- France

- /

- Other Utilities

- /

- ENXTPA:VIE

How Investors Are Reacting To Veolia Environnement (ENXTPA:VIE) Securing Key Chilean Desalination Contract

Reviewed by Sasha Jovanovic

- Veolia Environnement SA was recently awarded the operation and maintenance contract for the Aguas Pacifico multipurpose desalination plant in Valparaiso, Chile, following a competitive tender process that included major national and international firms.

- This contract emphasizes Veolia’s leadership in sustainable water management, featuring 100% renewable energy use and advanced ocean protection technologies in one of South America’s most drought-impacted regions.

- We'll examine how winning this major Chilean desalination contract may reinforce Veolia's global growth narrative and environmental innovation ambitions.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Veolia Environnement Investment Narrative Recap

To own shares of Veolia Environnement, an investor typically needs to believe that global demand for sustainable water and waste management solutions will continue to drive multi-year growth, despite exposure to margin pressures in key mature markets. The recent Chilean desalination contract aligns with Veolia’s growth catalysts in climate adaptation infrastructure, but by itself, is unlikely to shift the near-term risk of margin compression in France or fully offset secular declines in the French Municipal Waste segment.

The most relevant recent announcement for this development is Veolia’s 10-year agreement to operate the Holyoke, Massachusetts wastewater treatment plant, which underscores the company’s ongoing expansion in international water operations, highlighting how wins in new and established markets both support its recurring revenues and progress toward its climate and sustainability goals. Yet, in contrast to contracts in growth regions, investors should remain alert to...

Read the full narrative on Veolia Environnement (it's free!)

Veolia Environnement's narrative projects €51.5 billion revenue and €1.9 billion earnings by 2028. This requires 4.9% yearly revenue growth and a €0.7 billion earnings increase from the current €1.2 billion.

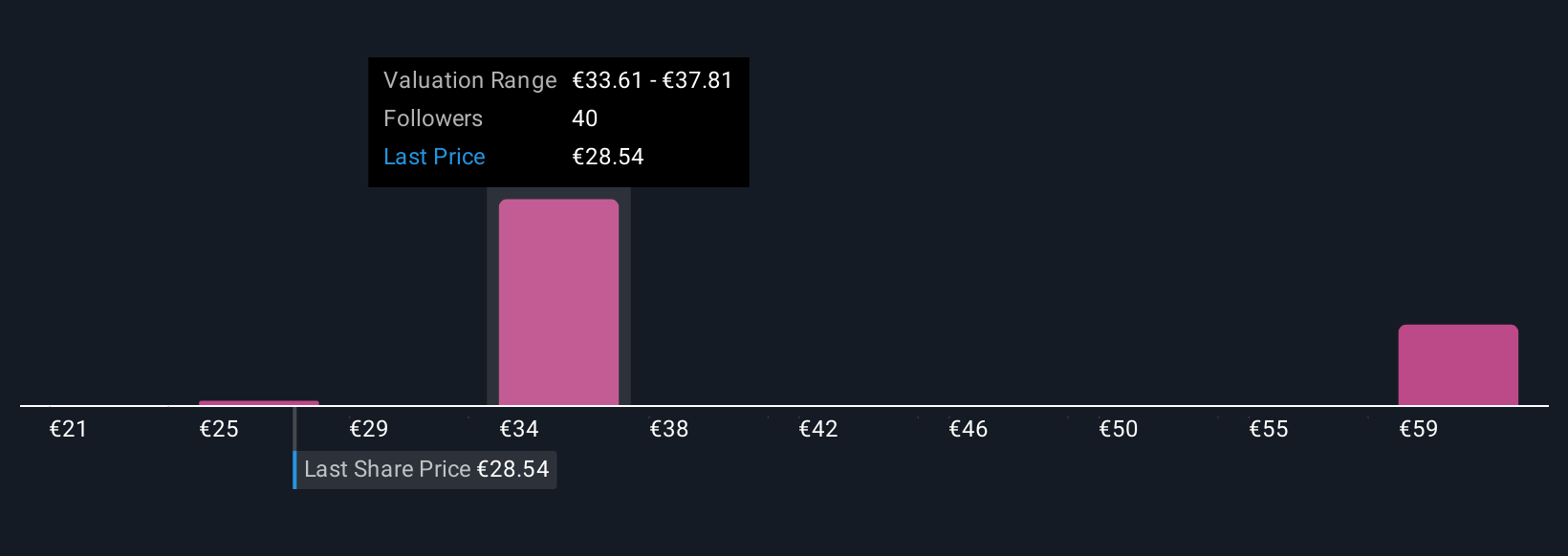

Uncover how Veolia Environnement's forecasts yield a €35.07 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set price targets for Veolia Environnement ranging from €25.15 to €58.81 across 10 viewpoints. While many forecast structural growth from global environmental compliance, you should consider how margin sustainability in core European markets might influence where performance ultimately lands.

Explore 10 other fair value estimates on Veolia Environnement - why the stock might be worth 12% less than the current price!

Build Your Own Veolia Environnement Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veolia Environnement research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Veolia Environnement research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veolia Environnement's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives