- France

- /

- Other Utilities

- /

- ENXTPA:VIE

Is Veolia Still a Bargain After New Sustainability Initiatives and Strong Five Year Gains?

Reviewed by Bailey Pemberton

- Curious whether Veolia Environnement is a hidden gem or already fully priced? Let’s break down what savvy investors are seeing in this global utilities player.

- The stock has edged up by 0.6% in the past week and has climbed 8.1% year-to-date. Over five years, it has posted an impressive 100.1% gain. These moves indicate both opportunity and shifting market sentiment.

- Recent headlines have centered around Veolia’s ambitious sustainability initiatives, including new circular economy partnerships and expanded water management projects in Europe. These developments provide context for its steady progress and keep the company in the spotlight for growth-oriented and ESG-minded investors alike.

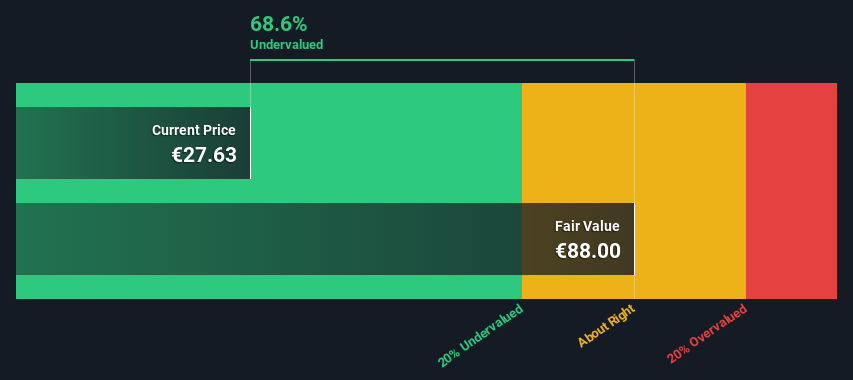

- On Simply Wall St’s valuation checks, Veolia scores 4 out of 6 for being undervalued. Next, we’ll dive into the numbers using several valuation approaches, but keep reading for what may be the best way to truly judge the company’s fair price.

Find out why Veolia Environnement's 7.8% return over the last year is lagging behind its peers.

Approach 1: Veolia Environnement Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach offers a forward-looking perspective grounded in real earnings power. For Veolia Environnement, the DCF model uses a "2 Stage Free Cash Flow to Equity" approach, relying on both analyst forecasts for the next five years as well as extrapolated estimates beyond that period.

Currently, Veolia generates €1.95 billion in Free Cash Flow, which serves as a strong foundation for potential long-term growth. According to projections, Free Cash Flow is expected to reach €2.10 billion by 2035, reflecting both sustainable operations and a degree of analyst optimism. It is important to note that the estimates after 2027 are extrapolated by model assumptions and are not based on direct analyst guidance.

Based on these calculations, the model assigns Veolia an intrinsic value of €55.81 per share. This figure implies the stock is trading at a 47.3% discount to its estimated fair value, suggesting it may be significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Veolia Environnement is undervalued by 47.3%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Veolia Environnement Price vs Earnings

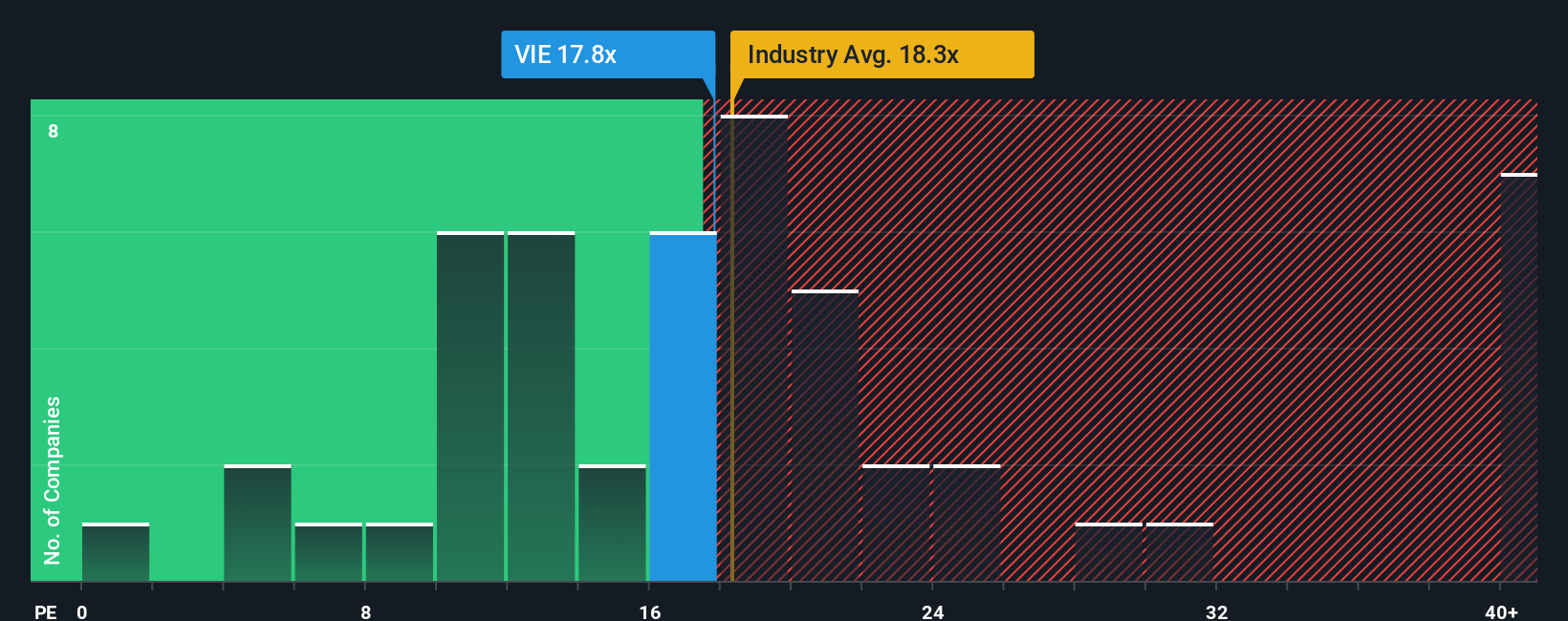

The Price-to-Earnings (PE) ratio is widely favored for valuing profitable companies, as it directly relates a company's stock price to its underlying earnings, making it a straightforward gauge of investor expectations. A higher PE can signal that investors anticipate higher growth, but it might also reflect greater perceived risk. On the other hand, a lower PE could mean the market has doubts about future prospects or sees more risk ahead.

Veolia Environnement currently trades on a PE ratio of 17.8x. This is lower than the industry average for Integrated Utilities at 18.3x and is also below the average across its peer group at 19.6x. Both benchmarks suggest that, at face value, the stock may be priced more attractively than many of its peers.

However, a more precise way to assess fair value is through Simply Wall St’s proprietary "Fair Ratio," which factors in Veolia’s expected profit growth, industry dynamics, profit margins, company size, and risk profile. Unlike simple industry or peer averages, the Fair Ratio aims to reflect what a reasonable multiple should be for Veolia specifically, avoiding one-size-fits-all comparisons.

For Veolia, the Fair Ratio is calculated at 17.6x, almost precisely matching its current PE multiple. This close alignment indicates the stock is aligned with its intrinsic value based on fundamentals, rather than being notably cheap or expensive relative to its prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

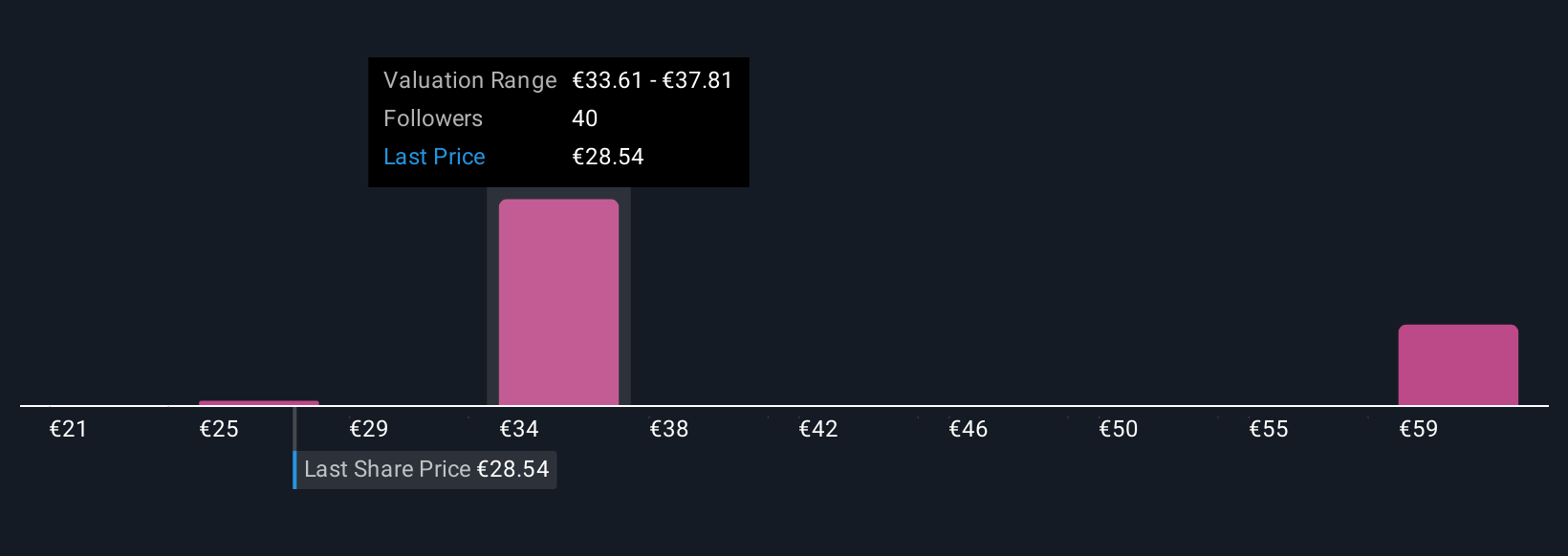

Upgrade Your Decision Making: Choose your Veolia Environnement Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives, an accessible tool for investors to combine their own perspective on Veolia Environnement's future with numbers and determine a fair value. A Narrative is simply your story of what matters most for the business, directly linked to specific financial forecasts and a calculated fair price. Narratives bring the company’s recent news, strategic advantages, key risks, and growth drivers together into a dynamic scenario. This connects the story you believe in to expected revenues, profits, margins, and ultimately, what you think the stock is worth.

Available through the Community page on Simply Wall St, Narratives are designed for all investors and update automatically whenever new information comes in, keeping your view relevant in real time. By comparing your Narrative’s fair value to the actual market price, you can easily decide if it’s the right time to buy or sell, and quickly spot changes as they happen. Different investors may reach very different conclusions; for example, some see Veolia’s strength in water technology and global expansion driving a fair value above €45, while others worry about acquisition integration and assign a fair value closer to €25.

Do you think there's more to the story for Veolia Environnement? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives