- United Kingdom

- /

- Trade Distributors

- /

- AIM:LTHM

James Latham (LON:LTHM) Will Pay A Larger Dividend Than Last Year At UK£0.15

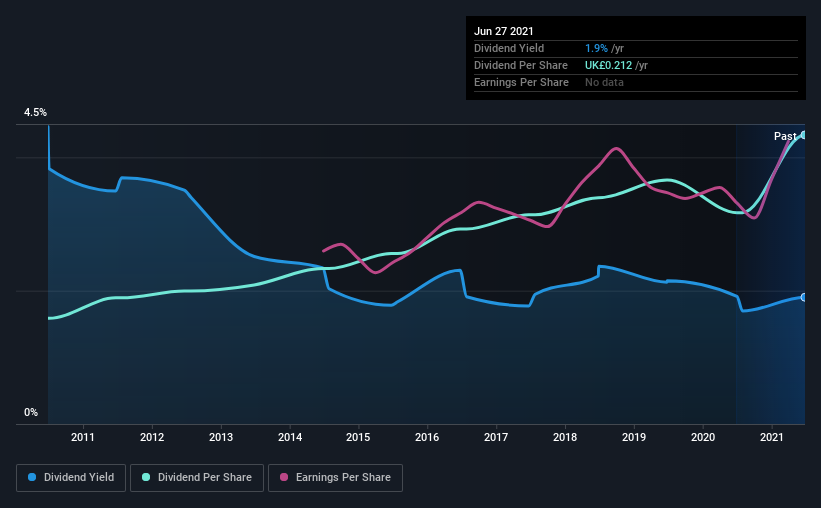

The board of James Latham plc (LON:LTHM) has announced that it will be increasing its dividend on the 27th of August to UK£0.15. This takes the dividend yield from 1.9% to 1.9%, which shareholders will be pleased with.

See our latest analysis for James Latham

James Latham's Dividend Is Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. However, James Latham's earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 7.0% over the next year if the trend from the last few years continues. Assuming the dividend continues along recent trends, we think the payout ratio could be 28% by next year, which is in a pretty sustainable range.

James Latham Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from UK£0.077 in 2011 to the most recent annual payment of UK£0.21. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

We Could See James Latham's Dividend Growing

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. James Latham has impressed us by growing EPS at 7.0% per year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for James Latham's prospects of growing its dividend payments in the future.

We Really Like James Latham's Dividend

Overall, a dividend increase is always good, and we think that James Latham is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Now, if you want to look closer, it would be worth checking out our free research on James Latham management tenure, salary, and performance. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade James Latham, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:LTHM

James Latham

Distributes timbers, panels, and decorative panels in the United Kingdom, the Republic of Ireland, rest of Europe, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives