- United Kingdom

- /

- Software

- /

- AIM:GBG

UK Stocks Trading Below Estimated Value In August 2024

Reviewed by Simply Wall St

The UK stock market has recently faced turbulence, with the FTSE 100 closing lower due to weak trade data from China and a global economic slowdown. Despite these challenges, investors can find opportunities in undervalued stocks that have strong fundamentals and potential for growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Liontrust Asset Management (LSE:LIO) | £6.41 | £12.25 | 47.7% |

| EnSilica (AIM:ENSI) | £0.43 | £0.81 | 47.1% |

| Topps Tiles (LSE:TPT) | £0.472 | £0.90 | 47.6% |

| GlobalData (AIM:DATA) | £2.21 | £4.11 | 46.3% |

| Marks Electrical Group (AIM:MRK) | £0.645 | £1.27 | 49.3% |

| C&C Group (LSE:CCR) | £1.56 | £2.98 | 47.6% |

| AstraZeneca (LSE:AZN) | £131.58 | £247.15 | 46.8% |

| Ferrexpo (LSE:FXPO) | £0.4965 | £0.96 | 48.3% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

| Franchise Brands (AIM:FRAN) | £1.83 | £3.60 | 49.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Ashtead Technology Holdings (AIM:AT.)

Overview: Ashtead Technology Holdings Plc offers subsea equipment rental solutions for the offshore energy sector across Europe, the Americas, the Asia-Pacific, and the Middle East, with a market cap of £621.35 million.

Operations: The company generates £110.47 million in revenue from its Oil Well Equipment & Services segment.

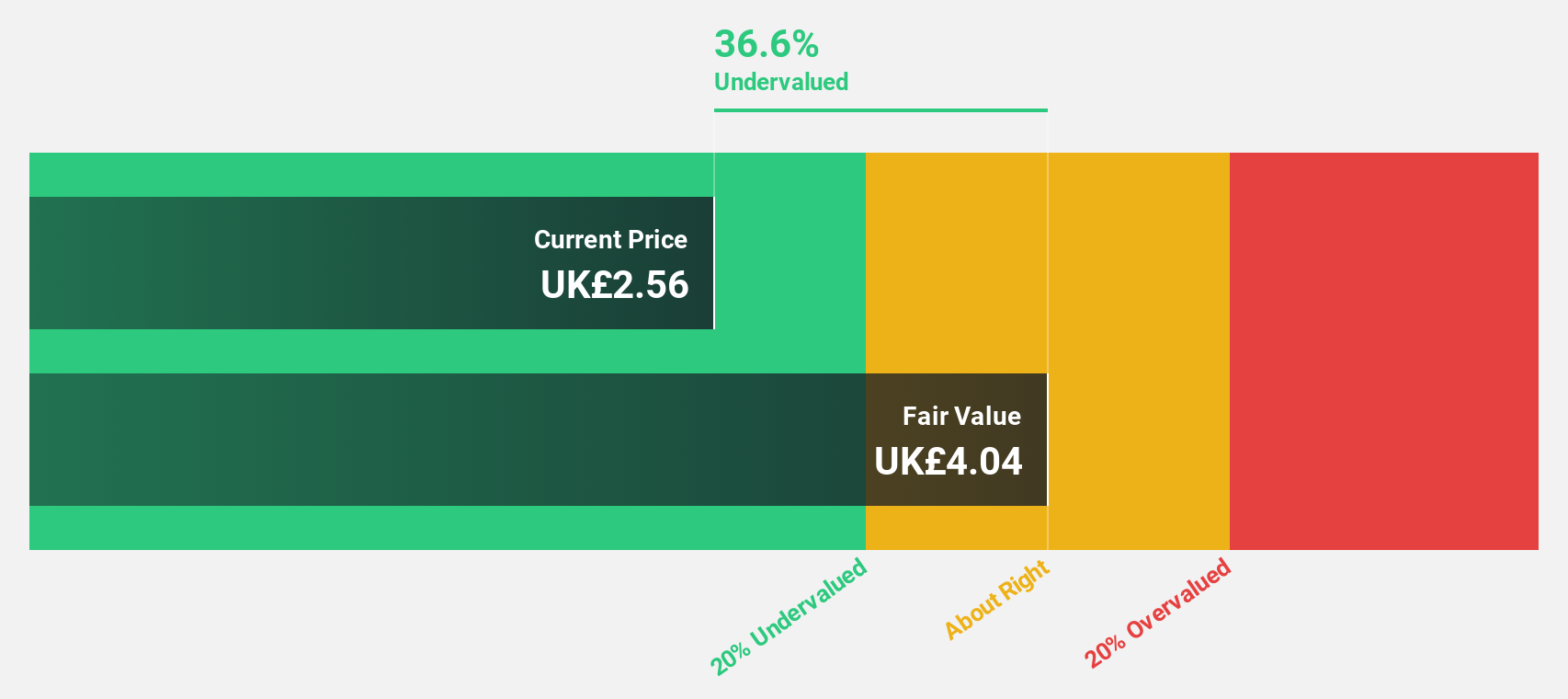

Estimated Discount To Fair Value: 34.9%

Ashtead Technology Holdings is trading at £7.75, significantly below its estimated fair value of £11.91, presenting a potential undervaluation based on cash flows. Despite a high level of debt, the company's earnings are forecast to grow 15.39% annually, outpacing the UK market's 14.3%. Recent earnings growth was substantial at 74.4%, and revenue is expected to increase by 15.4% per year, suggesting strong future cash flow generation capabilities despite moderate revenue growth projections.

- According our earnings growth report, there's an indication that Ashtead Technology Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Ashtead Technology Holdings.

GB Group (AIM:GBG)

Overview: GB Group plc, with a market cap of £854.61 million, provides identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally.

Operations: The company's revenue segments include Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million).

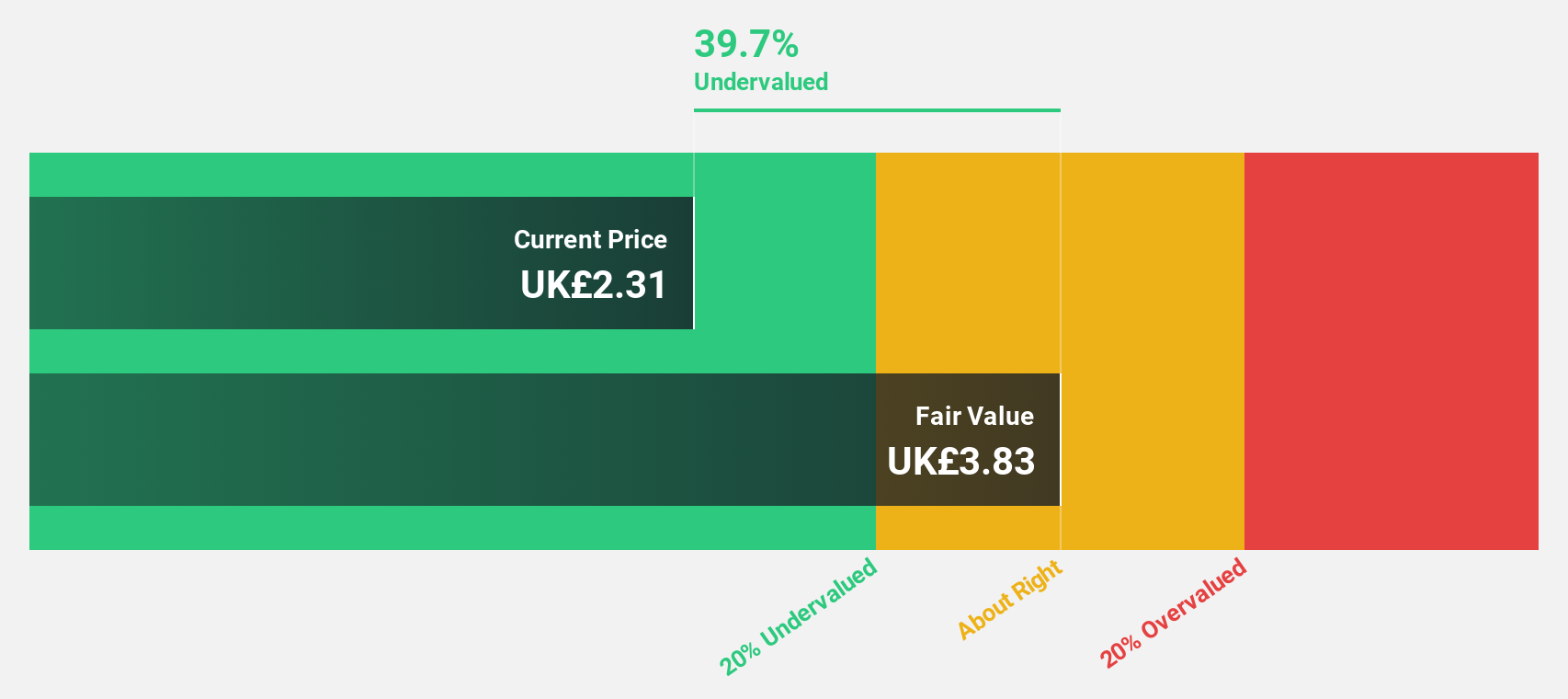

Estimated Discount To Fair Value: 32.2%

GB Group is trading at £3.39, significantly below its estimated fair value of £5, indicating potential undervaluation based on cash flows. Despite a net loss of £48.58 million for the fiscal year ending March 31, 2024, earnings are forecast to grow substantially by 92.89% annually over the next three years. The company also declared a final dividend of 4.20 pence per share and expects mid-single-digit revenue growth in 2025, supported by operational efficiency gains achieved in FY24.

- Our expertly prepared growth report on GB Group implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on GB Group's balance sheet by reading our health report here.

Liontrust Asset Management (LSE:LIO)

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of £409.65 million.

Operations: Liontrust Asset Management Plc generates its revenue primarily from Investment Management, totaling £197.89 million.

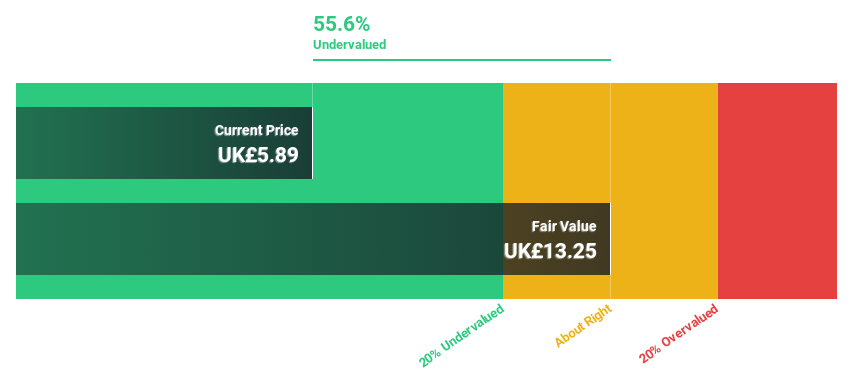

Estimated Discount To Fair Value: 47.7%

Liontrust Asset Management, trading at £6.41, is significantly undervalued compared to its estimated fair value of £12.25. Despite a challenging year with sales dropping to £197.89 million and a net loss of £3.49 million, the company is forecasted to achieve high returns on equity (29.8%) and become profitable within three years, growing earnings by 48.86% annually. However, its dividend yield of 11.23% is not well covered by earnings or free cash flows.

- Our growth report here indicates Liontrust Asset Management may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Liontrust Asset Management.

Where To Now?

- Gain an insight into the universe of 59 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Undervalued with reasonable growth potential.