- United Kingdom

- /

- Auto Components

- /

- AIM:SCE

Investors Appear Satisfied With Surface Transforms Plc's (LON:SCE) Prospects As Shares Rocket 63%

Despite an already strong run, Surface Transforms Plc (LON:SCE) shares have been powering on, with a gain of 63% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 66% in the last year.

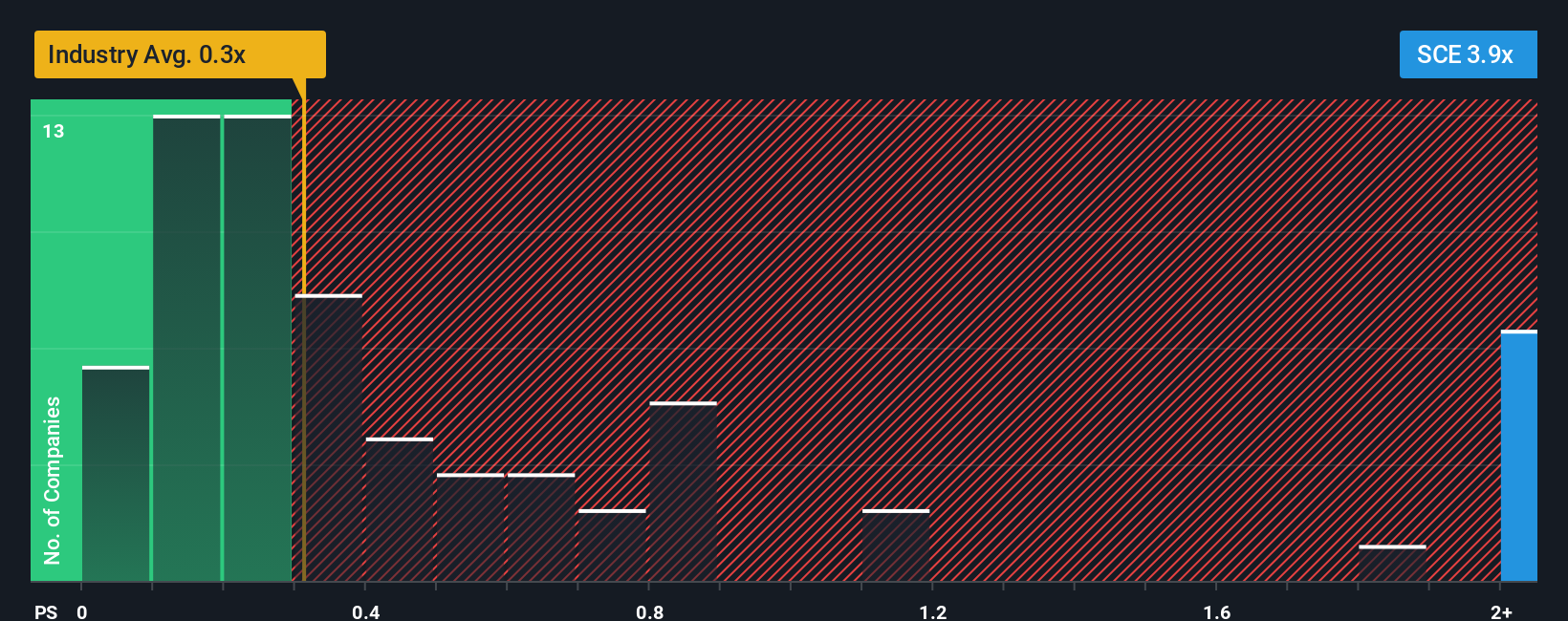

Since its price has surged higher, Surface Transforms may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 3.9x, since almost half of all companies in the Auto Components in the United Kingdom have P/S ratios under 2.3x and even P/S lower than 0.3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Surface Transforms

What Does Surface Transforms' P/S Mean For Shareholders?

Surface Transforms has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Surface Transforms will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Surface Transforms?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Surface Transforms' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. The latest three year period has also seen an excellent 248% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 0.8%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Surface Transforms' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Surface Transforms' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Surface Transforms revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Surface Transforms (3 don't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Surface Transforms, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SCE

Surface Transforms

Researches, develops, designs, manufactures, and sells carbon ceramic brakes for automotive market in the United Kingdom, Germany, Sweden, Netherlands, rest of Europe, the United States, and internationally.

Slight risk and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success