpac Group

Provides packaging and automation solutions to healthcare, clean energy, and food and beverage sectors worldwide.

Reasonable growth potential and fair value.

Market Insights

Community Narratives