- United Kingdom

- /

- Electrical

- /

- AIM:IKA

This Is Why Ilika plc's (LON:IKA) CEO Can Expect A Bump Up In Their Pay Packet

Shareholders will probably not be disappointed by the robust results at Ilika plc (LON:IKA) recently and they will be keeping this in mind as they go into the AGM on 22 September 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

View our latest analysis for Ilika

Comparing Ilika plc's CEO Compensation With the industry

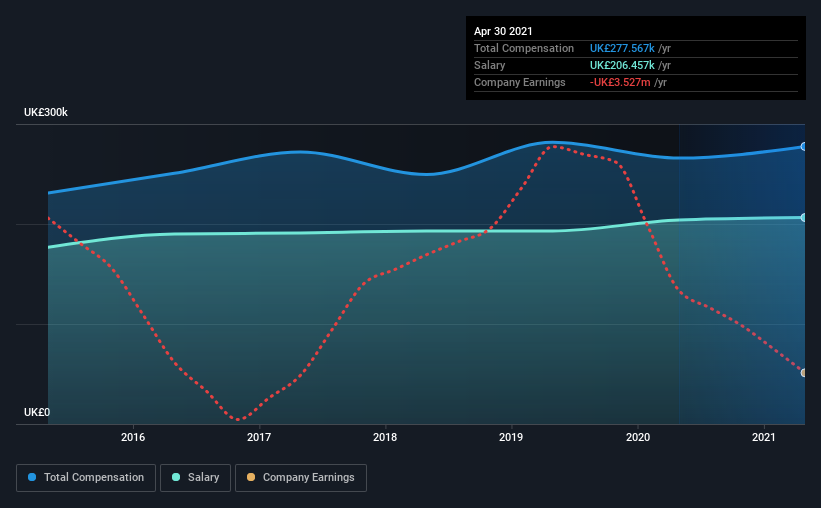

At the time of writing, our data shows that Ilika plc has a market capitalization of UK£221m, and reported total annual CEO compensation of UK£278k for the year to April 2021. That's just a smallish increase of 4.4% on last year. We note that the salary portion, which stands at UK£206.5k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between UK£144m and UK£578m had a median total CEO compensation of UK£507k. Accordingly, Ilika pays its CEO under the industry median. Furthermore, Graeme Purdy directly owns UK£1.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£206k | UK£204k | 74% |

| Other | UK£71k | UK£62k | 26% |

| Total Compensation | UK£278k | UK£266k | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. It's interesting to note that Ilika pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Ilika plc's Growth Numbers

Ilika plc has seen its earnings per share (EPS) increase by 9.6% a year over the past three years. In the last year, its revenue is down 21%.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Ilika plc Been A Good Investment?

We think that the total shareholder return of 708%, over three years, would leave most Ilika plc shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 6 warning signs (and 2 which are concerning) in Ilika we think you should know about.

Switching gears from Ilika, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Ilika or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IKA

Ilika

Engages in designing, production, and development of solid state batteries in the United Kingdom, Asia, Europe, and North America.

Flawless balance sheet with low risk.

Market Insights

Community Narratives