- United Kingdom

- /

- Renewable Energy

- /

- LSE:DRX

Top 3 UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China and its struggling economic recovery. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income streams.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.99% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.24% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.49% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.95% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.48% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.29% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.82% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.83% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.14% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.53% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Arbuthnot Banking Group (AIM:ARBB)

Simply Wall St Dividend Rating: ★★★★☆☆

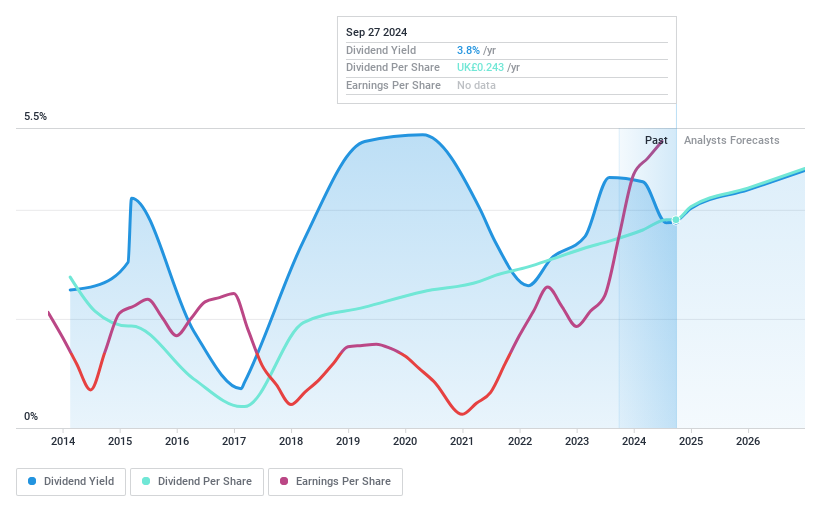

Overview: Arbuthnot Banking Group PLC, with a market cap of £152.23 million, offers private and commercial banking products and services in the United Kingdom through its subsidiaries.

Operations: Arbuthnot Banking Group PLC generates revenue through several segments, including Wealth Management (£12.32 million), Asset Alliance Group (£14.81 million), Renaissance Asset Finance (£9.42 million), and Arbuthnot Commercial Asset Based Lending (£16.03 million).

Dividend Yield: 5%

Arbuthnot Banking Group's dividend payments have increased over the past decade but have been volatile, with drops exceeding 20% annually. The company's current payout ratio of 24.9% suggests dividends are well covered by earnings and forecasted to remain sustainable with a 27.9% payout ratio in three years. However, ARBB's net income for H1 2024 declined to £15.44 million from £19.97 million in H1 2023, reflecting potential challenges ahead despite recent strategic board appointments and office relocations.

- Get an in-depth perspective on Arbuthnot Banking Group's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Arbuthnot Banking Group's share price might be too pessimistic.

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.50 billion, operates in the United Kingdom focusing on renewable power generation through its subsidiaries.

Operations: Drax Group plc's revenue segments include £4.38 billion from Customers, £5.99 billion from Generation, and £878.40 million from Pellet Production.

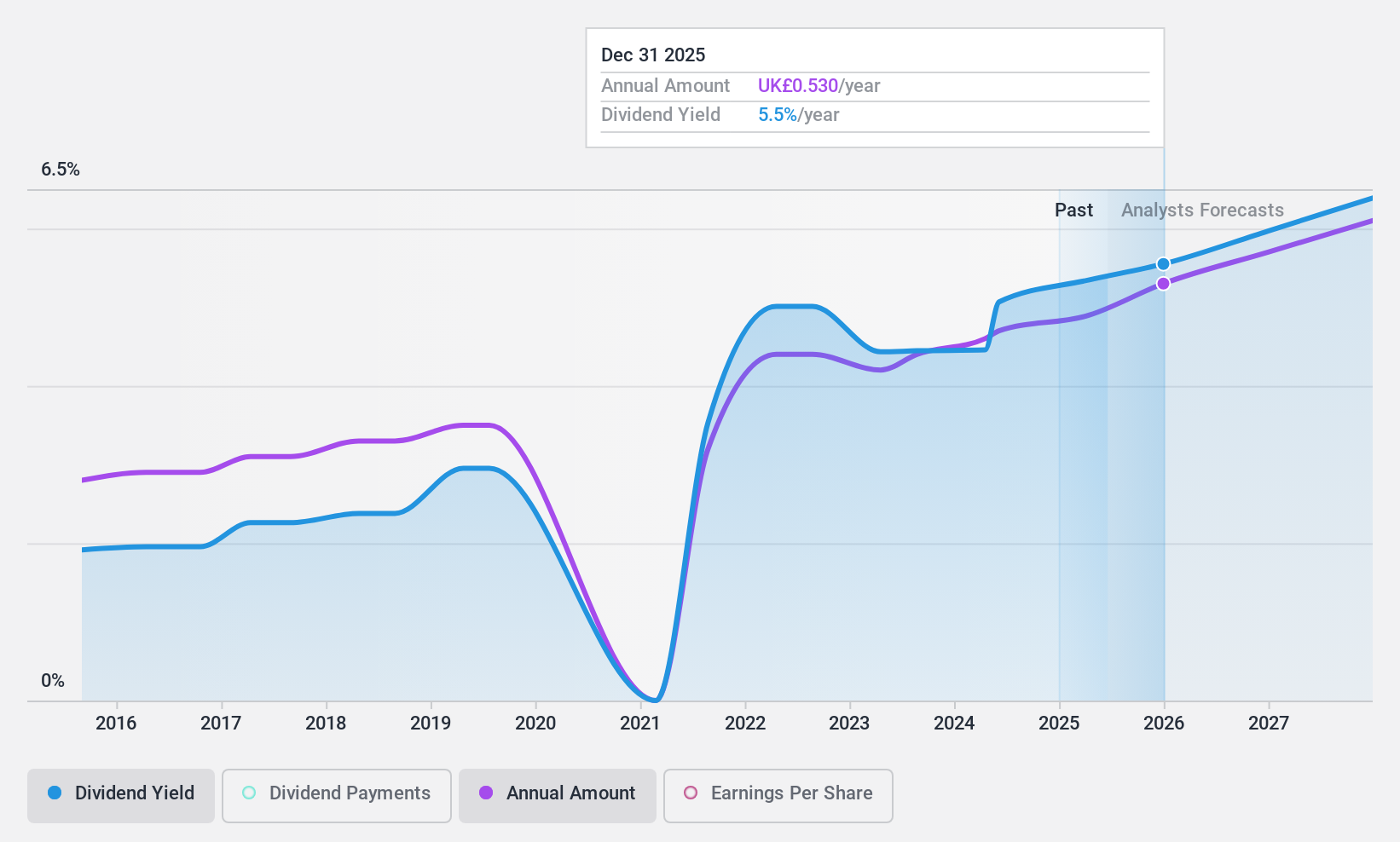

Dividend Yield: 3.7%

Drax Group's dividend payments have been volatile over the past decade but are well covered by earnings (payout ratio: 14.4%) and cash flows (cash payout ratio: 23.3%). Trading at a significant discount to its estimated fair value, Drax offers good relative value compared to peers. Recent refinancing of a £450 million revolving credit facility and a £50 million term loan enhances liquidity, while the announced £300 million share repurchase program signals confidence in future prospects.

- Take a closer look at Drax Group's potential here in our dividend report.

- Our expertly prepared valuation report Drax Group implies its share price may be lower than expected.

Pollen Street Group (LSE:POLN)

Simply Wall St Dividend Rating: ★★★★☆☆

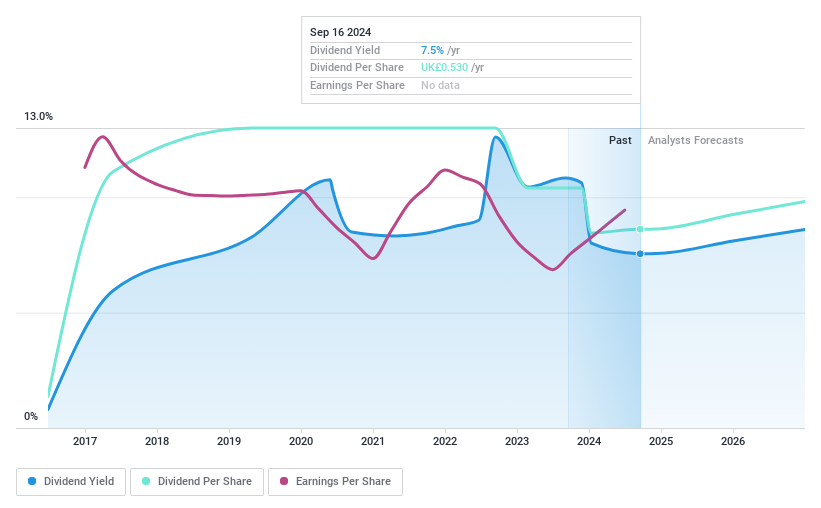

Overview: Pollen Street Group (LSE:POLN), founded in 2015 and headquartered in London, operates as an investment management company with a market cap of approximately £440.18 million.

Operations: Pollen Street Group generates its revenue primarily through its investment management services.

Dividend Yield: 7.4%

Pollen Street Group's interim dividend of 26.5 pence per share reflects a commitment to progressive dividend growth, with a total annual payout not below £33 million. Despite an unstable track record, dividends are well-covered by earnings (payout ratio: 84%) and cash flows (cash payout ratio: 18.1%). Recent H1 2024 results showed revenue at £54.34 million and net income at £23.57 million, indicating financial strength to support future dividends amidst a competitive yield environment in the UK market.

- Click here to discover the nuances of Pollen Street Group with our detailed analytical dividend report.

- According our valuation report, there's an indication that Pollen Street Group's share price might be on the cheaper side.

Turning Ideas Into Actions

- Get an in-depth perspective on all 60 Top UK Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DRX

Outstanding track record, undervalued and pays a dividend.