- United Kingdom

- /

- Auto Components

- /

- AIM:STG

Some Strip Tinning Holdings plc (LON:STG) Shareholders Look For Exit As Shares Take 29% Pounding

Strip Tinning Holdings plc (LON:STG) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

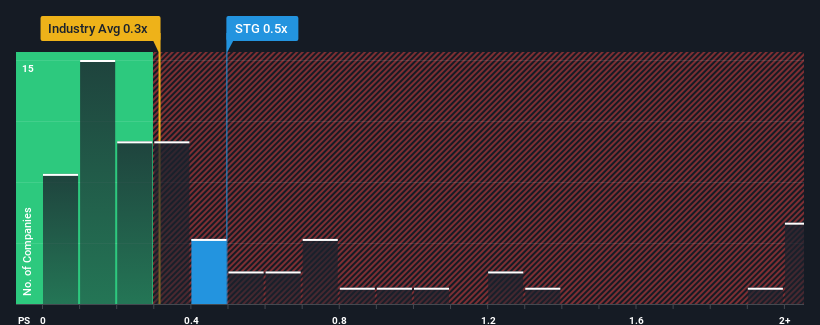

Although its price has dipped substantially, it's still not a stretch to say that Strip Tinning Holdings' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Auto Components industry in the United Kingdom, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Strip Tinning Holdings

How Has Strip Tinning Holdings Performed Recently?

While the industry has experienced revenue growth lately, Strip Tinning Holdings' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Strip Tinning Holdings will help you uncover what's on the horizon.How Is Strip Tinning Holdings' Revenue Growth Trending?

Strip Tinning Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 6.6% during the coming year according to the sole analyst following the company. Meanwhile, the broader industry is forecast to expand by 1.2%, which paints a poor picture.

In light of this, it's somewhat alarming that Strip Tinning Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Strip Tinning Holdings' P/S?

With its share price dropping off a cliff, the P/S for Strip Tinning Holdings looks to be in line with the rest of the Auto Components industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Strip Tinning Holdings' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Strip Tinning Holdings that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STG

Strip Tinning Holdings

Manufactures and supplies flexible electrical connectors for heating and antennae systems embedded within automotive glazing and to the connection of the cells within electric vehicle (EV) battery packs in the United Kingdom, rest of Europe, and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives