- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:SNR

Undiscovered Gems in United Kingdom Stocks to Watch This August 2024

Reviewed by Simply Wall St

The United Kingdom market has climbed by 2.4% over the past week, with every sector up, and has risen by 9.1% over the last year. In such a robust environment where earnings are forecast to grow by 14% annually, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that have yet to capture widespread attention.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 49.06% | 17.05% | 17.70% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Cohort (AIM:CHRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc, with a market cap of £346.37 million, operates through its subsidiaries to offer a range of products and services in defense, security, and related markets across the United Kingdom, Germany, Portugal, Africa, North and South America, and the Asia Pacific.

Operations: Cohort generates revenue primarily from two segments: Sensors and Effectors (£119.60 million) and Communications and Intelligence (£82.93 million).

Cohort plc, an aerospace and defense company, reported impressive earnings growth of 34.9% over the past year, outpacing the industry average of 14.8%. The company’s debt to equity ratio has improved from 32.5% to 29.2% in five years, and it holds more cash than total debt. Recent financials show net income at £15.32 million compared to £11.36 million last year with basic EPS rising to £0.38 from £0.28 per share.

- Get an in-depth perspective on Cohort's performance by reading our health report here.

Assess Cohort's past performance with our detailed historical performance reports.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing activities across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.10 billion.

Operations: Seplat Energy Plc generates revenue primarily from oil ($815.03 million) and gas ($120.87 million).

Seplat Energy has shown impressive earnings growth of 207.6% over the past year, significantly outperforming the Oil and Gas sector's -49%. The company's net debt to equity ratio stands at a satisfactory 20.6%, and interest payments are well covered by EBIT at 5.8x. Despite a volatile share price recently, Seplat remains profitable with high-quality earnings and positive free cash flow, making it an intriguing prospect in the UK market.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets globally; it has a market cap of approximately £675.37 million.

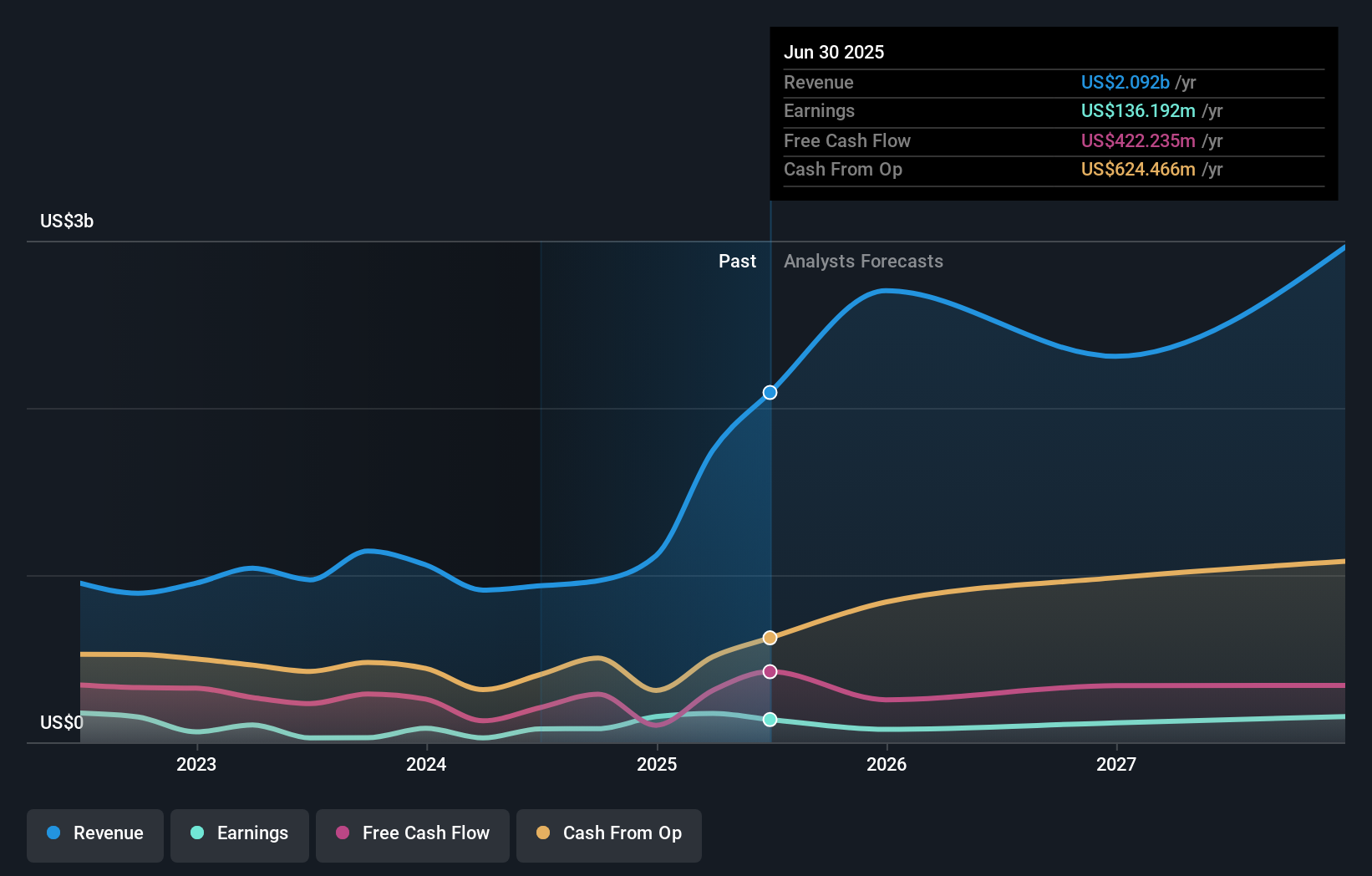

Operations: Senior plc generates revenue primarily from its Aerospace segment (£651.10 million) and Flexonics segment (£333 million), with a minor adjustment for central costs (-£1.50 million).

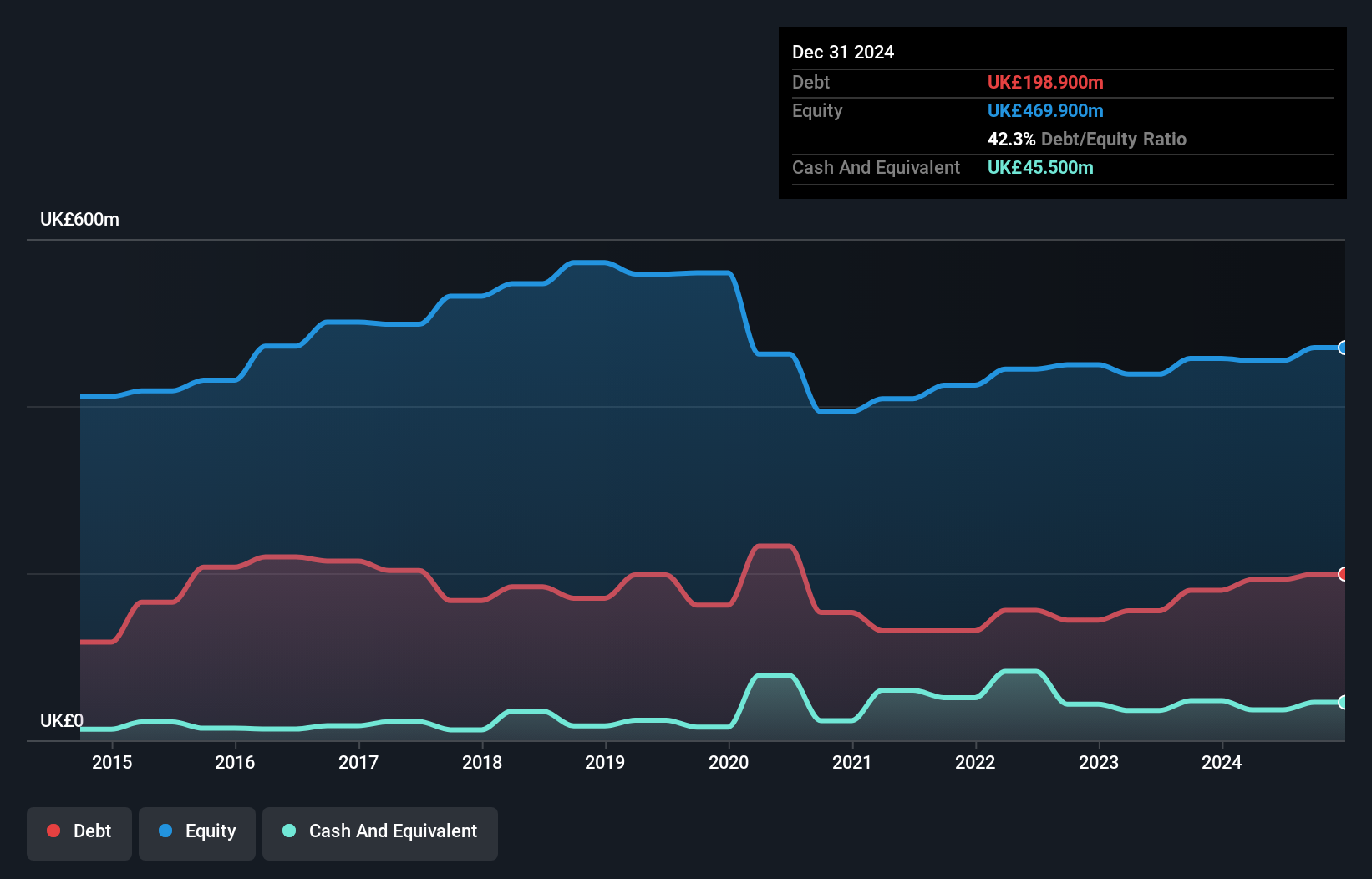

Senior plc, a notable player in the Aerospace & Defense sector, has shown impressive earnings growth of 40.1% over the past year, significantly outpacing the industry average of 14.8%. Trading at 67.8% below its estimated fair value, it represents an attractive investment opportunity. The company’s net debt to equity ratio stands at a satisfactory 34.4%, though interest payments are not well covered by EBIT (2.8x). Senior recently secured contracts with Deutsche Aircraft and Rolls-Royce and announced a dividend increase of 25%.

- Navigate through the intricacies of Senior with our comprehensive health report here.

Evaluate Senior's historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 81 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SNR

Senior

Designs, manufactures, and sells high-technology components and systems for the principal original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets in the United States, the United Kingdom, and internationally.

Undervalued with solid track record.