- United Kingdom

- /

- Building

- /

- AIM:ETP

Declining Stock and Solid Fundamentals: Is The Market Wrong About Eneraqua Technologies plc (LON:ETP)?

It is hard to get excited after looking at Eneraqua Technologies' (LON:ETP) recent performance, when its stock has declined 62% over the past three months. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. In this article, we decided to focus on Eneraqua Technologies' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Eneraqua Technologies

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Eneraqua Technologies is:

34% = UK£8.5m ÷ UK£25m (Based on the trailing twelve months to January 2023).

The 'return' is the yearly profit. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.34 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Eneraqua Technologies' Earnings Growth And 34% ROE

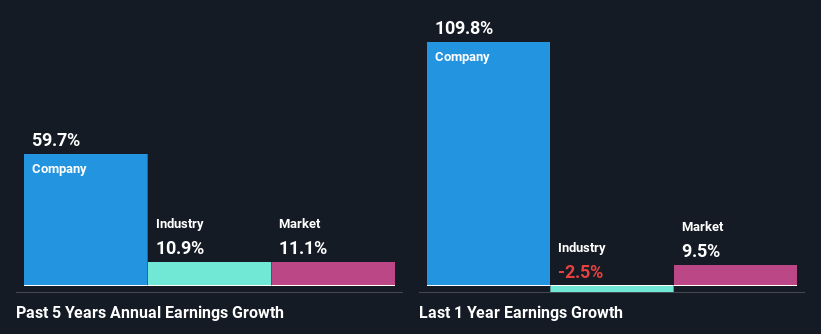

Firstly, we acknowledge that Eneraqua Technologies has a significantly high ROE. Secondly, even when compared to the industry average of 13% the company's ROE is quite impressive. So, the substantial 60% net income growth seen by Eneraqua Technologies over the past five years isn't overly surprising.

As a next step, we compared Eneraqua Technologies' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 11%.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Eneraqua Technologies''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Eneraqua Technologies Efficiently Re-investing Its Profits?

Eneraqua Technologies has a really low three-year median payout ratio of 6.1%, meaning that it has the remaining 94% left over to reinvest into its business. So it seems like the management is reinvesting profits heavily to grow its business and this reflects in its earnings growth number.

Along with seeing a growth in earnings, Eneraqua Technologies only recently started paying dividends. Its quite possible that the company was looking to impress its shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 8.0% over the next three years.

Summary

In total, we are pretty happy with Eneraqua Technologies' performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. You can see the 3 risks we have identified for Eneraqua Technologies by visiting our risks dashboard for free on our platform here.

Valuation is complex, but we're here to simplify it.

Discover if Eneraqua Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ETP

Eneraqua Technologies

Provides turnkey solutions for water efficiency and decarbonization through district heating and ground source heat pump systems for commercial clients, and social housing and residential sectors.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026