- United Kingdom

- /

- Auto Components

- /

- AIM:SCE

Market Might Still Lack Some Conviction On Surface Transforms Plc (LON:SCE) Even After 68% Share Price Boost

Surface Transforms Plc (LON:SCE) shares have continued their recent momentum with a 68% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 53% share price drop in the last twelve months.

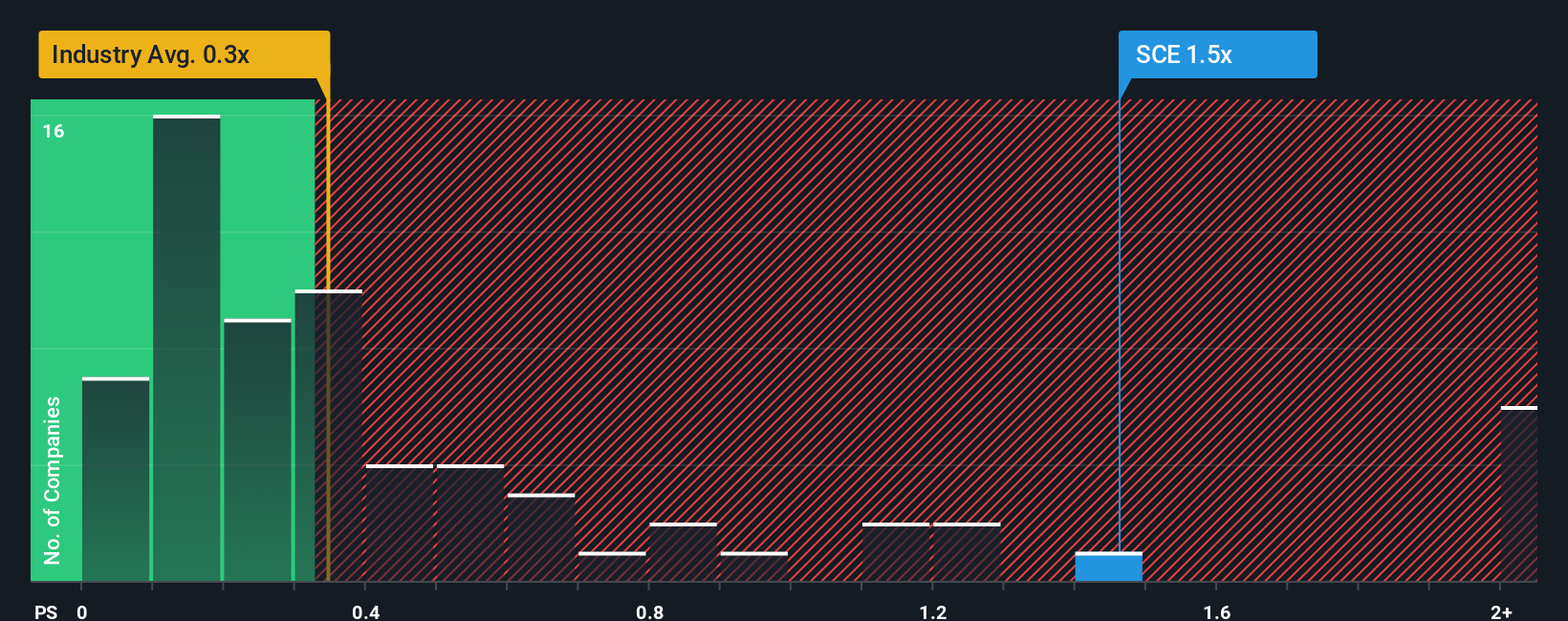

Although its price has surged higher, there still wouldn't be many who think Surface Transforms' price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in the United Kingdom's Auto Components industry is similar at about 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Surface Transforms

What Does Surface Transforms' Recent Performance Look Like?

Surface Transforms has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Surface Transforms' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Surface Transforms' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. The latest three year period has also seen an excellent 248% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 3.4%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Surface Transforms' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Surface Transforms' P/S

Its shares have lifted substantially and now Surface Transforms' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Surface Transforms currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Surface Transforms is showing 4 warning signs in our investment analysis, and 3 of those are significant.

If these risks are making you reconsider your opinion on Surface Transforms, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SCE

Surface Transforms

Researches, develops, designs, manufactures, and sells carbon ceramic brakes for automotive market in the United Kingdom, Germany, Sweden, Netherlands, rest of Europe, the United States, and internationally.

Slight risk and overvalued.

Market Insights

Community Narratives