- United Kingdom

- /

- Auto Components

- /

- AIM:JNEO

Journeo plc's (LON:JNEO) 33% Jump Shows Its Popularity With Investors

Journeo plc (LON:JNEO) shares have continued their recent momentum with a 33% gain in the last month alone. The annual gain comes to 150% following the latest surge, making investors sit up and take notice.

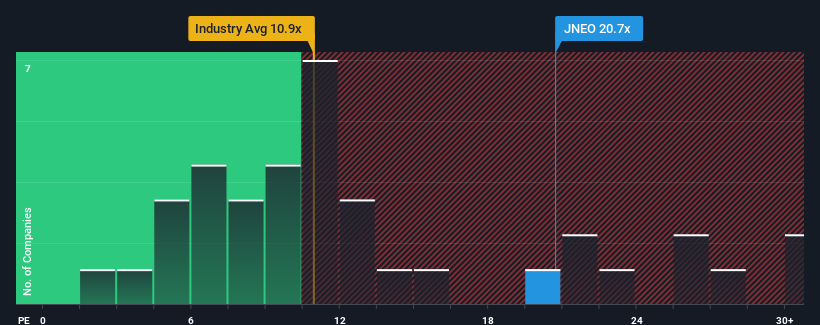

After such a large jump in price, Journeo's price-to-earnings (or "P/E") ratio of 20.7x might make it look like a sell right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios below 15x and even P/E's below 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Journeo certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Journeo

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Journeo's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 270% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 21% as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 13%, which is noticeably less attractive.

With this information, we can see why Journeo is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Journeo's P/E

Journeo's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Journeo maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Journeo you should be aware of, and 2 of them shouldn't be ignored.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:JNEO

Journeo

Provides solutions to the transport community that captures, processes, and displays essential information to enhance journeys in the United Kingdom and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives